Towson University Retired Faculty Association Fall Forum: Medicare Part D Transition for Maryland State Retirees

Fall Forum hosted by Towson University Retired Faculty Association (TURFA) on transitioning to Medicare Part D prescription plans for Maryland State Retirees. Covers how to choose plans, Via Benefits, cost insights, state financial assistance, and more.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Towson University Retired Faculty Association (TURFA) Fall Forum Making the Transition to Medicare Part D Prescription Plans for Maryland State Retirees Thursday, October 10, 2024 2:00 4:00 pm Towson University South Campus Pavilion Presented by Jim Roberts, President of TURFA 2024-2025

Todays Agenda Introduction. How we got here - State Senator Mary Washington (District 43). What is Via Benefits? How to find a new Medicare Part D prescription plan. Demonstrations of the Via Benefits websites. Understanding Medicare Part D costs. State of Maryland Financial Assistance Programs Update on the Fitch vs. Maryland court case. Other resources.

Purpose and Disclaimer The purpose of today s session is to inform you about the process for selecting a Medicare Part D prescription plan to replace the State-sponsored SilverScript prescription plan for retirees that terminates on December 31, 2024. The presenter (James Roberts) and other TURFA members are not licensed insurance agents and cannot help you to choose a Medicare Part D prescription plan. All information in this presentation is intended only to inform you about the process, not to help you evaluate Part D plans. TURFA does not endorse any Part D plan. You should refer further questions to Via Benefits or the Maryland Department of Management and Budget Employee Benefits Division.

Important Things to Remember You MUST choose a new Medicare Part D prescription plan by December 31, 2024. You will NOT be automatically transferred to a new plan. Open enrollment to choose a new plan began on October 1st and ends on December 31stfor those enrolled in the State s SilverScript plan for retirees. If you currently have a family plan, each Medicare-eligible member of your plan MUST enroll in a separate Medicare Part D plan. You MUST enroll through the Via Benefits system and you must maintain your group medical coverage (supplemental health insurance) through the State of Maryland to have access to the State s Health Reimbursement Arrangement (HRA) or Life-Sustaining Prescription Drug Assistance Program, if you are eligible for these benefits.

How We Got Here A Brief History of Losing our Prescription Benefits An obscure section buried deep within the Budget Reconciliation and Financing Act of 2011 eliminated the retiree prescription program beginning in 2019. The rationale was that the program threatened Maryland s AAA bond rating and that the Federal Medicare program was an adequate replacement. Retirees were not notified until 2018 when they reacted with outrage. Kenneth Fitch and his United We Matter organization filed a lawsuit and the judge issued a preliminary injunction enjoining the State from terminating the prescription program until the suit was resolved. In 2019, reacting to retiree complaints, the Maryland General Assembly passed a bill that provided some financial assistance for retirees who were hired before July 1, 2011 and retired on or before January 1, 2020.

How We Got Here (continued) Bills were introduced to reinstate our prescription benefits in every Maryland legislative session since 2019, including the 2024 session. None of these bills made it out of committee. The injunction on the State from the Fitch vs. Maryland case was dissolved in July 2023 and the US District Court dismissed the case in September 2023. The plaintiffs have since appealed to the US Court of Appeals for the Fourth District. The State of Maryland will terminate retiree prescription benefits effective on December 31, 2024. In August, 2024, the State hired a contractor, Via Benefits, to manage the transition to Medicare Part D prescription plans for State retirees.

How We Got Here A Legislator s Perspective Senator Mary L. Washington has represented District 43 in the Maryland Senate since 2019. District 43 covers parts of Baltimore City and Baltimore County including the Towson University campus. She is a member of the Education, Energy, and the Environment Committee.

Via Benefits the State Contractor for the Part D Transition Via Benefits is a product of Extend Health, LLC a WTW (Willis Tower Watson) Company whose Medicare exchange is the oldest and largest Medicare exchange supporting more than 750 employers including 125 public sector clients. Since 2006, they have supported nearly 2.5 million retirees through their transition to the individual marketplace. (DBM Email) Via Benefits will: provide one-on-one advising to help retirees identify and select Part D plans, provide educational services to help retirees understand the transition process, manage the Health Reimbursement Arrangement (HRA) accounts, and provide ongoing help and advocacy for future Part D selections.

Steps for Selecting a New Medicare Part D Prescription Plan You should be able to evaluate and select a new Medicare Part D prescription plan if you simply complete the following steps: 1) Gather the information you need, including the following: a) your Medicare card (Parts A & B) with your Medicare ID number, b) a list of all the prescriptions you take that includes their name and their dosage information, and c) the names and addresses for up to three local pharmacies that you are likely to use and, if you wish, one mail order pharmacy.

2) Create an account on the Via Benefits website (https://my.viabenefits.com/Maryland) and create a user profile in the Profile section of the home page of the website. a) Your user ID will be your email address. b) You will be asked for basic identifying and contact information. c) You will also need to sign disclaimer statements electronically and choose who is authorized to access your information.

3) In the Shop for Plans section of the home page, enter your prescription information into the Via Benefits website. You will enter the following for each of your prescriptions: a) the name of the drug (enter the generic name if you can take the generic version), b) the dosage, and c) the quantity and frequency of refills. For example, if you take one pill per day enter 30 for quantity and Every 30 Days for frequency.

4) Enter the names and address of up to three local pharmacies you are likely to use and, if you wish, one mail order pharmacy. 5) You can also set your contact preferences (email, text, USPS, etc.) in the Permission to Contact You section of the Via Benefits website.

Once you have created your profile and entered your prescriptions and entered your pharmacies, the Via Benefits website will display the list of Medicare Part D plans that are available in your area. Each plan will list the monthly premium, prescriptions covered by the plan, deductible amount, estimated annual cost of the plan, and a comparison of costs for each of your pharmacies. You should review these plans prior to your one-on-one enrollment appointment with a Via Benefits advisor, if you can.

6) Schedule a one-on-one enrollment appointment with a Via Benefits advisor in the Speak to an Expert section of the home page. You can also set up an appointment by calling 1-855-556-4419(TTY: 711) Monday through Friday, 8 am to 7 pm Eastern Time. All one-on-one sessions are conducted by phone and YOU will have to call them at the time of the appointment. The Via Benefits advisors are licensed insurance agents in the state where you live. You can select your plan during your one-on-one advising session or you can come back into the Via Benefits website and select your plan later. You can change your selection at any time until open enrollment ends on December 31, 2024.

TURFA members are NOT licensed insurance agents. We CANNOT help you choose a Medicare Part D prescription plan. It is highly recommended that you review and gather as much information about the process and the prescription plans available to you. There are many ways to find out more information. Make an appointment and talk with a Via Benefits advisor (see above). Attend one of the in-person education sessions that are being held throughout the state. You can see the list of sessions and register for one in the Important Information section of the Via Benefits website. Review the Via Benefits website thoroughly. Review the Maryland Department of Management and Budget (DBM) website for retirees thoroughly https://dbm.maryland.gov/benefits/pages/retirees.aspx .

Demonstration How to Use the Via Benefits Website https://my.viabenefits.com/Maryland

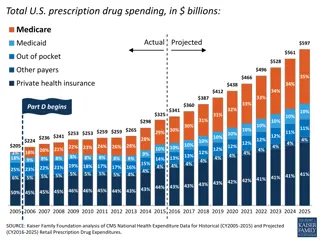

Understanding Medicare Part D Costs - Definitions Term The list of drugs covered by your Part D plans. Formularies vary from company to company and from plan to plan. The premium is the amount you pay each month for your Part D plan. Deductible ($0 - $590) The deductible is the amount you pay before your Medicare Part D plan begins paying for your prescriptions. If your deductible is $590, then you must pay $590 before Medicare will pay for any of your prescriptions. Copays and Coinsurance Copays and coinsurance are the amounts you pay for each prescription after you meet the deductible. Copay is a flat dollar payment while coinsurance is a percentage of the drugs retail cost. Description Formulary Premium Coinsurance and copays vary, depending on the type of drug (Medicare Tier) and whether you use a preferred or an in-network pharmacy.

Understanding Medicare Part D Costs (continued) Medicare will not pay for drugs not covered by your Part D plan. You must pay the full retail pricefor drugs that are not on your plan s formulary. You can use your Health Reimbursement Arrangement (HRA) to pay for Medicare-eligible drugs not covered by your Part D plan, if you qualify for an HRA. If you must take a drug that is not on your plan s formulary, you can ask your doctor if there is another drug that is on your formulary, or, ask your Part D Plan for an exception. Beginning in 2025, Medicare set an annual maximum, or cap, of $2,000 on the amount of coinsurance and copays you must pay out of pocket. This cap does not apply to drugs not covered by your Part D plan.

The donut hole, a phase of limited coverage, is eliminated in 2025

Understanding Medicare Part D Costs Pharmacies Each plan maintains a list of preferred and in-network pharmacies. A preferred pharmacy is one that has negotiated lower costs with the insurance company. For example CVS Health owns Aetna Insurance, so Aetna (SilverScript) plans will have lower costs if you use CVS pharmacies. Most plans also identify in-network pharmacies where cost savings can be found. You should note the pharmacies that are preferred and in-network for each plan you evaluate to obtain better prices.

Understanding Medicare Part D Costs - Tiers To lower costs, many plans offering prescription drug coverage place drugs into different tiers" on their formularies. Each plan can divide its tiers in different ways. Each tier costs a different amount. Generally, a drug in a lower tier will cost you less than a drug in a higher tier. Here's an example of a Medicare drug plan's tiers (your plan s tiers may be different): Tier 1 - lowest copayment: most generic prescription drugs Tier 2 - medium copayment: preferred, brand-name prescription drugs Tier 3 - higher copayment: non-preferred, brand-name prescription drugs Specialty Tier - highest copayment: very high cost prescription drugs Source: https://www.medicare.gov/drug-coverage-part-d/what-medicare-part-d-drug-plans-cover

Paying for your Medicare Part D Prescription Plan You will not be able to pay for your Part D plan premiums through deductions from your pension payments. You must arrange a payment plan with your Part D insurance provider. Most plans will allow monthly direct withdrawal from a bank account. You can also elect to pay monthly with a check. It is possible to have your premium deducted from your Social Security payment, but Via Benefits does not recommend this. Ask your Via Benefits advisor about this, if you are interested.

State of Maryland Financial Assistance Programs The State of Maryland offers two financial assistance programs for the eligible state retirees. You must meet the following eligibility requirements to qualify for these programs. You qualify for the Health Reimbursement Arrangement (HRA) if you were hired on or before June 30, 2011, and you retired on or before January 1, 2020. You qualify for the Life-Sustaining Prescription Drug Assistance Program if you were hired on or before June 30, 2011. To be eligible for either of these financial assistance programs you must maintain your group medical coverage (supplemental health insurance) through the State of Maryland, and you must sign up for your Medicare Part D plan through Via Benefits not through Medicare directly.

The Health Reimbursement Arrangement (HRA) If you qualify, the HRA is a special account that will provide $750 per year for an individual Medicare-eligible retiree, or $2,000 per year for a family with two Medicare-eligible retirees, and $2,000 per year for each additional Medicare-eligible dependent. The retiree and the dependents will share a single combined HRA. The HRA can be used to pay for Medicare-eligible costs including: your deductible, your copays and coinsurance for drugs covered by your Part D plan, and prescription drugs not covered by your Medicare Part D plan. It cannot be used to pay for your Medicare Part D prescription plan monthly premium.

The Health Reimbursement Arrangement (continued) If you qualify for the HRA, the State will send you a debit card that you can use to pay for eligible expenses. You cannot use this card to pay for your plan s premiums. You will get this money each year in January, but the balance from the previous year does not roll over to the next year. Via Benefits will administer the HRA and will send the Via Benefits Guide to Reimbursement to qualifying retirees.

The Life-Sustaining Prescription Drug Assistance Program The Life-Sustaining Drug program will reimburse eligible retirees for expenses related to a life-sustaining prescription drug that is not covered by your Medicare Part D plan but is covered by the State-sponsored prescription drug plan. This is a new program and at this time there is no more information about how a life-sustaining drug is identified or the process for receiving payment. The Department of Management and Budget says that it will provide more information on the Life-Sustaining Prescription Drug Assistance Program by December 1st.

The Status of the Lawsuit Fitch et al. vs. Maryland et al. In 2018, Kenneth Fitch and other plaintiffs filed a lawsuit to restore our prescription benefits. The judge in the US District Court for Maryland issued an injunction that kept the State from terminating our benefits until the case was decided. In July 2023, the judge in the US District Court for Maryland dissolved his injunction, which permitted the State to proceed with terminating our benefits. In September 2023, the judge ruled against the plaintiffs and the plaintiffs appealed to the US Court of Appeals for the Fourth District. That appeal is still pending. In August 2024, the plaintiffs filed a motion for relief from the prior judgement in US District Court. On October 7th, 2024 (last Monday) the plaintiffs filed another application for an injunction to prevent the State from terminating our benefits.

Fitch vs. Maryland continued TURFA is not in a position to evaluate the merits of either the plaintiff s arguments or the response from the State. The appeal of the judgement is continuing. There is no indication when a decision will be handed down. You should contact United We Matter, the organization founded by Kenneth Fitch, if you want more information on the status of the lawsuit or if you wish to support the attorney representing the plaintiffs. https://www.unitedwematter.com/

In Conclusion You must choose a new Medicare Part D prescription plan by December 31, 2024. If you are eligible for the HRA or the Life-Sustaining Drug Program, you must maintain group medical coverage (supplemental health insurance) through the State of Maryland and you must enroll in a Medicare Part D plan through Via Benefits to have access to these benefits You will pay the full retail price of drugs not covered by your Part D plan and these expenses are not covered by the Medicare cap on out-of-pocket expenses. Sometimes, plans with low premiums and deductibles end up costing you more because they cover fewer drugs.

Conclusions (continued) It s a good idea to stock up on prescriptions in December, if you can, in case there is any delay in processing your application for a new Part D plan Be sure to tell your pharmacies that you have a new prescription plan and give them your new Part D insurance ID numbers in 2025. Don t worry! Millions of retirees successfully use Medicare Part D to pay for their prescriptions. Just follow the steps for getting a new plan and you will succeed. Do not hesitate to ask Via Benefits for help.

Resources for More Information Via Benefits Website https://my.viabenefits.com/Maryland Maryland Department of Budget and Management Retirees Website https://dbm.maryland.gov/benefits/Pages/Retirees.aspx Medicare Plan Comparison Website https://www.medicare.gov/plan-compare/#/?lang=en&year=2025 You should also Register on the Via Benefits Website and make an appointment to speak with a Via Benefits advisor Attend one of the many in-person information sessions being offered around the state by Via Benefits and DBM. You can see the dates and locations for these session and register for one in the Important Information section of the Via Benefits website.

Thank you for participating in the TURFA Fall Forum on the transition to Medicare Part D prescription plans. This forum has been recorded. Links to the recording and this PowerPoint presentation will be available on the TURFA website https://www.towson.edu/retiredfaculty/