The Significance and Features of the Money Market

Explore the functions, significance, and features of the money market, which serves as a platform for short-term finance, liquidity provision, and efficient fund management. Discover how the money market facilitates economic stability through lending, borrowing, and dealing in various financial assets with short periods of maturity.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

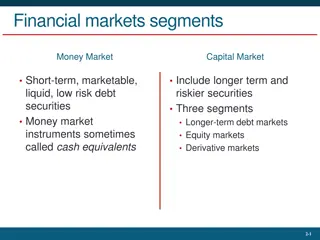

MONEY MARKET Money Market refers to the market for short term finance. Financial assets which have a short period of maturity are dealt in this market. Near money like Trade Bills, Promissory Notes, Short term Government Papers, etc., are traded in this market.

FUNCTIONS OF MONEY MARKET 1. It meets the short-term financial needs of various borrowers like individuals, institutions and governments 2. It provides liquidity to investors and savers of money 3. It provides a platform for dealing in short-term securities which have a maturity period of less than one year

SIGNIFICANCE / OBJECTIVES / IMPORTANCE OF MONEY MARKET 1. Provide a parking place for short term surplus funds mainly of commercial banks 2. Provide room for overcoming short term deficits 3. Facilitate development of trade and industry 4. Facilitate development of capital market 5. Facilitate smooth functioning of commercial banks 6. Enable central bank to influence and regulate liquidity in the economy 7. Provide non-inflationary finance to the government 8. Enable formulation and revision of monetary policy 9. Provide a reasonable access to borrowers of short term funds to meet their requirements quickly, adequately and at reasonable costs.

FEATURES OF MONEY MARKET 1. Money market is a market for lending and borrowing of short term funds 2. It deals with financial assets having a maturity period of a maximum of one year 3. It deals with only those assets which can be converted into cash immediately without any loss and with minimum transaction cost 4. It provides liquidity to lenders 5. It includes all individuals, institutions and intermediaries dealing with short term funds 6. The transaction takes place through telephone, mail, etc 7. Transactions are conducted without the help of brokers 8. It consists of a verity of specialized markets like Call money market, Acceptance market, Bill market, etc.

CHARACTERISTICS / FEATURES / ESSENTIALS OF A WELL DEVELOPED MONEY MARKET 1. Highly organized banking system 2. Presence of central bank 3. Availability of proper credit instruments 4. Existence of sub-markets 5. Availability of ample resources 6. Existence of secondary market 7. Existence of large demand and supply for short term funds 8. Rapid industrial development leading to the emergence of stock exchanges 9. Large volume of international trade leading to the system of bill of exchange 10. Political stability in the country 11. Favourable conditions for foreign direct investment 12. Price stability in the economy, etc.

COMPOSITION (FINANCIAL INSTRUMENTS DEALT IN MONEY MARKET) OF MONEY MARKET The money market comprises of the following: 1. Call money market 2. Commercial bills market 3. Treasury bills market 4. Short-term loan market