Transferable Permits in Environmental Policy

Transferable permits as a policy instrument for managing emissions. Learn about market-based strategies, permit trading systems, and firm choices under cap-and-trade schemes. Understand how transferable discharge permits operate in creating incentives for pollution control and innovation.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

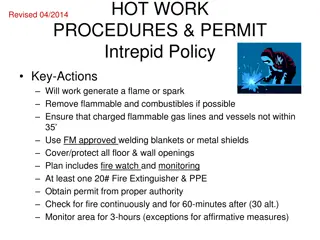

PRICE-BASED POLICY INSTRUMENTS: TRANSFERABLE PERMITS Session 6: Field and Field Chapter 13

Incentive Based Strategies Transferable Discharge Permits You own the rights to a certain quantity of emissions. You can sell those you do not use and purchase additional emissions rights in the market with other owners. The EU emissions trading System Explained

Learning Outcomes After completing this module you should be able to Explain the difference between non-market and market- based environmental policies. Explain the difference between price and quantity based policies. Assess the practical issues associated with permit trading systems. Describe the characteristics of at least one major market based trading program. Compare the efficiency of several types of pollution control policies.

4 FIG 13.1 Individual Firm Choices Under Cap-and-Trade Reduce emissions until level covered by permits Maintain or increase emission levels by buying additional permits Reduce emission levels below original permit award and sell excess permits

How Transferable Discharge Permits Operate FIG. 13.2 Market for Discharge Permits TDPs create a property right to emit pollutants Government decides on the total number of permits Allocates permits between different polluting sources Permits are transferable; bought and sold in the market.

Under what conditions do TDPs operate best? When the Initial Rights Allocation (IRA) is managed equitably When clear trade rules and systems exist Who may participate? How are permits to be reduced in the future? How to deal with non-uniform emissions? Should trade be restricted? When they can be effectively monitored and enforced

8 FIGURE 13.4 TDP and Technological Change How much is it worth for the firm to shift from MAC1 to MAC2? With MAC2 firm would reduce its emissions to e2 Total abatement costs =(b+d) Sells (e1-e2) in permits for revenue of (c+d) Benefit to firm = (a+c) creates incentive to innovate. Lower cost, sell permits.

Emission Charges vs TDPs Which are the most effective and efficient policies to deal with current environment issues such as climate change? Policy tool Tax Benefits Cost-effectiveness Drawbacks Uncertain emission reduction Well-known policy tool Reduced cost-effectiveness due to state fiscal objectives Replacement of other taxes may give additional benefits Unilateral use can lead to migration and carbon leakage Emissions trading Cost-effectiveness Uncertain quota price Emission reduction target achieved with certainty Not much experience with use Could conserve industry structure reduce rate of technological progress? Unilateral use can lead to carbon leakage

10 FIGURE 13.3 Nonuniform Emissions and CAP Programs

CH13:Transferable Discharge Permits: Cap and Trade Does it work? The impact of the EU ETS on carbon emissions and economic performance | Antoine Dechezlepr tre What are some distributional concerns? Warren Buffett concerns about cap and trade being regressive

Firms affected by EPA programs The Acid Rain Program (ARP) and the Cross-State Air Pollution Rule s (CSAPR) sulfur dioxide (SO ) and nitrogen oxides (NO ) emission reduction programs apply to large electricity generating units (EGUs) that burn fossil fuels to generate electricity for sale. Mercury and Air Toxics Standards (MATS) only cover large EGUs that burn coal or oil to generate electricity for sale and excludes gas-fired units, resulting in fewer units in MATS than in the ARP and CSAPR. This section covers units affected in 2019.

SO Emission Trends ARP: Units in the ARP emitted 954 thousand tons of SO in 2019. The ARP sources reduced emissions by 94% vs 1990 levels. CSAPR: Annual SO emissions in the CSAPR SO program fell 92% from 2005 to 2019 SO Emission Rates Average SO emission rate in the ARP or CSAPR SO program fell to 0.09 pounds per million BTU, an 88% reduction from 2005 rates, mostly from coal-fired units. Emissions reductions since 2005 are mostly due to greater use of control technology on coal-fired units and increased generation at natural gas-fired units.

Summary TDPs are an efficient and cost effective method of pollution control A major advantage is that they encourage innovation However, their effectiveness depends on the initial rights allocation, clear trade rules, large and competitive markets and effective monitoring and enforcement

Reading Field & Field, chapter 13 Watch some of the videos in this document