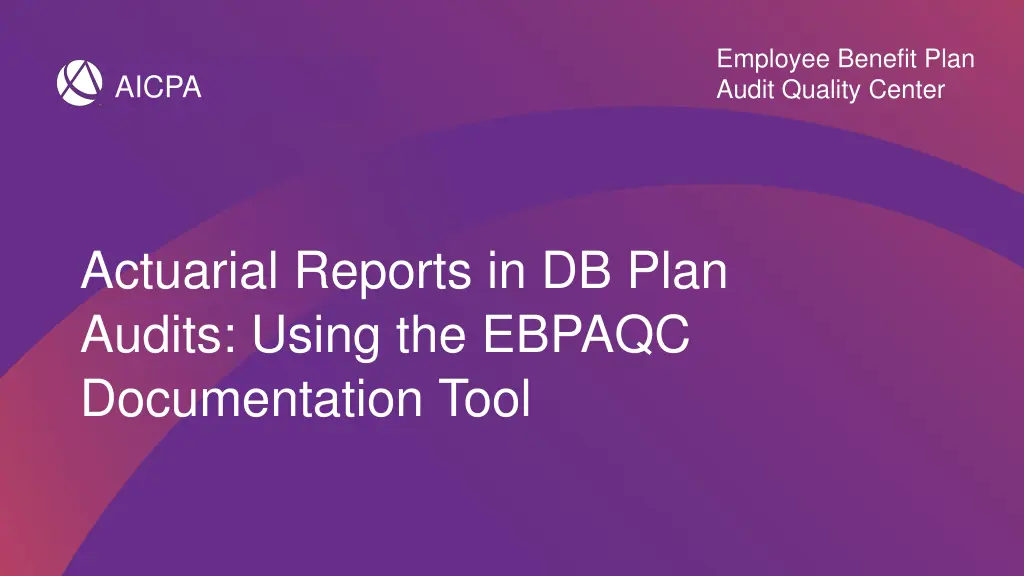

Understanding Actuarial Reports in Defined Benefit Pension Plan Audits

Learn about the key steps in the actuarial valuation process, understanding actuarial reports, and the responsibilities of auditors when using actuarial reports in audits of defined benefit pension plans. Gain insights from industry experts on utilizing tools for documentation and more.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Employee Benefit Plan Audit Quality Center AICPA Actuarial Reports in DB Plan Audits: Using the EBPAQC Documentation Tool

Handouts for todays event You can download presentation slides (in PDF or PowerPoint format) and other handouts by clicking on in the toolbar at the bottom of your screen Instructions to obtain your CPE certificate for today s event Webinar presentation slides Summary of EBPAQC Resources and Tools Documentation of Use of an Actuarial Report in audit of a Defined Benefit Pension Plan s Financial Statements TIS 3700.01 Illustrative letters to plan actuary 2

Key take-aways from this webinar Become familiar with the components of an actuarial report for a DB plan, including relevant assumptions Understand the auditor s responsibilities when information to be used as audit evidence has been prepared using the work of an actuary Learn how to utilize the EBPAQC DB plan actuarial report documentation tool 3

Presenters Dennis Polisner, KPMG Debbie Smith, Grant Thornton Diane Walker, Johnson Lambert LLP 4

Dennis Polisner, FSA Director KPMG 5

Background Key steps in the actuarial valuation process Obtain plan provisions from sponsor Obtain census data from the plan sponsor Review data for reasonableness General testing of data (not audit the data) Consult with sponsor on actuarial assumptions Perform actuarial valuation Issue actuarial valuation report 6

Understanding the actuarial report Actuarial reports address many issues Funding, PBGC premiums, plan sponsor reporting, plan reporting Only certain information pertains to plan financial statements Important to extract the information that is appropriate for plan reporting Certain sections of the report are specific to ASC 960 AFTAP certification Other sections may also contain important information (for example, certain census data summaries, summary of plan provisions, and Actuary s Certification) 7

Considerations by actuaries Plan Provisions relevant to the determination of the actuarial present value of accumulated plan benefits (eligibility, entitlement to benefits, funding, operation and administration of plan provisions) Amendments to plan instrument that affect accrued benefits. Mortality assumptions Retirement assumptions Benefit elections assumptions Interest rate assumptions Any findings, such as operational errors, that might affect the determination of accumulated plan benefits. 8

A Word about ASC 960 Methods Actuarial methods are used to allocate obligations to reporting periods These are normally applied for funding and expense determinations ASC 960 reporting only presents a benefit obligation ASC 960 reporting does not include period costs Therefore, no specific actuarial method is used The ASC 960 obligation represents the full present value of future cashflows related to benefits accrued to the measurement date 9

Debbie Smith, CPA Partner Grant Thornton 10

Diane Walker, CPA Partner Johnson Lambert LLP 11

AU-C Section 500, Audit Evidence AU-C section 500: Addresses the auditor s responsibilities when information to be used as audit evidence has been prepared using the work of a management s specialist. Defines a management s specialist as an individual or organization possessing expertise in a field other than accounting or auditing whose work in that field is used by the entity to assist the entity in preparing the financial statements. For an employee benefit plan, a management s specialist would include an actuary used to determine accumulated plan benefits for financial reporting purposes in accordance with FASB ASC 960, Plan Accounting Defined Benefit Pension Plans. 12

Requesting information from plan actuary Illustrative confirmation letters available in AICPA Audit and Accounting Guide, Employee Benefit Plans Information commonly requested Copy of actuarial report Other information, for example o Benefit restrictions due to the funded status o Unbilled or unpaid fees o Nature of any interests or relationships that could impair objectivity [Example letters included in webinar handout material] 13

Auditors responsibilities: evaluating professional qualifications of actuary What can go wrong? Actuary doesn't have appropriate qualifications or related experience to perform valuation Evaluate competence, capabilities and objectivity of the actuary, for example: Evaluate any interests or relationships of specialist to client Actuary s objectivity is impaired Professional qualifications of specialist 14

Professional standards for actuaries 15

Actuarial credentials Fellow of the Society of Actuaries (FSA) Fellow of the Canadian Institute of Actuaries (FCIA) Associate of the Society of Actuaries (ASA) Enrolled Actuary (EA) Fellow of the Conference of Consulting Actuaries (FCA) Associate of the Conference of Consulting Actuaries (ACA) Member of the American Academy of Actuaries (MAAA) Fellow of the American Society of Pension Professionals and Actuaries (FSPA) Member of the American Society of Pension Professionals and Actuaries (MSPA) 16

Section I Actuarys competence, capabilities, and objectivity 17

Section IActuarys competence and capabilities 18

Auditors responsibilities: benefit information date What can go wrong? Actuary calculates accumulated plan benefits as of an incorrect valuation date Understanding whether the plan s benefit obligation is being determined as of the beginning of the year or as of the end of the year 20

Benefit information date Beginning of year or end of year End of year preferred January 1, 20x2 valuation presented as of December 31, 20x1 (one day earlier) Typically not a material difference unless a plan amendment adopted on or after January 1, 20x2 with a January 1, 20x2 effective date 21

Beginning of year information vs. end of year information Beginning of Year Benefit Information Date* End of Year Benefit Information Date Financial Statements Comparative Comparative Statement of net assets available for benefits Comparative Single Statement of changes in net assets available for benefits Single Comparative Accumulated plan benefits (in the notes or in separate financial statements) Single Single Changes in accumulated plan benefits (in the notes or in separate financial statements) *If presenting comparative statements of accumulated plan benefits, also need to present 3 years of statements of net assets available for benefits. See ASC 960-205-45-4. 22

What can go wrong? Auditor s responsibilities: actuarial methods and assumptions Benefits paid per actuary doesn't agree with benefits paid per trustee or plan sponsor Incorrect classifications (Active, deferred vested or retired) Company gave wrong file to actuary Actuary gave wrong file to auditor (Partial or preliminary file, wrong year) Actuary maintains incomplete or incorrect census data or uses inappropriate factors or assumptions Assumptions not based on plan provisions, plan experience, are inappropriate (i.e. discount rate, method of benefit payments) or are unreasonable Plan amendments have not been properly included/excluded depending on the valuation date Identified operational errors aren't appropriately communicated to actuary (may result in over/understatement of accumulated benefit obligation) Obtain understanding of actuaries objectives, scope, and work Ascertain whether the methods and assumptions used are in accordance with FASB ASC 960 24

Understanding objectives, scope of work, and assumptions used Auditor required to obtain an understanding of actuary s work and evaluate appropriateness of the information Calculations should reflect all benefits specified in the plan document and plan amendments, in accordance with ASC 960 Calculations performed using an end of year valuation date, often are presented in a separate report Actuary must provide rationale used in selecting significant assumptions used in the valuation of accumulated plan benefits 25

Understanding objectives, scope of work, and assumptions used (cont d) Actuary must consider any findings, such as operational errors, that might affect the determination of accumulated plan benefits 26

Benefit obligations Benefit Obligations represent Benefits accrued to date Probability that they will be paid A present value Referred to as the Present Value of Accumulated Plan Benefits 27

Benefit obligations Accumulated Plan Benefits Benefits accrued to date Based on service to date Based on salary to date No projection of future salary Present Value reflects amount and timing of benefits and time value of money 28

Assumptions for benefit obligations Mortality Retirement Turnover Interest (discount) Including lump sum and cash balance crediting rate 29

Section IIIobjectives, scope of work, and assumptions used 30

Plan amendments Benefit obligations are affected by amendments affecting accrued benefits Amendments affecting future benefits are not recorded currently Amendments are recognized when adopted even if effective date is in the future 31

Matrix for recognition of plan amendments Effective Date Amendments Adopted Within Reporting Year Effect of amendment should be included in the actuarial present value of accumulated plan benefits presented as of the end of the reporting year Amendments Adopted After the Reporting Year Effect of amendment should not be included in the actuarial present value of accumulated plan benefits presented as of the end of the reporting year Effective date within the reporting year Effective date after the reporting year Effect of amendment should be included in the actuarial present value of accumulated plan benefits presented as of the end of the reporting year Effect of amendment should not be included in the actuarial present value of accumulated plan benefits presented as of the end of the reporting year 32

Section IIIassumptions used: plan provisions 33

Mortality tables RP 2014 RP 2000 (including variations and projections)* *Generally considered out of date Confusion when mortality is used for plan provisions 34

Mortality - recent history The Society of Actuaries released new mortality tables in October 2014 called the RP-2014 tables MP-2015 improvement scale released Oct 8, 2015 MP-2016 improvement scale released Oct 20, 2016 MP-2017 improvement scale released Oct 20, 2017 Plan funding assumptions may differ from financial reporting IRS has issued regulations effective beginning in 2018 Society of Actuaries (SOA) issued MP-2017 improvement scale on October 20, 2017 Technical Question and Answer (TIS 3700.01) [TIS 3700.01 included in webinar handout material] 35

Mortality improvement scales (MP-2017) Incorporates mortality data from the Social Security Administration, which indicates that deaths are occurring at rates slightly higher than assumed in 2016 mortality improvement scale (MP-2016) Reflects a decrease in the rate of improvements in life expectancies in the United States compared with the data in the MP-2016 SOA does not frequently update the RP-2014 base mortality tables Updated projections scales should be considered for 2017 audits and any 2016 audits issued after October 20, 2017 Technical Question and Answer (TIS 3700.01) [TIS 3700.01 included in webinar handout material] Society of Actuaries (SOA) issued MP-2017 improvement scale on October 20, 2017 36

Retirement assumptions Decrements generally from ages 55 to 65 Bumps at 62 and 65 Or single age such as 65 Should reflect plan provisions Should reflect plan experience 38

Turnover assumptions For accrued benefits used to value non-vested benefits Usually reflects age Often recognizes years of service Or both age and service 40

Benefit election assumptions For plans that provide for a lump-sum option- Estimates of the number of people who will elect a lump sum benefit and those who will elect an annuity ASC 960 requires that the election assumptions used should represent a best estimate of the plan's future benefit payment elections (should reflect the plan's experience and future expectations) 42

Section IIIassumptions used: benefit elections 43

Interest rates Lump sum rates Percentage electing lump sum Interest rate(s) used to calculate lump sum The interest rate(s) may differ from valuation discount rate 44

Discount rates (ASC 960) Used to calculate present value of accumulated benefits ASC 960 has two options: Long-term rate of return on assets (FASB ASC 960-20-35-1) OR Settlement rate (FASB ASC 960-20-35-1A) Instead Some are trying to use the FASB ASC 715 rate (rate used for sponsor accounting) or segment rates (funding rates) instead of FASB ASC 960 settlement rate Some are using segment rates and asserting that they are within the "range" between the two acceptable FASB ASC 960 rates 45

Discount rate expected return Usually the funding rate prior to PPA PPA three-tiered rates not appropriate Usually FASB ASC 715 long-term expected return on plan assets (not discount rate used to determine pension obligations) Generally, should not change frequently 46

Discount rate settlement Reflects rate used to settle obligations Usually FASB ASC 715 discount rate Generally should change every year 47

Discount rate basis (ASC 960) Should select either long-term or settlement approach consistently A change from one basis to another may be a change in accounting Preferability required if considered a change in accounting 48

What can go wrong? Auditor s responsibilities: census data Incomplete or missing participant records Participant groups are inappropriately excluded or included from census data Test the reliability and completeness of census data -Census omitted participants in one or more locations -Missing participant census data for acquired company Errors in census data -Deceased participants included in census data -Demographic data is wrong -Date of birth, hire date, termination date, salary, gender -Lump sum requests at or near year end are erroneously deleted or omitted from census data 50