The Great Recession & Fiscal Allocation for Public Health:

Discover the latest updates and highlights of V15 by Dan Baronet. Dive into the significant speed-ups, Windows installation without administrative privileges, and new cross-platform native file functions. Explore environment modifications and language-specific changes. Learn about the version 15.0 restrictions and new OS functions introduced in this Spring 2016 release.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The Great Recession & Fiscal Allocation for Public Health: How Has Our Slice of The Pie Changed?

Authors J. Mac McCullough, PhD, MPH Assistant Professor School for the Science of Health Care Delivery Arizona State University JP Leider, PhD Consultant, JP Leider Consulting LLC Gulzar Shah, PhD, MStat, MS Associate Dean for Research & Associate Professor Jiann-Ping Hsu College of Public Health Georgia Southern University

Introduction & Motivation Local sources of revenues are important for LHD financial stability and may reflect local prioritization of public health relative to other programs Focus of most of the post recession studies have been to examine the changes in budgets regardless of sources of revenue A local health department s local revenues are often evaluated relative to non-local revenues (e.g., % of revenues from local sources) Revenues from local sources Total Local Public Revenues 1 2 3 Total LHD Revenues A more informative comparison is an area s local revenues for public health relative to other non- public health revenues Fiscal allocation for public health

Research Question What is the local fiscal allocation for public health as of 2008? What organizational or jurisdictional factors are associated with higher fiscal allocation? How has fiscal allocation for public health changed since before the Great Recession? What organizational or jurisdictional factors are associated with higher levels of fiscal allocation retention? Especially important at the extremes (what separates the big gains from the big declines?)

Methods Data sources: Local governmental revenue data from U.S. Census of Local Governments (2007 & 2012) Contains geographic and financial data on 87,000 local governments (cities, counties, school districts, special districts, etc.) LHD data from NACCHO Profile survey (2008 & 2013) Matched using FIPS codes, excluded LHDs with missing/unreliable expenditure data # LHDs in sample in both years: n = 983 LHDs Outcome of interest: Fiscal Allocation = (Total LHD Local Revenue) (Total Local taxes for corresponding local governments) Local revenue expenditure data self-reported to NACCHO by LHDs Local taxes include: property taxes, other collected taxes, fees, fines 2007, 2012, and change between 07-12 Univariate, bivariate, multivariate analyses Also compute models stratified by level of long-term debt

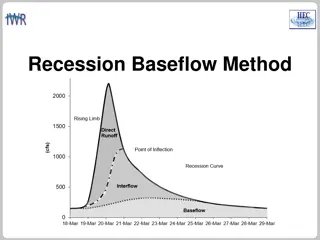

Results Fiscal allocation varies widely across LHDs Large number of LHDs receive no fiscal allocation Small number of LHDs receive high fiscal allocation 25% 20% 15% Substantial state-level variation 10% 5% 0% 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20+ Fiscal Allocation (% of total local taxes for local public health)

Correlates of Fiscal Allocation in 2007 Association with Fiscal Allocation LHD or Area Characteristic Single-county LHD jurisdiction (versus all other jurisdiction types) LHD has a Local Board of Health (versus no LBOH) LHD per capita revenues (standardized) # of Services Provided by LHD Single county jurisdiction 0.80 percentage point higher Fiscal Allocation LBOH 1.84 percentage point higher Fiscal Allocation ~$40 increase of per cap revenues 2.38 percentage point higher Fiscal Allocation 1 additional service provided 0.09 percentage point higher Fiscal Allocation Estimates correspond to the predicted percentage point change in fiscal allocation for presence or one-unit increase for each factor Variables not significant in model: Setting (urban, suburban, rural), % of population that is Non-White, LHD authority to set and impose fees for public health, LHD authority to impose taxes for public health, LHD authority to request tax levy for public health, number of services provided by state, number of services provided by other local government, number of services not available in area

Changes in Fiscal Allocation Lots of small changes before versus after the Great Recession 40 Small negative changes more frequent than small positive changes, but 30 There were LHDs that managed to increase their fiscal allocation from 2007 to 2012! Were these LHDs just lucky or are there patterns lurking in the data? Percent 20 10 0 -10 -5 0 5 10 Percentage Point Change in Fiscal Allocation (2007-2012)

Correlates of Changes in Fiscal Allocation Factors associated with increasedlikelihood of having a large decline in FA from 2007-12: Higher percent population served that is non-white (OR = 1.02*) Greater number of public health activities provided by the state health department (OR = 1.05**) Higher baseline fiscal allocation (OR = 1.09**) Factors associated with lowerlikelihood of having a large decline in FA from 2007-12: Greater number of public health activities provided by the local health department (OR = 0.97**) Other factors included in the model (not significantly associated) Urban/Suburban/Rural; Population served; Single-county jurisdiction; Presence of LBOH; Per capita expenditures; Jurisdictional authority to levy taxes for public health; Number of public health activities provided by other entities; Number of public health activities not available in jurisdiction.

Correlates of Changes in Fiscal Allocation Previous slide discussed likelihood of large changes (> |25%|). What about smaller changes? In addition to previous (% jurisdiction that is non-white, # PH activities provided by LHD and by state): Compared to rural LHDs, urban LHDs had larger declines BUT, area s Long-Term Debt serves as moderator to many of these relationships! Association between percent non-white and decline in FA only holds in areas with high debt Associations between state and local service provision and changes in FA only hold in areas with low debt In addition, suburban LHDs and jurisdictions with the ability to set and impose fees for public health saw gains in FA compared to their counterparts.

Fiscal Allocation for LHDs Fiscal allocation for public health averages approximately 3.3% of all local governmental own revenues High variation within and between states The Great Recession not only resulted in a smaller overall pie, but public health now receives a smaller piece of that pie.

Takeaways for Practitioners & Implications for Health Equity A range of factors are associated with levels of fiscal allocation for public health LHD jurisdiction type, governance, expenditures, service provision Some are amenable to LHD leadership intervention (e.g., service provision), others are harder to impact From health equity and disparities perspective: Findings that areas with high proportion of non-white population and high levels of long-term debt were prone to declines in FA during the Great Recession may be concerning. Suburban LHDs, those able to set their own fees, and those providing higher number of direct services tended to fare better.

Impacts of Long-Term Debt on LHDs Anecdotally, we generally understand that very high levels of long-term debt is bad Less room for other priorities Less flexibility to match current needs Public health is not immune An area s long-term debt level is extremely important Areas with high long-term debt tend to have lower fiscal allocation for public health Only know which levers are relevant/effective after considering long-term debt Take Away Researchers: also consider additional financial measures beyond per capita revenue Policy Makers: what local tax and debt conditions are most conducive to advocacy for increased funding? What areas may be especially prone to erosion of local funding during future economic recessions?

Thank You Questions? mccullough@asu.edu