The Financial Aspects of Planning CIL Knowledge

Explore the direct financial implications of strategic planning, community infrastructure levy, business rates, and modeling financial benefits of planning and growth in this informative presentation. Discover the key points and processes involved in CIL payments, business rate promotion for growth, and more.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The Direct Financial Implications of Planning CIL Knowledge www. pas.gov.uk

1. Long term Strategic Planning Carefully calculated needs assessments Business Cases Options appraisal Building political consensus Delivery routes Working with private providers & 2. Opportunism

THE COMMUNITY INFRASTRUCTURE LEVY

Business Rates Why promote growth? Before NNDR Funding level Local share level + Business Rates collected Allocated to local authority

Business Rates Why promote growth? Now NNDR Funding level Local share level + Business Rates collected + Allocated to local authority

How to Model the Financial Benefits of Planning & Growth

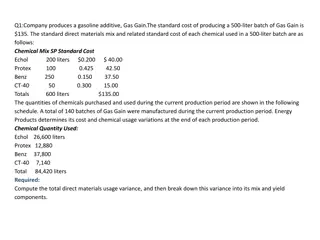

Community Infrastructure Levy (CIL) Net additional floor space in square metres Payable CIL CIL Rate Set by the Council; Charging Schedule will determine rates by use

Community Infrastructure Levy 3 key points to remember: 1. CIL is a one-off payment, payable by the developer at the beginning of a development (following planning permission). 2. Replacement floor space & affordable housing do not pay CIL. 3. Planning obligations cannot be collected to pay for items in the Reg 123 list

Community Infrastructure Levy Example 3,000 sqm of new retail floorspace X 100 per sqm (your CIL rate for retail) = 300,000 CIL! Development & CIL

New Homes Bonus (NHB) 2013/14 National Average Band D Council Tax Rate Number of homes Private: 1,4 44 6 Affordable: 1,794 + 350 supplement

New Homes Bonus 3 key points to remember: 1. New Homes Bonus payable from Central Government to a Council is calculated based on net increases to the Council Tax base; 2. New Homes Bonus is an un-ringfenced funding stream; 3. NHB is paid for six consecutive years.

New Homes Bonus Example a) 100 units of market housing x 1444 x 6 (years) b) 100 units of affordable housing x 1794 x 6 (years) (a) + (b) = 1.73m Total NHB Development & NHB

Business Rates how theyre calculated Total Rateable value of property is 100k Payable Business Rates = 47.1k 0.471 NNDR MULTIPLIER

Business Rates Retention (NNDR) Payable Business Rates (RV*0.471) Proportion to Central Government Proportion to Upper Tier authority % retained by Local Authority

Business Rates Retention 3 key points to remember: 1. Different uses get different Rateable Values (RV). RVs are set by the Valuation Office Agency, and are reviewed every 5 years. 2. Business Rates are an un-ringfenced, on-going funding stream, and are payable annually; 3. Housing does not pay business rates.

Business Rates Retention Example London Borough 1) 100,000 x 0.471 = 47,100 Payable Business Rates 2) 47,100 50% = 23,550 3a) 23,550 x 40% = 9,420 3b) 23,550 x 60% = 14,130 Development & NNDR Local Share Paid to upper tier Retained by Local Authority

Financial benefits over time CIL NHB NNDR

Finance as a Material Consideration in Planning Decision

What is a Material Consideration e.g. Plan policies Previous appeal decisions Case law Loss of sunlight / overshadowing Capacity of physical infrastructure

When should a local finance consideration be taken into account as a material planning consideration? Whether or not a local finance consideration is material to a particular decision will depend on whether it could help to make the development acceptable in planning terms.

Example 1 City in South West UK Master Plan Delivery Programming

The Scenario Ten strategic sites; unviable without intervention Future prospects of main city as regional growth centre under threat Outlying housing sites capable of subsidising city Needed to understand medium to long term planning and financial options

Income from Growth by type 2013-18 2019-2024 Whole Council CIL NNDR NHB CT S106 108,000,000 101,500,000 4,000,000 37,000,000 23,000,000 42,00,000 2,000,000 3,000,000 62,000,000 12,000,000 23,000,000 1,500,000

The Implications Clear understanding of cash flow Informed decisions on release of assets Use of asset receipts to ease cash flow Influenced CIL rate setting Informed successful funding applications

Example 2 Local Authority in Urban Growth Area 1: Strategic Infrastructure Investment

The scenario Desire to use infrastructure investment to drive development growth Immature approach to capital prioritisation No major strategic infrastructure priorities

Income from Growth by type 2013-14 2015-2024 2025-2034 2035-2044 Whole Borough CIL NNDR NHB CT S106 13,239,915 137,087,736 128,665,536 137,613,160 4,042,752 1,946,535 2,033,934 2,614,925 2,601,769 48,145,998 15,659,223 33,587,776 17,461,796 22,232,944 38,146,752 47,859,440 27,805,634 9,947,610 4,906,100 34,412,028 61,969,274 30,903,917 7,835,241 2,492,700 Total of 416m

Income from Growth by type Income / Type S106 7.74% COUNCIL TAX 9.09% CIL 29.94% NEW HOMES BONUS 22.64% NNDR 30.59%

Income from Growth by type 2044 2013 S106 (estimated) COUNCIL TAX NEW HOMES BONUS BUSINESS RATE RETENTION COMMUNITY INFRASTRUCTURE LEVY

The Implications Business Case for each infrastructure item Prioritised programme of infrastructure investment Basis for setting capital investment programme & single regeneration fund

Example 3 Urban Growth Area 2 Medium Term Financial Planning

The scenario 8 major regeneration areas In process of major outsourcing Information sought to inform infrastructure investment priorities

CIL & New Homes Bonus TOTAL (to 2031) Area3 West Hendon 7% 345,444,768 Area2 Stonegrove Spur Road 2% Mill Hill East 9% Area4 9% Area5 Dollis Valley 3% CIL 186,954,357 Granville Road (Ph2) 1% Area6 NHB 158,490,411 Area1 Brent Cross Cricklewood 41% Area7 Grahame Park 9% Area8 Colindale (exc GP) 28%

Business Rates Retention & Council Tax ANNUAL TOTAL (mature development position) Area2 Stonegrove Spur Road 2% Area3 West Hendon 6% Area4 38,836,788 Mill Hill East 6% Dollis Valley 2% Area5 Granville Road (Ph2) 0% Area6 12,972,70 0 NNDR Area 1 54% Area1 Area7 Grahame Park 8% 25,864,08 9 Council Tax Area8 Colindale (exc GP) 22%

Business Rates Retention & Council Tax A significant proportion of collected Council Tax will be used for payment of increased cost of services. When Council Tax and NNDR income streams are separated, a single large shopping centre shown to provide 97 per cent of all NNDR retained income.

The Implications Informed a departmental outsourcing deal Informed negotiations with Government on major infrastructure investment Re-prioritised housing estate investment programme

Example 4 Local Authority in Urban Growth Area 3 Informing Public Sector Interventions

The Approach Site-specific assessments Detailed assessment of ROI from any site-specific interventions, including the cashable impact on wider public financing and regeneration Site residual valuations public finance sources, such as NHB, CIL, Business Rate Retention, etc? implementation planning Where, when and how is Council intervention likely to have the biggest impact?

FINDINGS SITE FOR INTERVENTION Site Selection Probability of development History of planning applications Cost of intervention Delivery/site constraints and issues, such as land ownership, existing lease arrangements, etc. Impacts - blight effect on town centre Potential to have windfall benefits from adjacent development, i.e. gateway site Potential regeneration impact Financial return on investment from intervention

FINDINGS STRATEGIC SITE OPPORTUNITIES

Site Purchase Residual Valuation (Working Results) All Scenario #1 Scheme Site 1 Site 2 Site 3 Site 4 Site 5 Site 6 Site 7 Site 8 RLV ( million) 13,886,468 5,470,159 11,809,142 21,842,095 27,436,949 1,508,628 13,206,476 10,686,177 CPO costs ( ) 6,550,865 1,679,172 19,128,526 1,084,097 2,274,437 1,285,900 29,834,933 18,735,474

SCENARIO TESTING SITE 2 Site characteristics Directly in front of regeneration site, adjacent to new development Current use can easily be re-located Development partner interest Opportunities Scenario 1: Office 98% Office, 2% Assembly 9,205 sqm office Scenario 2: Mixed-use 90% Residential, 10% Retail 141 Homes; 1,097 sqm retail

SCENARIO TESTING Finance Cumulative Totals SITE 2 : Scenario 1: 98% Offices, 2% Assembly & Leisure YEAR 5 1,571,085 - - 1,122,600 2,693,685 YEAR 10 3,840,452 - - 1,122,600 4,963,052 YEAR 20 8,835,037 - - 1,122,600 9,957,637 YEAR 35 16,706,044 - - 1,122,600 17,828,644 NNDR NHB COUNCIL TAX CIL TOTAL SITE 2: Scenario 2: 90% Residential, 10% Retail YEAR 5 133,069 770,600 493,500 131,640 1,528,809 YEAR 10 325,281 1,321,029 1,198,500 131,640 2,976,450 YEAR 20 748,316 1,321,029 2,608,500 131,640 4,809,485 YEAR 35 1,414,979 1,321,029 4,723,500 131,640 7,591,148 NNDR NHB COUNCIL TAX CIL TOTAL

Income by Year 1 36 COUNCIL TAX CIL NHB BUSINESS RATE RETENTION

Income by Year 1 36 COUNCIL TAX CIL NHB BUSINESS RATE RETENTION