Theory of Corporate Law and Ownership Structures

Explore the A Team Production Theory of Corporate Law and ownership structures in organizations, focusing on shareholder interests, principal-agent relationships, property rights, and hierarchy within corporations. Understand the challenges and limitations of traditional economic theories in explaining modern corporate structures.

Uploaded on | 2 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

A Team Production Theory of Corporate Law Margaret M. Blair and Lynn A. Stout Virginia Law Review (1999) Daniela Pedraza Novak, Spring 2021 (Revised by Bryn Choi, Spring 2023)

Motivation Who owns a corporation? Most economists and legal scholars Shareholders Corporations are bundles of assets collectively owned by shareholders (principals) who hire directors and officers (agents) Two key challenges: To reduce agency costs by keeping directors and managers faithful to shareholders interests. To prioritize the maximization of shareholder s wealth. Limitations of this principal-agent model The firm exists to minimize agency costs and maximize wealth This reasoning does not explain the publicly-traded corporation.

Overview Standard economic theory of the firm Why do firms exist? 1. Principal-agent explores contracting problems that arise when one actor hires another to act on his/her behalf. 2. Property rights examines the role of property rights in coordinating productive activities where it is too costly to write and enforce complete contracts. 3. Team production considers the role hierarchy may play in policing against shirking problems that may rise in coordinating team production.

1. Principal-Agent Approach Focuses on bilateral relationships A principal who wants to accomplish some project she cannot do by herself hires an agent to do that project on her behalf. Efficiency problems Stem from monitoring challenges and decoupling between efforts and results. How can the principal write a contract that motivates the agent to do his best to accomplish the principal s goals? Limitation: It ignores the possibility that: The agent might have trouble getting the principal to perform their end of the deal. Part of the agent's job is to figure out what needs to be done (more common in public corporations). Many relationships are ambiguous (no principal-agent authority).

2. Property Rights Approach Focuses on long-term productive relationships Writing complete contracts that explicitly provide for all contingencies can often be costly or even impossible. Who does what and who gets what in the course of a long-term productive relationship? Solution for closing contractual gaps: Assigning property rights to one of the parties - giving that party a residual right of control over the assets used in the joint enterprise. Limitation: Not applicable for public corporations It is not a theory of the corporation; Corporate law is clearly not needed to achieve common ownership of assets. The theory mis-states the nature of shareholders interests in public corporations. Knowledge and experience reside in the minds of employees, not in the hands of shareholders.

A Theory of Hierarchy Principal-Agent + Property Rights All relationships of interest in the production process are vertical. Hierarchy plays an important role in gathering and processing info. Emphasizes top-to-bottom coordination. Limitation: Ignores horizontal interaction. Some productive activities depend at least as much upon horizontal relationships as vertical ones (some kinds of outcomes can only be achieved through joint effort). Hierarchical governance also serves to mediate disputes among team members.

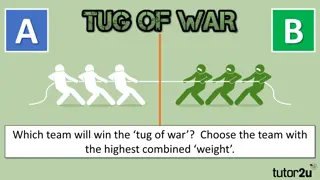

3. Team Production Approach Alchian and Demsetz (1972) Team production: 1) Several types of resources are used. 2) The product is not separable. 3) Not all resources used in team production belong to one person. Shirking problems (free riders) with in advance agreements. Rent seeking problems (wasteful behavior) without agreements. Hierarchies arise to address One member of the team is the monitor (residual claimant). All other team members become employees who are paid a fixed wage equal to their opportunity cost.

3. Team Production Approach Holmstrom (1982) Addressed the agency cost problem (the difficulty of monitoring the agent) and the free- rider problem. How can a monitor write an employment contract that provides appropriate incentives for each member of a team of hard-to-monitor employees not to shirk? Holmstrom's impossibility theorem Such a (first-best) contract cannot be written. One possible answer: Arranging for an outsider to absorb any surplus that is not distributed to the team members but without any control rights, which can be used to influence the outcome of the team s efforts. Team members (executives and rank-and-file employees) vs. budget breakers (shareholders)

The Mediating Hierarchy Approach Rajan and Zingales (1998) Modified the team production analysis in a subtle but critical way They assume that team production requires each member of the team to make an irrevocable commitment of resources to the joint enterprise. Although property rights can protect at least one team member's specialized investment, they can also empower that owner to capture economic rents by exploiting the other member's specialized investment. Both team members might improve their welfare by agreeing to give up control rights to a third party, an outsider to the actual productive activity. Public corporation as a nexus of firm-specific investments Several different groups contribute unique and essential resources.

Public Corporation as a Mediating Hierarchy Team members all agree to give up control rights over the output from the enterprise and over their firm-specific inputs. No one member as the principal, but a board of directors. Third function of a corporation (streamline info & decision-making, control shirking) Encourage firm-specific investment in team production by mediating disputes among team members about the allocation of duties and rewards. Sources of surplus Vertical coordination + Horizontal interactions Primary job of board of directors Trustee for the corporation itself. Balance team members competing interests to keep everyone in the coalition.

A team production analysis of the law of corporations Both law and economics scholars describe American corporate law as following the shareholder primacy model. Directors are controlled by and owe extracontractual legal duties only to shareholders. Two features of the US corporate law support this assumption: The derivative suit procedure, which allows shareholders to file suit on behalf of the corporate entity against directors accused of breaching their duties to the firm. Shareholder voting rights, which appear to give shareholders a unique measure of control over how the firm is run. However, corporate law does not treat directors as shareholders agents but as independent hierarchs who are charged not with serving shareholders interests alone, but with serving the interests of the legal entity known as the corporation. The mediating hierarchy approach provides a more solid theoretical foundation for the basic structure of public corporation law.

A team production analysis of the law of corporations Directors legal role: Trustees more than agents As the ultimate decision makers, directors are not subject to direct control or supervision by anyone - They are supported by the mediating hierarchy model. Shareholders can elect and remove directors, but not commend the board to action. Corporate personality Legal person Shareholders can only sue in derivative cases to serve the interests of the firm as a whole, rather than the interests of shareholders per se. Directors fiduciary duties Duty of Loyalty and Duty of Care Corporate law often explicitly authorizes directors to sacrifice shareholders' interests to protect other constituencies.

A team production analysis of the law of corporations Re-examining shareholders voting rights They elect the board of directors Yet, the voting rights are so weak as to be virtually meaningless (at least in publicly-traded corporations) and they can only vote yes or no when directors propose a corporate change. How corporate law keeps directors faithful Directors have an interest in serving their corporate constituents well if they want to keep their positions. Corporate law encourages directors to serve their firms interests by severely limiting their abilities to serve their own interests. Directors are encouraged to serve the firm by corporate cultural norms of fairness and trust.

Conclusion This article proposes an approach to thinking about public corporations that does not reject the nexus of contracts view. Rather, it builds on it by acknowledging the limits of what can be achieved by explicit contracting or by assigning property rights. Gaps in explicit contracts can be filled by assigning residual control rights (property rights) to a third party the board of directors which is largely away from the direct control of any of the various economic interests. The mediating hierarchical model: Explains many important aspects of corporate law much more robustly than its alternatives, especially principal-agent theories. Insulates corporate directors from the direct command and control of any of the groups that comprise the corporate team, including its shareholders. While it may not reduce agency costs, it may provide an efficient (albeit second-best) solution to the contracting problems that arise in team production.

Discussion When discussing the ability of directors to serve their own interests, the authors explain that corporate law encourages directors to serve their firms interests by severely limiting their abilities to serve their own. The underpinning assumption here is that if directors are unable to serve their own interests, they will serve the interests of the firm. Is this a valid assumption? Is what the authors describe what people think about when they decide to incorporate as a firm? Why or why not ? Does it matter whether they do?