Topical Issues and Solutions in the Field of Currency Regulation and Control

Explore the latest discussions on currency regulation and control. Gain insights into the key issues and solutions shaping the financial landscape. Stay informed with expert opinions and innovative approaches in this dynamic field.

Uploaded on Mar 09, 2025 | 2 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

AEBRUS.RU KEY TOPICAL ISSUES AND SOLUTIONS IN THE FIELD OF CURRENCY REGULATION AND CONTROL 21 April 2022

OPENING 2 Tadzio Schilling CEO Association of European Businesses OPENING REMARKS AEBRUS.RU

MODERATORS 3 NINA GOULIS Chairperson of the AEB Taxation Committee, KPMG KSENIA LITVINOVA Deputy Chairperson of the AEB Taxation Committee, Pepeliaev Group MODERATION AEBRUS.RU

PROGRAM 4 SESSION 2 SESSION 1 Special guest: Alexey Moiseev, Deputy Minister of Finance of the Russian Federation. Repatriation of capital and payment of dividends: opportunities and limitations Dmitry Babiner, EY Risks of administrative and criminal liability for violation of decrees on currency regulation Vladimir Tchikine, Alumni Partners Restrictions applicable to foreign trade operations Ksenia Gritsepanova, PwC Unpaid loans and crisis financing issues currency restrictions Andrey Grachev, Eversheds Sutherland Administrative liability under new currency restrictions: risks and ways of mitigation Petr Popov, Pepeliaev Group Currency operations of individuals (employees) in new reality Sergey Zhestkov, Baker McKenzie AEBRUS.RU

AEBRUS.RU REPATRIATION OF CAPITAL AND PROFIT Dmitry Babiner, EY 21 April 2022

REPATRIATION OF CAPITAL AND PROFIT 6 1 Payment of dividends (distribution of profits) 2 Reduction of the charter capital 3 Reduction of the additional capital AEBRUS.RU

MORATORIUM ON BANKRUPTCY RESTRICTIONS ON PAYMENT OF DIVIDENDS (DISTRIBUTION OF PROFITS) 7 From April 1, 2022, Russian Government introduced a six-month moratorium on the initiation of bankruptcy cases Decree of the Government of the Russian Federation dated 28.03.2022 497 Among other limitations moratorium also restricts payment of dividends Article 9.1 (3) Federal Law on Bankruptcy To retain the right to pay dividends, the company (source of dividends) shall voluntarily refuse the moratorium Article 9.1 (1) Federal Law on Bankruptcy There are no any currency control restrictions for a limited liability company AEBRUS.RU

FEATURES OF THE DIVIDEND PAYMENTS BY THE JOINT-STOCK COMPANY 8 Russian anti-sanction regulation provides the temporary procedure for the fulfillment of obligations to certain foreign creditors which applies, inter alia, to payments on financial instruments President s Decree 95 dated 5 March 2022 Shareholders from unfriendly foreign states Dividends shall be paid in Rubles to type C account opened in the Russian bank in the name of foreign shareholder. No cash may be transferred to foreign bank accounts Decision of the Board of Directors of the Central Bank dated 18 March 2022 Other foreign shareholders Dividends shall be paid in Rubles? May be paid to foreign bank accounts in Rubles? Item 6(a) President s Decree 95 dated 5 March 2022 AEBRUS.RU

FEATURES OF THE DIVIDEND (DISTRIBUTION OF PROFITS) PAYMENT BY LLC 9 Tax implications: disproportionate distribution of profits Regulatory implications: the dividends shall not be paid (respective decision shall not be taken) if the company meets the signs of insolvency (bankruptcy) net assets is less than its authorized capital and reserve fund AEBRUS.RU

LLC: FEATURES OF REDUCTION OF THE CHARTER CAPITAL 10 5 business days No terms. Could be within 1 day Within 3 business days No terms. Could be within 1 day 5 business days 1 month The company publishes a first notice to creditors Decision of shaholder(s) to reduce the capital The Notification to tax authorities / The company submits a capital reduction notice to special online platform for Russian entities The tax authority registers that the company is in the process of the capital reduction The company publishes a second notice to creditors The company submits the necessary package of documents to the tax authority The tax authority registers the capital reduction / Transfer to the shareholder The reduced capital should not lead to Net Assets (Financial Statements under Russian GAAP) below the charter capital after reduction There is a risk that in case of reduction of the charter capital of JSC Russian authorities will demand from the JSC to follow the temporary procedure established by President s Decree N95 and JSC will be required to transfer funds to respective type C account in Rubles AEBRUS.RU

LLC: REDUCTION OF THE ADDITIONAL CAPITAL 11 Russian Law On LLC expressly provides only for one form of distributions from the company to its shareholders (other than charter capital reduction), that is through the distribution of profit by payment of dividends. The legal feasibility of reduction of the additional capital is indirectly confirmed by the Russian Tax Code. It is explicitly provided that in case the shareholder contributes monetary funds to the additional capital, the consecutive reduction of the additional capital within the limits of the shareholder's contribution is exempt from taxation Article 309 (2.3) of the Tax Code There are no resolutions of the Supreme Court and/or official clarifications of similar legal weight that would expressly prohibit distributions of the additional capital One could argue that, in the absence of a direct restriction, such distribution should be seen as permitted under Russian law on the basis of general principles of Russian law and / or through the doctrine of additional rights of shareholders under clause 2 article 8 of Law on LLC. This view seems to have been adopted by Russian companies in practice. However, such distribution runs a risk of being challenged on formal grounds AEBRUS.RU

AEBRUS.RU CURRENCY CONTROL AND REGULATION Ksenia Gritsepanova, PwC 21 April 2022

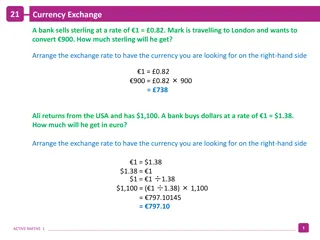

SALE OF FOREIGN EXCHANGE PROCEEDS 13 Presidential Decree of March 28, 2022: Official letter of the Federal Tax Service of Russia of August 10, 2020 N VD-4-17/12881@: From February 28, 2022, residents are required to carry out the mandatory sale of foreign currency in the amount of 80 percent of the amount of foreign currency credited to their accounts in authorized banks on the basis of export foreign trade contracts. Other methods permitted by the legislation of the Russian Federation, by which the execution of the agreements may be terminated, include the following: - receipt from non-residents of funds in accordance with the terms of the agreements to resident s accounts in foreign banks; - offset of a counterclaim; - transfer of the claim to another person; - novation (an agreement of the parties to replace the original obligation that existed between them with another obligation), etc. For all export foreign trade contracts. Calculation of 80% of the amount is carried out by companies from the amount of foreign currency held on accounts as of February 28, 2022 and received from export activities in the period from January 1, 2022 to February 28, 2022. It is possible to sell the proceeds in parts, but within three working days from the moment of crediting. Official interpretation of CBR of April 4, 2022 N 3- : It is necessary to transfer all export foreign exchange proceeds to accounts opened in authorized banks for the purpose of its further mandatory sale. All types of foreign currencies are subject to mandatory sale without exceptions. The currency will be sold at the market rate. Responsibility for non-compliance with the requirement for the mandatory sale of a part of foreign exchange proceeds has not been established yet. Do not require the sale of foreign exchange proceeds: contracts for the sale of shares and securities; derivative financial instruments. From April 19, 2022, the Central Bank increased the period for the mandatory sale from 3 to 60 working days for exporting companies in the non-resource and non-energy sectors. AEBRUS.RU

RESTRICTIONS ON ADVANCE PAYMENTS 14 Decision of the Board of Directors of the Bank of Russia of April 1, 2022: 1. Advance payment by residents in favor of foreign legal entities and individuals should be carried out within 30% of the amount of obligations stipulated under each agreement of a resident of the following type: Contracts of the provision of services by a non-resident; Contracts of the performance of work by a non-resident, the transfer of information, the results of intellectual activity, including exclusive rights to them, by a non-resident. 2. The limitation on the amount of advance payment or advance payment does not apply to the following agreements: Contracts of the purchase from a non-resident or the provision of services by a non-resident related to the purchase of fuels and lubricants (bunker fuel), food, inventory and other goods necessary to ensure the operation and maintenance of vehicles, regardless of their type and purpose; Contracts of the provision of financial services by non-residents to residents, including insurance and reinsurance contracts; Contracts of the provision by non-residents to residents of services for the international cargo services, forwarding and logistics services; Contracts of the provision of services by a non-resident, the performance of work by a non-resident, the transfer of information, the results of intellectual activity, including exclusive rights to them, by a non-resident if the amount of obligations for each of contracts does not exceed 15,000 US dollars. The amount of obligations under such contracts (agreements) is determined using the official exchange rates of foreign currencies against the ruble established by the Bank of Russia on the date of conclusion of the agreement. AEBRUS.RU

AEBRUS.RU OUTSTANDING LOANS AND CRISIS FINANCING ISSUES CURRENCY RESTRICTIONS Andrey Grachev, Eversheds Sutherland 21 April 2022

GETTING YOUR MONEY OVERSEAS: OFFSET, FORGIVENESS, REPAYMENT 16 Foreign company Assign to a third party (resident or non-resident) Yes or No ? Current loan Offset Forgiveness ? Repayment does not require the sale of foreign currency earnings Russian company Current loan repaid in rubles AEBRUS.RU

GRANTING LOANS FROM THE RUSSIAN FEDERATION ABROAD 17 Foreign company There is no prohibition on taking out a loan New Loan ? No restrictions on selling currency Offset Forgiveness Russian company AEBRUS.RU

AEBRUS.RU LIMITATIONS ON CURRENCY OPERATIONS OF INDIVIDUALS (EMPLOYEES) IN THE NEW ENVIRONMENT Sergey Zhestkov, Baker McKenzie 21 April 2022

OLD RULES VS NEW RULES FOR RESIDENTS: SNAPSHOT 19 Prior March 1, 2022 After March 1, 2022 Settlements between residents: - RUB without limitations - foreign currency with few exceptions (foreign trade operations, money transfers) Settlements between residents: - RUB without limitations - foreign currency with few exceptions (limited money transfers) Settlements between residents and non-residents: - RUB without limitations - foreign currency without limitations Settlements between residents and non-residents: - RUB with a few limitations - foreign currency with a few limitations Reporting countries (EAEU or AEoI) vs Non-reporting countries Reporting countries (EAEU or AEoI) vs Non-reporting countries plus counterparties from Friendly countries (EAEU or non-sanctioning) vs counterparties of Unfriendly countries Accounts in Reporting countries: - unlimited receipts with a few restrictions (e.g. return of loans) - unlimited payments Counterparties of Friendly countries: - limited receipts (salaries for work abroad, dividends and coupon/interest on securities, rentals, proceeds from sale of securities accounted with foreign depositories/brokers, RUB transfers from Russia, including with conversion, foreign currency transfers from Russia within $10k per month) - unlimited payments Accounts in Non-reporting countries: - limited receipts (salaries for work abroad, dividends, pensions, interest/coupon, own money, payments from other individuals, etc.) - unlimited payments Counterparties of Unfriendly countries: - limited receipts (same as for Friendly countries) - limited payments (no loans/deposits to non-residents, no transfers from accounts open after March 1, 2022 to other own accounts, etc.) AEBRUS.RU Accounts with foreign banks or financial organizations can be freely open subject to disclosing in Russia: notices on opening/closing accounts and annual reports on movement of cash and non-cash assets. No reporting for residents living more than 183 days outside Russia in a calendar year

RUSSIAN RESIDENTS (EMPLOYEES) EMPLOYMENT BY RUSSIAN COMPANIES 20 $ on exercise of options, ESPP Stock on vesting of RSU, restricted stock Stock on exercise of options, ESPP $ on cashless exercise of options, ESPP, RSU, restricted stock $ awards of RSU, restricted stock, options, ESPP Foreign Bank/Broker Account Foreign Entity $ dividends, interest/coupon, rentals, capital gains (stock) by $ 10,000 per month permitted operations non-permitted operations questionable operations $ any payments RUB any payments Russian Bank Account RUB salary, bonuses Russian Entity AEBRUS.RU

RUSSIAN RESIDENTS (EMPLOYEES) EMPLOYMENT BY FOREIGN COMPANIES 21 $ on exercise of options, ESPP Stock on vesting of RSU, restricted stock Stock on exercise of options, ESPP $ on cashless exercise of options, ESPP, RSU, restricted stock $ or RUB salary, bonuses $ awards of RSU, restricted stock, options, ESPP Foreign Bank/Broker Account Foreign Entity $ dividends, interest/coupon, rentals, capital gains (stock) by $ 10,000 per month permitted operations non-permitted operations questionable operations $ any payments RUB any payments Russian Bank Account Russian Entity AEBRUS.RU

RUSSIAN RESIDENTS (EMPLOYEES) OWN OPERATIONS / SETTLEMENTS 22 Permitted operations Non-permitted operations Purchase of foreign real property or foreign securities from entities of Friendly countries with payments in foreign currency from non-Russian accounts* or in RUB from Russian accounts Purchase of Russian real property or Russian securities from entities of Unfriendly countries (unless they are disclosed CFCs of Russian residents) with payments in foreign currency or in RUB from Russian or non-Russian accounts Purchase of foreign real property or foreign securities from entities of Unfriendly countries with payments in foreign currency from non-Russian accounts* Purchase of foreign real property or foreign securities from entities of Unfriendly countries with payments in foreign currency from Russian accounts* Receipt of foreign currency on non-Russian accounts: - from non-residents: salary, dividends, interest/coupon, rentals, proceeds from sale of securities - from residents Russian accounts: own accounts and family members accounts (maximum $10,000 per month) - from own non-Russian accounts open by March 1, 2022 Receipt of foreign currency on non-Russian accounts on any grounds with exception for those stated in the left column Extending loans/deposits in RUB to own disclosed CFCs in Friendly countries or Unfriendly countries Extending loans/deposits in foreign currency to non-residents Extending loans in RUB to non-residents other than own disclosed CFCs Transfers of RUB to own accounts abroad (including with later conversion into foreign currency) Making payments in foreign currency from Russian accounts for acquisition from residents of Unfriendly countries of participatory interest in companies, funds, etc. AEBRUS.RU *If duly disclosed in Russia

POTENTIALLY QUESTIONABLE TRANSACTION OR SETTLEMENTS QUESTIONS 23 Transactions with foreign securities or financial instruments for no consideration: - grant of stock options and restricted stock - vesting of RSU and restricted stock with delivery of common stock What is permitted by clause 1.11 of CBR Clarification of 18 March 2022: all acquisitions of securities or only sale/purchases with payment to/from from non-Russian accounts? Acquisition of participatory interest of foreign companies, funds, etc. with - payment of foreign currency from non-Russian accounts or - payment in-kind (e.g. by non-Russian securities/equities/other assets held abroad) Are they permitted? Or Decree 126 restriction is universal? Transactions/settlements on undisclosed accounts Are they automatically become illegal (75-100% penalty?) What if they later be disclosed, e.g. using a new amnesty? AEBRUS.RU

AEBRUS.RU COFFEE BREAK 21 April 2022

AEBRUS.RU ALEXEY MOISEEV, DEPUTY MINISTER OF FINANCE OF THE RUSSIAN FEDERATION 21 April 2022

AEBRUS.RU RISKS OF CRIMINAL LIABILITY FOR VIOLATION OF DECREES ON CURRENCY REGULATION Vladimir Tchikine, Alumni Partners 21 April 2022

CURRENCY REGULATION 27 Russian Presidential Decrees No. 79, 81, 95 and 126 pursuant to the preamble are based on federal laws On special economic measures and coercive measures On measures of impact (counteraction) to unfriendly actions of the United States and other foreign states On security Russian Presidential Decrees Russian Currency Legislation (see art. 4, 173-FZ) Protocols of the subcommittee of the governmental commission Letters of the Central Bank Official clarifications by the Central Bank Acts of currency regulation authorities (see art. 4, 173-FZ ibid) AEBRUS.RU

CURRENCY REGULATION AND CRIMINAL LIABILITY 28 Article 193 of the Criminal Code - non-repatriation example: evasion of compulsory foreign currency sales by submitting to the bank false additional agreements on payment delays under a foreign trade contract Article 193.1 of the Criminal Code - currency operations based on fake documents example: submission of fake documents to the credit organization for the purpose of loan agreement signing Article 275 of the Criminal Code - high treason example: providing non-residents with foreign currency knowingly used to finance activities directed against the Armed Forces of the Russian Federation during a special operation on the territory of Ukraine AEBRUS.RU

PENDING CRIMINAL LIABILITY RISKS 29 Draft clause 2 of article 201 of the Criminal Code abuse of authority person performing administrative functions in a commercial or other organization contrary to the legitimate interests of that organization for the purpose of deriving benefits and advantages for himself or other persons or causing harm to other persons committed for the purpose of implementing a decision of a foreign state, union of foreign states or international organization to introduce restrictive measures against the Russian Federation or act has resulted in substantial harm to the rights and legitimate interests of citizens AEBRUS.RU

AEBRUS.RU ADMINISTRATIVE LIABILITY UNDER NEW CURRENCY RESTRICTIONS: RISKS AND WAYS OF MITIGATION Petr Popov, Pepeliaev Group 21 April 2022

WHAT ARE THE RISKS? 31 Code of Administrative Offences, Article 15.25. Violation of currency legislation are the Decrees legislation? The Federal Tax Service suspends currency control audits other than on Decrees compliance > it s irrational to believe in fruitless and toothless audits. Anyway legislative changes are very probable. (1) Prohibited transactions, e.g. receipt of funds by a resident to a foreign account + spending of such receipts. 75%-100% of the transaction amount. (2) Non-repatriation, e.g. in case of set-offs that are deemed prohibited. 3%- 10% or 5%-30% of the transaction amount. AEBRUS.RU

HOW TO MITIGATE? 32 (1) Amnesty of capitals, stage 4 Funds on foreign accounts are to be repatriated. Special filing is necessary before the violation is known to relevant authorities. (2) Draft law No. 94339-8 on changes to Article 15.25 (April-May, 2022). Fines for prohibited transactions to become lower, up to 40% instead of 100%. Exemption for transfer of funds to a Russian account to become universal. Currency conversion issue still unresolved. AEBRUS.RU Fines for non-repatriation are to stay essentially the same.

CLOSING REMARKS 33 Ksenia Litvinova Deputy Chairperson of the AEB Taxation Committee, Pepeliaev Group CLOSING REMARKS AEBRUS.RU