The Perfect Buyer An ESOP? - Understanding Employee Stock Ownership Plans

Employee Stock Ownership Plans (ESOPs) are a unique financial technique for privately-owned businesses to provide employees with a stake in the company's success. This article delves into the benefits, challenges, and success stories of ESOPs, featuring insights from industry experts.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The Perfect Buyer An ESOP? March 9th & 10th, 2015

Participants: Ron Gilbert, President, ESOP Services, Inc. Jim Parham, Managing Partner, Transport Capital Partners Bill Prevost, President and CEO, Quickway Distribution Services, Inc. Robert Bearden, President, Robert Bearden, Inc. Randy Vernon, President, Big G Express, Inc.

Agenda Carrier Summary The Ideal Situation ESOP Overview Tax Shields Advantages Challenges Is an ESOP for You? Questions from the Audience

Big G Express Shelbyville, TN 467 tractors 100% owned by ESOP January 2009 become an ESOP Combination of Bank and Seller financing

Quickway Converted to C Corp for the sale in 2004; then became a 100% ESOP-owned S Corp in 2005 Nashville, TN 1400 tractors 100% owned by ESOP Bank and Seller financing Elected the Tax-free rollover (but undone during the Great Recession)

Robert Bearden, Inc. Cairo, GA 200 tractors July 1, 2012 date of sale 100% owned by ESOP Sold to an ESOP (Quickway)

When the Stars Align The ESOP pays a very competitive price for a partial or complete buyout Sellers pay no capital gains tax The corporation operates as a tax-free entity Banks provide attractive financing ESOP participants have a significant wealth building opportunity, turnover reduced The business is perpetuated

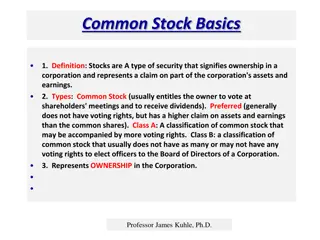

Employee Stock Ownership Plan (ESOP) A unique financial technique for the perpetuation of successful privately-owned businesses that provides employees of that business a piece of the action A direct stake in the success of the business

Overview 11,000 ESOPs in U.S. (10% of private sector) 3,500 majority owned by the ESOP In a broad range of industries 70% of ESOPs are in companies with fewer than 250 employees As small as a few dozen employees and as large as 100,000 (Publix Supermarkets)

Financing Experienced ESOP lenders aggressively hunting for deals Seller financing can provide cushion Warrants attached to seller debt provide up side potential 100% ESOP vs. partial (successor management team in place??)

ESOP Lenders Bank Loan is to the company, which makes back-to-back loan to ESOP Typically 5 - 7 years Assessment of company credit similar to other loans Selling shareholders receives cash up front Sellers can collateralize shortfall with proceeds from ESOP sale (securities)

ESOP Lenders (continued) Owner/selling shareholder Take back a subordinated note with warrants Taxed on principal upon receipt at capital gains and interest as ordinary income under installment sale treatment Principal can be tax free The Company Cash-rich company can make loan to the ESOP Advantage: company repays itself with tax-deductible contribution Private equity group Mezzanine financing subordinated to the bank, no collateral May be interest only for several years

Discussion on How Carriers Are Financing their Deals

Tax Shields The ESOP tax shield equals 40% - 80% Every $1,000,000 of ESOP transaction provide $400,000 - $800,000 in tax savings Tax-deductible principal repayment IRC 404(a)(9) Tax-free S corporation income IRC 409(p) and 512(a) Tax-deferred sale C corporation stock IRC 1042

Perpetuation Planning C Corporation IRC 1042 Tax-Free Rollover Seller can elect to defer gain on C corporation shares sold to ESOP by reinvesting all or any portion of the sale proceeds in Qualified Replacement Property ( QRP ) QRP is stock or debt instruments of a domestic operating corporation QRP must be acquired within 12 months of the ESOP sale (or 3 months before) After the sale, the ESOP must own at least 30% of company

Perpetuation Planning C Corporation IRC 1042 Tax-Free Rollover (continued) QRP can be pledged as collateral Floating Rate Notes ( FRNs ) provide excellent collateral, and are suitable for monetization Seller must have owned stock for at least three years Seller cannot have acquired the stock in a Section 83 transaction, nor from a qualified retirement plan Seller, certain related individuals, and greater-than-25% owners generally cannot participate in ESOP stepped-up basis at death under current tax law

Discussion of the Tax Impacts on Sellers

Competitive Price Compared to financial buyer 5%-10% marketability discount 10-15% minority discount 30% greater net proceeds if tax-free rollover applies

Discussion of Current Pricing Environment

Advantages Retains employees lower turnover rates (30 years of studies) Employees share directly in equity growth Employer contributions tend to be larger than profit sharing contributions ESOP stock allocated proportionate to compensation Proven motivator Accounts accumulate tax-free

What Advantages did the Carriers Experience?

Challenges Government agency oversight IRS Clarity Good continuing dialog, ongoing Department of Labor Partial clarity and dialog (GreatBanc - DOL 2014 settlement)

Challenges (continued) Repurchase Obligation Corporate Obligation Spread over 5 to 11 years Similar to budgeting for capital equipment

Challenges (continued) Control - - Keep ESOP at minority level Majority ESOP, proper board and committee structure, i.e. nominating, etc. allows ongoing operating control Trustee votes for Board of Directors Marketing it to employees -

Future Sale of Company An offer you can t refuse Minority ESOP or majority ESOP with equity incentives for key executives Buyouts are typically at substantial premiums Life span of ESOPs 6 mos to 40 years

Comparison of After-Tax Proceeds IPO Recap Stock Swap ESOP 100% 8% 75% 40% 50% 100% 90% 100% 50% 25% 0% Percent remaining in company stock Percent available to invest in diversified portfolio

The Perfect Buyer An ESOP? Competitive price No capital gains tax (low basis?) Tax-free corporate income (S corporation) Bank financing Seller financing with upside Lower turnover Business perpetuation

Resources www.transportcap.com www.esopservices.com www.nceo.org www.esopassociation.org