Trucking in Georgia: Big Numbers, Big Impact

Presentation to the Joint Study Committee on Critical Transportation Infrastructure Funding highlights the significant impact of trucking in Georgia, showcasing key statistics on freight movement, modal share, future distribution, and fuel tax rates.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

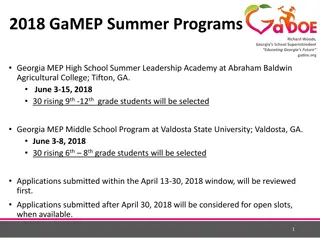

PRESENTATION TO THE JOINT STUDY COMMITTEE ON CRITICAL TRANSPORTATION INFRASTRUCTURE FUNDING Trucking in Georgia: Big Numbers, Big Impact October 1, 2015

TRUCKING IN GEORGIA: BIG NUMBERS, BIG IMPACT 85% 213,000 1,764,682,30038%

MANUFACTURED FREIGHT MOVED IN GEORGIA 85% Rail Intermodal Truck Air Water 23,914,889 1,072,321 385,728 1,129,210 Inbound 135,135,279 18,865,376 820,296 18,841 615,600 Outbound 129,759,569 42,780,265 1,892,616 404,569 1,744,811 Total 264,894,848 13.7% 0.6% 0.13% 0.6 Modal Share 84.9% More than 19,000,000 truck trips delivering freight through Georgia and to 100% of Georgia communities, 76% of which are served only by truck. 76% Source: American Transportation Research Institute

FUTURE FREIGHT DISTRIBUTION Source: American Transportation Research Institute

PORTS, FREIGHT MOVEMENT, AND ECONOMIC PORTS, FREIGHT MOVEMENT, AND ECONOMIC COMPETITIVENESS COMPETITIVENESS

SAVANNAH 500 TRUCK SAMPLE AT 24 HOURS

38% FUEL TAX RATES Comparative State Fuel Tax Rates (cents per gallon) 50 GA ranks 18th 45 40 35 30 Cents 25 20 15 10 5 0 TX GA TN HI NV NE ND NH NJ NY NC IL WI NM WA PA ID IA LA WY IN ME DE MS MI FL WV RI OR OH Excise Tax KY VT SD MD AR AL AZ OK SC AK MN MA VA MO KS MO CA CT UT Other Tax CO Source: American Petroleum Institute

State & Local Taxation of On-Highway Gasoline & Diesel Fuel in Georgia THREE COMPONENTS Excise Tax Prepaid State Tax Prepaid Local Tax Use same sales price as Prepaid State Tax applied to local county rates $0.075 per Gallon (fixed) 4% of Average Retail Price (less taxes) 3% - motor fuel tax - DOT 1% - state sales tax (general fund) (variable) Revised Jan1 and July 1 each year interim revision if price changes by 25% Revised Jan1 and July 1 each year interim revision if price changes by 25% STATE TAXES LOCAL TAXES REMITTED VIA MOTOR FUEL RETURN REMITTED VIA SALES TAX RETURN

BUT IN FUEL TAXES GOING TO TRANSPORTATION Comparative State Fuel Tax Rates (cents per gallon) Only half of the sales tax on fuel is dedicated to transportation. GA ranks 18th X 50 GA actually ranks 47th 45 40 35 30 Cents 25 20 15 10 5 0 GA TX NJ HI NE TN NH NY NC NV ND IA IN NM IL WI ID WA PA LA WY MI FL WV RI ME OH Excise Tax KS DE AL MS OK AK OR KY VT SD MD MA AR VA AZ SC MN MO CO MO CT UT CA Other Tax Source: American Petroleum Institute

DIVERSION: ALSO BIG NUMBERS, BIG IMPACT Diversion generally costs the state more than $500,000,000 in road taxes a year (1% of state sales tax and 2% to 4% in local taxes) Georgia tax laws create an even more onerous and wasteful system for interstate trucking Hurts trucking companies of all types, fuel resellers and state s citizens

THE IFTA ISSUE Cars pay tax where they purchase fuel Trucks pay tax where they operate Georgia signed into International Fuel Tax Agreement decades ago but never changed tax system to meet requirements Truck operators buying in Georgia pay effectively the highest tax in the nation, but state gets no benefit

THE IFTA ISSUE (CONT.) Truck operator buys 1,000 gallons in South Carolina Uses 500 gallons in SC and 500 gallons in Georgia Reports usage to SC; receives a credit for all taxes paid in SC but due in GA SC sends a check to GA BUT IT DOESN T WORK THE OTHER WAY Truck operator buys 1,000 gallons in Georgia Uses 500 gallons in SC and 500 gallons in GA Reports usage to GA; receives credit only for state taxes paid (not local). Trucker has to write additional check to pay the difference to SC

THE IFTA ISSUE (CONT.) Results of this system? Truckers avoid buying in GA if possible Drivers penalized for GA purchases Businesses Avoid Georgia Some fuel retailers have publicly vowed no expansion in GA until this practice changes Georgia fuel resellers, convenience stores and employees lose Sales in GA lower than nearby stores on other side of borders

THE IFTA ISSUE (CONT.) Georgia is the only state in the nation with this issue but it can be fixed and it will produce increased revenue if fixed Solution(s) A. Make all taxes on Diesel excise tax only (cents per gallon) or B. Make all sales taxes collected on Diesel state sales tax (not local) Then distribute to local governments net due after IFTA debits and credits

FIX DIVERSION AND DONT GIVE UP ON FUEL TAX Return fuel tax to true user fee raises money before any tax increase Diesel is in for the long haul (energy density, ease of handling, safety, etc.) Gasoline won t go to zero Most alternative fuels can be taxes on an energy-equivalent basis

FIX DIVERSION AND DONT GIVE UP ON FUEL TAX Electric vehicles can be taxed on a subscription basis (license fees) Consultant touted Silver bullets such as VMT or tolling have real negatives -far less efficient than fuel tax -suffer from lower use just as fuel tax (ITR just went bankrupt) -data and privacy issues fuel tax doesn t have -evasion issues

CONCLUSIONS Diversion is major issue that costs both money and credibility It has real and negative impacts Solving it will raise more money without increasing user fees The trucking industry; which employs Georgians is ready to help and is a vital part of Georgia s future growth Thank you for your time and your consideration

PRESENTATION TO THE JOINT STUDY COMMITTEE ON CRITICAL TRANSPORTATION INFRASTRUCTURE FUNDING Thank You Edward Crowell ed@gmta.org