Top Six Developers in Dubai Drive Market - Inchbrick Realty

Top Six Developers in Dubai Drive Market & Dubai's property market sees a 55% surge in Q4 deals. Sobha, Azizi, Damac & moreu2014lead the growth - Inchbrick Realty.n

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

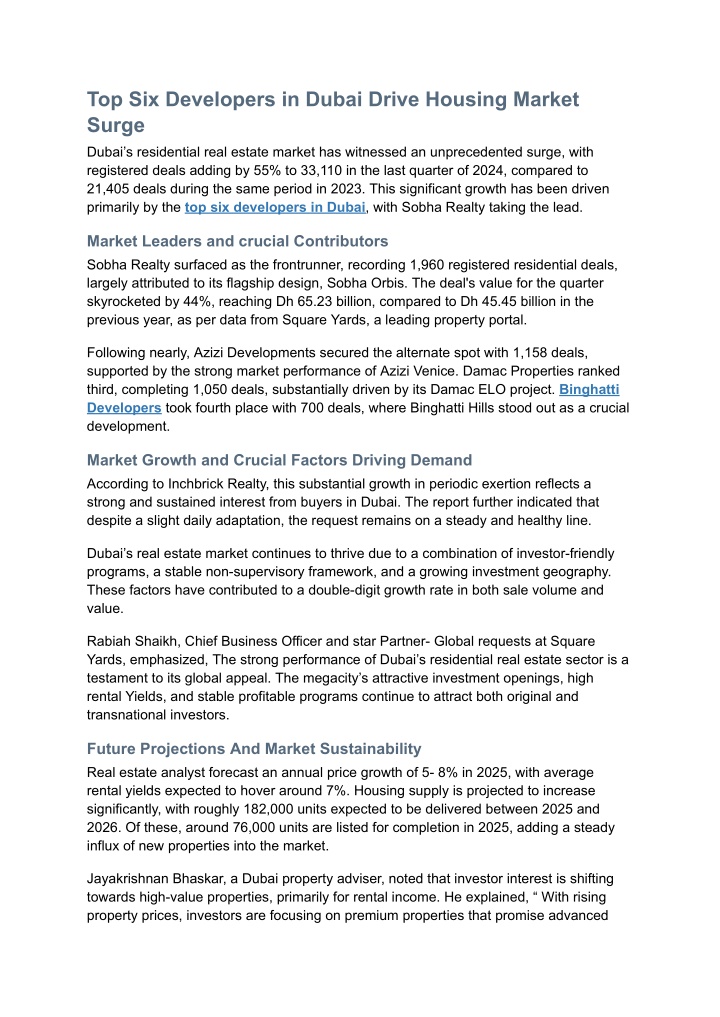

Top Six Developers in Dubai Drive Housing Market Surge Dubai s residential real estate market has witnessed an unprecedented surge, with registered deals adding by 55% to 33,110 in the last quarter of 2024, compared to 21,405 deals during the same period in 2023. This significant growth has been driven primarily by thetop six developers in Dubai, with Sobha Realty taking the lead. Market Leaders and crucial Contributors Sobha Realty surfaced as the frontrunner, recording 1,960 registered residential deals, largely attributed to its flagship design, Sobha Orbis. The deal's value for the quarter skyrocketed by 44%, reaching Dh 65.23 billion, compared to Dh 45.45 billion in the previous year, as per data from Square Yards, a leading property portal. Following nearly, Azizi Developments secured the alternate spot with 1,158 deals, supported by the strong market performance of Azizi Venice. Damac Properties ranked third, completing 1,050 deals, substantially driven by its Damac ELO project. Binghatti Developers took fourth place with 700 deals, where Binghatti Hills stood out as a crucial development. Market Growth and Crucial Factors Driving Demand According to Inchbrick Realty, this substantial growth in periodic exertion reflects a strong and sustained interest from buyers in Dubai. The report further indicated that despite a slight daily adaptation, the request remains on a steady and healthy line. Dubai s real estate market continues to thrive due to a combination of investor-friendly programs, a stable non-supervisory framework, and a growing investment geography. These factors have contributed to a double-digit growth rate in both sale volume and value. Rabiah Shaikh, Chief Business Officer and star Partner- Global requests at Square Yards, emphasized, The strong performance of Dubai s residential real estate sector is a testament to its global appeal. The megacity s attractive investment openings, high rental Yields, and stable profitable programs continue to attract both original and transnational investors. Future Projections And Market Sustainability Real estate analyst forecast an annual price growth of 5- 8% in 2025, with average rental yields expected to hover around 7%. Housing supply is projected to increase significantly, with roughly 182,000 units expected to be delivered between 2025 and 2026. Of these, around 76,000 units are listed for completion in 2025, adding a steady influx of new properties into the market. Jayakrishnan Bhaskar, a Dubai property adviser, noted that investor interest is shifting towards high-value properties, primarily for rental income. He explained, With rising property prices, investors are focusing on premium properties that promise advanced

rental returns. Demand for settlements remains strong, feeding into both short- and long-term tenants. Shaikh further emphasized the key advantages of investing in Dubai s real estate market, including streamlined property acquisition processes, favorable visa and mortgage regulations, tax benefits, and attractive rental yields. These factors have corroborated Dubai s position as a premier global real estate investment destination. Strategic Growth And Long-Term Plans Looking ahead, Dubai s real estate market is poised for sustained growth, backed by strategic initiatives like the Dubai Real Estate Sector Strategy 2033. This ambitious plan aims to double the sector s donation to GDP, increase homeownership rates, and push the market s total value beyond Dh 1 trillion. Shaikh developed, With strategic governmental enterprise in place, we envision long-term request stability. Dubai s domestic sector remains the backbone of this growth, attracting a different pool of investors. Sales Performance by Developer In terms of registered home deals value,Sobha Realty led with Dh 4.297 billion, largely due to the success of Sobha Orbis. Emaar Properties secured the alternate position with Dh 1.965 billion, substantially attributed to Emaar Marina Cove. Damac properties came in third with Dh 1.464 billion, supported by Damac Lagoon Views, while Azizi Developments ranked fourth with Dh 1.370 billion, driven by Azizi Venice. Despite the increase in total sale volume, the average registered home deals value declined by 7.0 percent to Dh 1.97 million compared to the previous time. This trend indicates a market shift towards further affordable casing options, even amid high transaction activity. Shift in Property Preferences Residential units below 1,000 sq. ft. dominated 75 percent of deals in the December quarter, rising from 61 percent in the same period in 2023. Again, units larger than 1,000 sq. ft. reckoned for only 25%, down from 39 percent in the previous year. This shift towards compact living spaces is reflected in sale values, as properties priced under Dh 2 million accounted for 74% of the requests, up from 70 percent the previous time, the Square Yards report stressed. Market data suggests that the focus is shifting toward mid-range and budget-friendly parts, with decoration properties priced between Dh 3- 5 million and above Dh 5 million seeing a slight decline in demand. Micro-Markets Driving the Surge Among micro-markets, Dubailand led with a 28 percent share of the total request, followed by Jumeirah at 22 percent. Mohammed Bin Rashid City ranked third,

contributing 9.0 percent to the overall request volume. inclusively, these three areas accounted for 59 percent of Dubai s total registered residential transactions. Regarding registered home deals value, Dubailand contributed 24 percent of the aggregate, followed nearly by Palm Jumeirah at 14 percent and Jumeirah at 13 percent. These three micro-markets represented 51 percent of Dubai s total residential property deals value for the quarter. Key Locations and Growing Demand Business Bay and Jumeirah Village Circle( JVC) surfaced as the most active points, with Business Bay leading in total deals value and JVC recording the highest number of deals. Other high locales similar to Dubai Marina, Downtown Dubai, and Al Barsha also endured strong market activity. also, arising areas like Bukadra and Dubai World Central demonstrated promising growth trends, particularly in the outer regions. Why Choose Inchbrick Realty? Inchbrick Realty has established itself as a trusted real estate agency, offering expertise in Dubai s dynamic property market. With an expansive portfolio of residential and commercial properties, the company provides tailored results to meet the unique requirements of investors, homebuyers, and tenants. Expert Market insight - Inchrick Realty keeps investors informed with real-time market trends, ensuring optimal investment opinions. Exclusive Property listing - The company provides access to decoration parcels across Dubai, including new launches andoff-plan properties. Personalized Consultation guests admit to devoted backing from educated professionals, guiding them through property selection, backing, and legal processes. Comprehensive Investment Strategies Inchbrick Realty offers acclimatized investment strategies to maximize returns and long-term capital appreciation. Flawless Buying Experience From property hunt to final purchase, Inchbrick Realty ensures a hassle-free and transparent buying process. Strong developers partnerships uniting with top inventors like Sobha Realty, Emaar Properties, and Damac, the company delivers high-quality property options to its guests. Conclusion Dubai s real estate market is witnessing robust growth, driven by leading developers and strategic government enterprises. With strong sale volumes, adding investor confidence, and seductive reimbursement yields, the request is set to sustain its upward line in the coming years As property preferences shift towards compact and affordable units, inventors are responding with acclimatized systems to meet the demand. also, crucial micro-markets

similar to Dubailand, Jumeirah, and Mohammed Bin Rashid City continue to play a significant part in shaping Dubai s domestic sector. For investors, homebuyers, and real estate suckers, Dubai remains a economic destination. Whether looking for high-yield reimbursement properties or long-term capital appreciation, Inchbrick Realty stands as a dependable partner in navigating the megacity s thriving property market. With strategic planning, government-backed enterprise, and adding demand, Dubai s real estate sector remains a powerhouse of opportunity. Investors seeking a secure and profitable investment need not look further than the ever-expanding geography of Dubai s property sector, with Inchbrick Realty guiding the way to successful investments.