Trust and Company Asset Enforcement Principles

Learn about the key principles surrounding enforcement against trust and company assets, including the concept of beneficial ownership, controlling interests, and the legal implications of piercing the corporate veil. Explore cases such as Salomon v. A. Salomon & Co. Ltd., Prest v. Petrodel Resources Ltd., and more to understand the complexities of trust assets and beneficial ownership in legal contexts.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

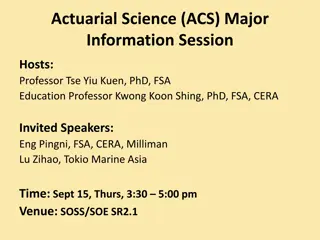

Enforcement against trust and company assets Alexander Milner 1 June 2017

Some basic principles Some basic principles Either the limited company was a legal entity or it was not. If it was, the business belonged to it and not to Mr Salomon. Salomon v. A Salomon & Co Ltd [1897] AC 22, 31 A discretionary trust is one which gives the beneficiary no right to any part of the income of the trust property, but vests in the trustees a discretionary power to pay him, or apply for his benefit, such part of the income as they think fit. ... The beneficiary thus has no more than a hope that the discretion will be exercised in his favour. Gartside v. IRC [1968] AC 553, 574

Company assets Company assets Prest v. Petrodel Resources Ltd [2013] 2 AC 415 (SC) per Lord Sumption at [52]: Whether assets legally vested in a company are beneficially owned by its controller is a highly fact-specific issue. It is not possible to give general guidance going beyond presumptions of equity, especially those relating to gifts and resulting trusts. But I venture to suggest, however tentatively, that in the case of the matrimonial home, the facts are quite likely to justify the inference that the property was held on trust for a spouse who owned and controlled the company... the ordinary principles and

Beneficial ownership Beneficial ownership United Overseas Bank Ltd v. Iwuanyanwu [2001] All ER (D) 40 JSC BTA Bank v. Solodchenko [2015] EWHC 3680 (Comm) AAZ v. BBZ [2016] EWHC 3234 (Fam) Chai v. Peng [2017] EWHC 792 (Fam) NRC Holding Ltd v. Danilitskiy (2017)

Indicia of beneficial ownership Indicia of beneficial ownership Source of purchase monies Occupation Management Control Adverse inferences

Piercing the veil Piercing the veil The evasion principle: the court may disregard the corporate veil if there is a legal right against the person in control of it which exists independently of the company's involvement, and a company is interposed so that the separate legal personality of the company will defeat the right or frustrate its enforcement (Prest, per Lord Sumption at [28])

Trust assets Trust assets More difficult to show the settlor has retained a beneficial interest? Arab Investment Syndicate Ltd v. Hiseman (15 Feb 1994, CA) Nightingale Mayfair Ltd v. Mehta [1999] All ER (D) 1501 The key matter is the underlying intention that Omdeep should be the beneficial owner of the property so that the desired tax objectives could be achieved. cf Chai v. Peng [2017] EWHC 792 (Fam) at [121]: That, of course, presupposes however that the relevant authorities would be aware of any such beneficial interest. The alternative viewpoint is that anonymous and complex structures like these allow what is actually beneficial ownership and usage to exist, but below the radar.

Trust assets (cont.) Trust assets (cont.) Other options: Sham trust Rights and powers of the debtor Informal ability to control?

Sham trusts Sham trusts acts done or documents executed by the parties to the sham which are intended by them to give to third parties or to the court the appearance of creating between the parties legal rights and obligations different from the actual rights and obligations (if any) which the parties intend to create Snook v. London and West Riding Investments Ltd [1967] 2 QB 786, 802 Both the settlor and the trustee must intend the trust to be a sham: Abacus (CI) Ltd v. Al-Sabah (Royal Court of Jersey, 13 June 2003) Shalson v. Russo [2005] Ch 281 at [190]

Rights and powers of the debtor Rights and powers of the debtor Tasarruf Mevduati Sigorta Fonu v. Merrill Lynch [2012] 1 WLR 1721 Receivers appointed over the debtor s powers of revocation of Cayman trusts The debtor can also be ordered to exercise a power directly: Blight v. Brewster [2012] 1 WLR 2841.

Informal control Informal control a new principle? a new principle? JSC Mezhdunarodniy Promyshlenniy Bank v. Pugachev [2016] 1 WLR 160 Unless it can be said either that (a) the discretionary trusts are shams or (b) in practice at least the trustees do whatever Mr Pugachev asks them to, he cannot be regarded as the owner, either legally or beneficially, of any of the trust assets themselves (per Lewison LJ at [26]) JSC VTB Bank v. Skurikhin [2015] EWHC 2131 (Comm) Property subject to trust or analogous foreign arrangements [can] be regarded in equity as assets of the judgment debtor if he has the legal right to call for those assets to be transferred to him or to his order, or if he has de facto control of the trust assets in circumstances where no genuine discretion is exercised by the trustee over those assets (per Christopher Butcher QC at [39], [45]).