The Standard Model: International Trade and Economic Equilibrium

The Standard Model by Alan V. Deardorff delves into the fundamental concepts of international trade, focusing on relative supply and demand, international equilibrium, effects of growth, and trade barriers. The model assumes two goods, cloth and food, with prices and quantities determined by production possibilities and consumer preferences. Explore how this model encompasses various trade scenarios and special cases, such as the Ricardian model and the Heckscher-Ohlin model, to analyze economic interactions across different countries.

Uploaded on Apr 09, 2025 | 3 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

PubPol/Econ 541 Classes 15, 16 The Standard Model by Alan V. Deardorff University of Michigan 2023

Announcements Paper 2 Due Nov 6 Meetings with me: If your group wants to meet with me by Zoom, email me with a couple of suggested times for me to select from, including on the weekend if that s what you prefer. Class 15: The Standard Model 2

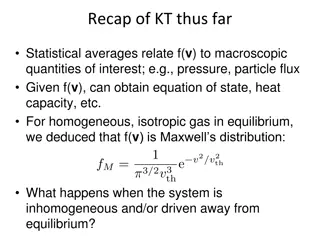

Outline Relative supply Relative demand International equilibrium Small country Two country world Effects of growth Effects of trade barriers Class 15: The Standard Model 3

The Standard Model* Assumes Two goods, cloth C and food F Outputs: QC, QF Prices: PC, PF Takes as given: Production possibilities Represented by Production Possibility Frontier (PPF) Preferences for consumption Represented by community indifference curves Assumed to be homothetic (see below) *Name given to this model by Krugman and Obstfeld (1991) and subsequent editions. Class 15: The Standard Model 4

The Standard Model Also assumes (as before) Homogeneous products Perfect competition No distortions (externalities, etc.) Zero costs of trade (transport, etc.) except when we add tariffs Also (and not needed before) Balanced trade Class 15: The Standard Model 5

The model Includes as special cases The Ricardian model (but linear PPF) Heckscher-Ohlin Model Specific factors model Class 15: The Standard Model 6

Outline Relative supply Relative demand International equilibrium Small country Two country world Effects of growth Effects of trade barriers Class 15: The Standard Model 7

Production Possibilities QF Curvature Ricardian Model: Not curved Heckscher-Ohlin Model: due to industries different factor intensities Specific Factors Model: due to diminishing returns to non- specific factor PPF = Production Possibility Frontier Why Frontier ? Because it could certainly produce less, If it produced inefficiently Or if resources were not fully employed QC Class 15: The Standard Model 8

Prices QF Price lines = iso-value lines: V = PCQC+PFQF or QF = V/PF (PC/PF )QC V3 PC/PF V2 V1 QC Class 15: The Standard Model 9

Equilibrium Production Tangency implies maximum value QF Supplies depend on price ratio, or relative price : SC = SC (PC/PF ) SF = SF (PC/PF ) SF0 PC0/PF0 SC0 QC Class 15: The Standard Model 10

Equilibrium Production QF Thus Relative Supply , RS = SC/SF, also depends on relative price, RP = PC/PF: RS= RS(RP) SF0 RP0 SC0 QC SF/SC=1/RS Class 15: The Standard Model 11

How Supplies Depend on Prices QF RP = (PC/PF) > 0 => SC > 0 SF < 0 RS > 0 RP1 RP0 SF0 SF1 SC0 SC1 QC RP = (PC/PF) > 0 Class 15: The Standard Model 12

Relative Supply RP = PC/PF It follows that RS as a function of RP thus RS(RP) is upward sloping RS(RP) RP1 Note: There is no reason for this to be a straight line. But it could curve either way. RP0 RS0 RS1 RS= SC/SF Class 15: The Standard Model 13

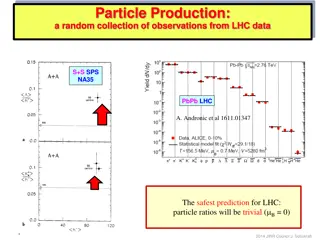

14 Figure 6.2 How an Increase in the Relative Price of Cloth Affects Relative Supply In panel (a), the isovalue lines become steeper when the relative price of cloth rises. As a result, the economy produces more cloth and less food. Panel (b) shows the relative supply curve associated with the production possibilities frontier TT. The rise in the relative price of cloth leads to an increase in the relative production of cloth.

Pause for Discussion Class 15: The Standard Model 15

Questions (Not asked before) If the relative price of C goes up, the isovalue line gets steeper. Is there a way to see this without deriving it or remembering the equation? Does this model display upward sloping supply? How does it differ, in this respect, from the partial equilibrium model we have seen before? In partial equilibrium, supply slopes up because marginal cost rises. Is that true here? Class 15: The Standard Model 16

Outline Relative supply Relative demand International equilibrium Small country Two country world Effects of growth Effects of trade barriers Class 15: The Standard Model 17

Preferences QF Represented by a family of indifference curves for the whole country: Called community indifference curves Their shapes are like those of individual consumers in micro- econ, but these are for the whole country. QC Class 15: The Standard Model 18

Preferences QF If we knew the budget line, then we would use it to find demand, from Tangency between budget line and an indifference curve That s the most preferred bundle of the two goods that consumers can afford. QC Class 15: The Standard Model 19

Equilibrium Demand QF Given prices, income is the value of production. So the budget line is the price line tangent to the PPF. And demand is then given by its tangency with an indifference curve. D0 DF0 SF0 S0 DC0 SC0 QC Class 15: The Standard Model 20

Trade QF For arbitrary prices, RP0, demand will not equal supply Their difference will be trade: Exports: SC DC=XC Imports: DF SF=MF Trade Triangle D0 DF0 MF0 SF0 S0 RP0 XC0 DC0 SC0 QC We can use this as the complete model for the small-country case, and we will. But for the large country we ll need Relative Demand. Class 15: The Standard Model 21

Relative Demand QF We will use this first, however, to find Relative Demand: RD = DC/DF D0 DF0 SF0 S0 RP0 DC0 SC0 QC DF/DC=1/RD Class 15: The Standard Model 22

How Demands Depend on Prices RP1 QF RP = (PC/PF) > 0 => ? With no assumption on preferences (indifference curves) we can say little about how prices affect demand (Recall income and substitution effects from microeconomics) D1 RP0 D0 DF0 RP0 DC0 QC Class 15: The Standard Model 23

Homothetic Preferences QF So we assume: each indifference curve is a radial expansion or contraction of all others Thus: Ratio of demands depends only on ratio of prices Change in income (with prices fixed) does not change relative demand RD = DC/DF QC Class 15: The Standard Model 24

How Demands Depend on Prices RP1 QF With homotheticity: RP = (PC/PF) > 0 => DF > 0 RD < 0 But we still don t know DC >,=,< 0 That s why we now work with relative supply and demand. D1 DF1 RP0 D0 DF0 RP0 DC1 DC0 QC Class 15: The Standard Model 25

Relative Demand RP = PC/PF It follows that RD(RP) is downward sloping RP1 Note: Again, there s no reason for this to be a straight line. It could curve either way. RP0 RD RD1 RD0 RD= DC/DF Class 15: The Standard Model 26

Autarky Equilibrium RP = PC/PF Combine RS and RD RS RPaut RD RQaut RQ= QC/QF Class 15: The Standard Model 27

Pause for Discussion Class 15: The Standard Model 28

Questions (Not asked before) Does this display downward sloping demand? How does it differ, in this respect, from the partial equilibrium model we have seen before? As shown above, demand for C falls when its relative price rises. How could it be otherwise? How will RPaut and RQaut change with shifts in RS & RD? With changes in production possibilities and preferences? Class 15: The Standard Model 29

How Demands May Depend on Prices RP1 QF As RP rises, consumers still substitute away from cloth. But now they can buy more of both goods (the income effect), and with a tighter curvature of the indifference curves, they do, buying more cloth and more food. RP0 D1 DF1 D0 DF0 RP0 DC0 DC1 QC Class 15: The Standard Model 30

Outline Relative supply Relative demand International equilibrium Small country Two country world Effects of growth Effects of trade barriers Class 15: The Standard Model 31

Small Country Trade Suppose that the country is too small to matter for both PC and PF in the world market. Then RPW = PCW/PFW is given Class 15: The Standard Model 32

Small-Country Trade Equilibrium RP = PC/PF RP0W > RPaut implies RS0 > RD0 Country Exports good C Imports good F RS RP0W RPaut RP1W < RPaut implies RS1 < RD1 Country Exports good F Imports good C RP1W RD RS1 RD0 RS0 RD1 RQ= QC/QF Class 15: The Standard Model 33

Small-Country Trade Equilibria Trade Triangle Trade Triangle QF QF D0 RP1W S1 RD0 D1 RS1 S0 RP0W RS0 RD1 QC QC Class 15: The Standard Model 34

Pause for Discussion Class 15: The Standard Model 35

Questions (Not asked before) Looking at the figures, where can you see the gains from trade ? Suppose that you knew that events in other countries were going to worsen your country s terms of trade. How will that hurt your country? Would your country therefore be better off if it did not trade at all? Class 15: The Standard Model 36

Worsening of Terms of Trade QF QF RP0W RP1W D0 D1 S0 S1 Saut=Daut Saut=Daut D1 D0 S1 RP0W RP1W S0 QC QC Class 15: The Standard Model 37

Outline Relative supply Relative demand International equilibrium Small country Two country world Effects of growth Effects of trade barriers Class 15: The Standard Model 38

Two-Country World Additional assumption: Preferences are the same in the two countries Since they are also homothetic, If the two countries consumers face the same relative prices (as they will with free trade) then they will consume the two goods in the same proportions. Class 15: The Standard Model 39

World Relative Supply & Demand For international equilibrium, we need world relative supply and demand (of 2 countries) These cannot be gotten by just adding up those for the individual countries Instead, they are weighted averages of the separate countries QCW = QC + QC* QFW = QF + QF* QC + QC* => RQW = QF + QF* QF QC QF* QC* = + QF + QF* QF QF + QF* QF* RQW = QFRQ + (1 QF)RQ* where QF = QF + QF* QF Class 15: The Standard Model 40

World Relative Supply & Demand Thus: RSW = SFRS + (1 SF)RS* where SF = SF + SF* SF RDW = DFRD + (1 DF)RD* where DF = DF + DF* DF Class 15: The Standard Model 41

World Relative Supply RP = PC/PF World relative supply is a weighted average; it thus lies between the domestic and foreign relative supplies (Strictly speaking, these need not be straight and should not be parallel) RS* RSW RSW RS SF The larger is the home share of supply, SF = , the closer RSW will be to home relative supply RS. SF SF + SF* RQ= QC/QF Class 15: The Standard Model 42

World Relative Demand RP = PC/PF Because preferences are identical and homothetic in the two countries, RD is the same in both. So world relative demand is the same as well. RDW=RD=RD* RQ= QC/QF Class 15: The Standard Model 43

International Market Equilibrium RP = PC/PF Int l market equilibrium is the relative price that equates world relative supply to world relative demand. RS* RSW RS RP0 As drawn, the home (no *) country is assumed to be the larger relative supplier of good C. So home exports C. RDW RQ0 RQ= QC/QF Class 15: The Standard Model 44

45 Figure 6.5a Equilibrium Relative Price with Trade and Associated Trade Flows

Movement Autarky to Free Trade RP = PC/PF RS* Home: RP rises RQ rises Exports cloth Imports food Foreign: RP falls RQ falls Imports cloth Exports food RSW RS RPaut* RP0 RPaut RDW RQ0 RQ= QC/QF Class 15: The Standard Model 46

International Market Equilibrium RP = PC/PF The next slide shows production, consumption, and trade in this free-trade equilibrium RS* RSW RS RP0 RDW RQ0 RQ= QC/QF Class 15: The Standard Model 47

International Market Equilibrium QF* Foreign QF Home SF* DF* DF SF QC* DC SC QC SC* DC* Class 15: The Standard Model 48

International Trade Trade Triangles (Must be identical for equilibrium) QF* Foreign QF Home SF* XF* DF* DF MF SF XC MC* QC* DC SC QC SC* DC* Class 15: The Standard Model 49

Pause for Discussion Class 15: The Standard Model 50