Temporal Aspects of Human Action and Efficient Resource Allocation

Explore the intriguing concepts of time placement, duration, and preference in human action, delving into the efficient allocation of resources over different time periods to maximize value. Understand the inter-temporal aspect of decision-making and the implications of time preference on production choices and interest rates.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The Theory of Interest Mises University July 23-29, 2023

Time in Human Action: Duration of an Action Duration of an action Time before action time during action time after action Two parts to the duration of action 1. Period of production: time from start of action to the beginning of the attainment of end Working time: stages of production Maturing time: time between taking an action and its effects 2. Duration of serviceableness: time over which a good generates its consumption services

Time in Human Action: Time Placement Timeline Start Stop Start Stop Time is an irreversible flux: each moment has a unique place in the sequence of moments of time with respect to action Economize action with respect to time: choose when to begin and end an action to obtain its greatest value

Temporal Aspect of Action Time placement of a good Value of a good can vary at different moments in time Allocate a good to obtain the greatest value Allocation eliminates further value differences Forward price of a good Agree today to trade at a date in the future at the forward price Higher, lower, or the same as current price Efficient temporal allocation of goods

Time in Human Action: Time Preference Timeline Period of Production Duration of Serviceableness Start Stop For any action economized with respect to its time placement Time before its satisfaction (period of production) Time during its satisfaction (duration of serviceableness) Prefer to begin its satisfaction closer to the start of the action Disutility of waiting

Inter-temporal Aspect of Action Time Preference Definition Satisfaction sooner is preferred to the same satisfaction later Logical aspect of action, not physiological or psychological Time Preference Implications Inter-temporal production choices regulated by TP Pure Rate of Interest TP premium of present money over future money Efficient inter-temporal allocation of goods

Time Preference Theory of Interest Demand for a consumer good Supply of a consumer good Preferences Price of the Consumer Good Demand for present money Supply of present money Time Preferences Pure Rate of Interest Pure rate of interest: inter-temporal trade in money, not goods Inter-temporal trade of goods, would mix the temporal and inter- temporal aspects of trade Inter-temporal trade of money can isolate the inter-temporal aspects of trade from the temporal aspects

Time Preference and the Pure Rate of Interest Preference Rank Person A $1,100 in one year $1,000 today $1,090 in one year $1,000 in one year Preference Rank Person B $1,300 in one year $1,000 today $1,290 in one year $1,000 in one year Person A lends $1,000 to person B at 0.10 r 0.29

Time Market Interest Rate r0 A S Lower TP D Higher TP PM0 Present Money

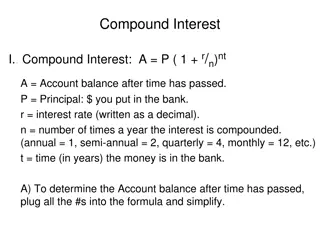

Time Market Time preferences determine Pure rate of interest Amount of present money lent and borrowed Pure rate of interest equates future value of money with the present value of money FV = PV x (1+r) FV = $1,000 x 1.10 = $1,100 PV = FV (1+r) PV = $1,100 1.10 = $1,000 Compounding Discounting

Components of the Time Market Time Market: exchange of present money for future money Credit Markets Consumer Loans Producer Loans Capital Structure Uniform pure rate of interest for all inter-temporal exchange of money of the same time structure

Pure Rate of Interest Across Components of the Time Market Interest Rate r1 r0 Consumer Loans S1 A Present Money S0 D Interest Rate S0 r0 A r1 B S1 B D Capital Structure Present Money

Pure Rate of Interest Across Different Lines of Production Interest return in smart phone investments = 0.075 Interest return in tablet investments = 0.025 Dynamic adjustment in the time market Capitalist-Entrepreneurs will sell assets in tablet production Capitalists-Entrepreneurs will buy assets in smart phone prod. Interest rate in tablets will rise and that in smart phones will fall Neither physical productivity nor value productivity of assets affects the pure rate of interest

Prices of Factors of Production Discounted by Pure Rate of Interest MRP from factors to be received in one year r = 0.10 MRPC = $11,000 MRPN = $5,500 MRPL = $2,200 DMRPC = $10,000 DMRPN = $5,000 DMRPL = $2,000 Net Income = $18,700 $17,000 = $1,700 Interest return = $1,700 17,000 = 0.10

Sources of Net Income Earned by Capitalist-Entrepreneur Interest from satisfying time preferences Capitalist-Entrepreneur lends to suppliers of factors of production Wages from supplying labor Capitalist-Entrepreneur works instead of hiring someone Quasi-wages from supplying leadership Capitalist-Entrepreneur raises the productivity of other workers Profit for superior foresight Capitalist-Entrepreneur anticipates future conditions better than other capitalist-entrepreneurs

Sources of the Market Rate of Interest Pure rate of interest Higher (lower) time preferences, higher (lower) interest rate Entrepreneurial uncertainty Greater (lesser) uncertainty, higher (lower) interest rate Price premium Larger (smaller) price premium, higher (lower) interest rate Unanticipated changes in PPM Decrease (increase) in PPM, higher (lower) interest rate