Understanding Aid Worksheets in School Financial Services

Delve into aid worksheets and formulas for equalization aid in school financial services. Explore shared costs and district factors affecting aid distribution. Learn about revenue limits, property taxes, and more in this informative conference overview.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

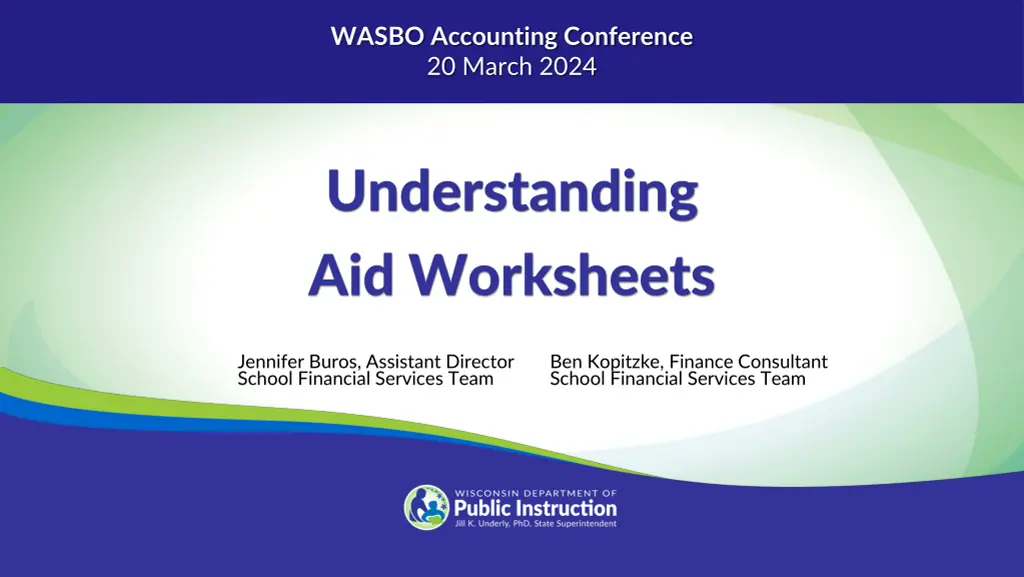

WASBO Accounting Conference 20 March 2024 Understanding Aid Worksheets Jennifer Buros, Assistant Director School Financial Services Team Ben Kopitzke, Finance Consultant School Financial Services Team

The Big Picture State Aid (General + High Poverty + Computer + Exempt Personal Property) Revenue Limit Property TaxLevy 2/30

State General Aids The fundamental purpose of the Equalization Aid formula is to level the playing field by providing assistance (distributing aid) to poorer districts (those with lower property value) to make up for what they can t get from their property tax base. reasonable tax burden 3/30

Equalization Aid Factors What affects the amount of a district s Equalization Aid? District Factors (Prior Year Audited) Shared cost Membership Equalized property value State Factors Cost ceilings Guaranteed valuations per member Amount of funding the State puts into the formula 4/30

What is Shared Cost? Shared Cost was developed to be used in the Equalization Aid computation and captures ONLY certain elements of the General (10) and Debt Service (38 and 39) Funds. Shared Cost can be defined as the district expenditures for which the district has no other revenues except for local Property Tax and Equalization Aid. Determine Shared Cost for the General Fund by starting with the total General Fund expenditures and remove from those expenditures the dollar amount of all the revenues EXCEPT for Property Tax and Equalization Aid. 5/30

Membership: Revenue Limit vs Aid Revenue Limit Three-year rolling average Equalization Aid Prior year audited data 100% of 3rd Friday in September FTE Average of 3rd Friday in September and 2nd Friday in January FTE 40% of Summer School FTE 100% of Summer School FTE New Independent Charter School FTE New Independent Charter School FTE and voucher students, including SNSP Group and Foster + Part-Time Non-Resident 6/30

Property Value Assessed valuation is property value as determined by the local municipal assessor on January 1 in any given year. Equalized valuation results when the Department of Revenue applies an adjustment factor to assessed value. The adjustment factor is meant to ensure each type of property has comparable value regardless of local assessment practices. Most state computations use equalized value, also known as "fair market" value. The October 1 Tax Apportionment Value Certification is used to apportion levies and set municipal tax bills. A "final" version is issued the following May (i.e., almost 1.5 years after the original assessment). This final version is known as the School Aid Value Certification and will be used in the FOLLOWING year's Equalization Aid formula, e.g., property value as of January 1, 2024, will eventually be used in the 2025-26 Equalization Aid computation. 7/30

Assessed Value vs Equalized Value Equalized Value Assessed Value Valuation date January 1 January 1 Updated Annually Yes No Applies to individual properties No Yes oApportionment of tax levy oAllocation of state aids oDebt limit calculation oMunicipal Compliance oEquating of manufacturing assessments oLevy limit calculations oDetermines amount of tax levy covered by the property Uses Source: Department of Revenue 8/30

2023-24 General Aid Data (From October 15th Aid Cert) 2022-23 Property Wealth Data 2022-23 Shared Cost Data Highest Property Value District Highest Overall District North Lakeland: $17,506,625 per pupil Washington $26,106 per pupil Equalization aid: $0 per pupil Lowest Property Value District* Lowest Overall District* Menominee Indian $8,548 per pupil Abbotsford: $308,910 per pupil Equalization aid: $9,625 per pupil Statewide Average $12,450 per pupil Statewide Average $861,627 per pupil Equalization aid: $6,361 per pupil * Excluding Norris Source: Department of Public Instruction 9/30

Property Value Per Member Source: Department of Public Instruction 10/3

Shared Cost Per Member Source: Department of Public Instruction 11/3

WISCONSIN DEPARTMENT OF PUBLIC INSTRUCTION OCTOBER 15 CERTIFICATION OF 2023-24 GENERAL AID GUARANTEES FOR OCT 15 CERTIFICATION K-12 UHS K-8 Property Value PRIMARY (G1) 1,930,000 5,790,000 2,895,000 SECONDARY (G6) 1,984,342 5,953,026 2,976,513 USING 2022-23 PI-1506-AC DATA, 2022-23 AUDITED MEMBERSHIP TERTIARY (G11) 861,627 2,584,881 1,292,440 2022 TIFOUT SCHOOL AID VALUE (CERT MAY 2023) & 2016 COMPUTER VALUE (CERT MAY 2017) Madison Metropolitan 3269 2023-2024 OCT 15 CERTIFICATION E4 = PART A: 2022-23 AUDITED MEMBERSHIP A1 3RD FRI SEPT 2022 MEMBERSHIP* (include Challenge Academy) A2 2ND FRI JAN 2023 MEMBERSHIP* (include Challenge Academy) A3 TOTAL (A1 + A2) A4 AVERAGE (A3/2) (ROUNDED) A5 SUMMER 2022 FTE EQUIVALENT* (ROUNDED) A6A FOSTER GROUP + PARTTIME RESIDENT FTE EQUIVALENT (AVE SEPT+JAN) A6B PARTTIME NON-RESIDENT FTE EQUIVALENT (AVE SEPT+JAN) A6C STATEWIDE CHOICE & RACINE PUPILS STARTING IN FALL 15 & AFTER A6D STATEWIDE SPECIAL NEEDS SCHOLARSHIP PROGRAM PUPILS A6E INDEPENDENT CHARTER SCHOOLS (ICS) NEW AUTHORIZERS STUDENTS A7 AID MEMBERSHIP (A4+A5+A6A+A6B+A6C+A6D+A6E) (ROUNDED) * Ch 220 Resident Inter FTE counts only 75%. PART B: 2022-23 GENERAL FUND DEDUCTIBLE RECEIPTS (PI-1506-AC REPORT) B1 TOTAL REVENUE & TRNSF IN B2 PROP TAX + EXEMPT AIDS FROM DOR B3 GENERAL STATE AID B4 IMPACT AID DISTS: NON-DED IMPACT AID B5 REORG SETTLEMENT B6 LONG TERM OP BORR, NOTE B7 LONG TERM OP BORR, STF B8 PROPERTY TAX/EQUAL AID REFUND B9 DEDUCTIBLE RECEIPTS FTE PART E: 2022-23 SHARED COST - CONTINUED E6 PRIMARY COST CEILING PER MEMBER E7 PRIMARY CEILING (A7 * E6) E8 PRIMARY SHARED COST (LESSER OF E5 OR E7) E9 SECONDARY COST CEILING PER MEMBER E10 SECONDARY CEILING (A7 * E9) E11 SECONDARY SHARED COST ((LESSER OF E5 OR E10) - E8) E12 TERTIARY SHARED COST (GREATER OF (E5 - E8 - E11) OR 0) 397,372,593.07 25,546.00 25,751.00 51,297.00 25,649.00 338.00 1,000 26,904,000.00 26,904,000.00 11,194 301,163,376.00 274,259,376.00 0.95 0.00 384.00 32.00 500.00 26,904.00 96,209,217.07 SHARED COST PER MEMBER = $14,770 PART F: EQUALIZED PROPERTY VALUE F1 2022 TIFOUT VALUE (CERT MAY 23) + EXEMPT COMPUTER VALUE (CERT MAY 17) 36,486,785,574 10R 000000 000 10R 210 + 691 10R 000000 620 (DPI AMOUNT) 10R 000000 850 10R 000000 873 10R 000000 874 10R 000000 972 (TO LINE C6) + - - - - - - - = 452,755,733.10 325,247,224.00 45,686,384.00 VALUE PER MEMBER = 1,356,184 PART G: 2023-24 EQUAL AID BY TIER - OCT 15 CERT G1 PRIMARY GUARANTEED VALUE PER MEMBER G2 PRIMARY GUARANTEED VALUATION (A7 * G1) G3 PRIMARY REQUIRED RATE (E8 / G2) G4 PRIMARY NET GUARANTEED VALUE (G2 - F1) G5 PRIMARY EQUALIZATION AID (G3 * G4) (NOT LESS THAN 0) G6 SECONDARY GUARANTEED VALUE PER MEMB G7 SECONDARY GUARANTEED VALUATION (A7 * G6) G8 SECONDARY REQUIRED RATE (E11 / G7) G9 SECONDARY NET GUARANTEED VALUE (G7 - F1) G10 SECONDARY EQUALIZATION AID (G8 * G9) G11 TERTIARY GUARANTEED VALUE PER MEMB G12 TERTIARY GUARANTEED VALUATION (A7 * G11) G13 TERTIARY REQUIRED RATE (E12 / G12) G14 TERTIARY NET GUARANTEED VALUE (G12 - F1) G15 TERTIARY EQUALIZATION AID (G13 * G14) 0.00 0.00 0.00 0.00 0.00 1,930,000 51,924,720,000 0.00051813 15,437,934,426 7,998,856.96 1,984,342 53,386,737,168 0.00513722 16,899,951,594 86,818,769.33 861,627 23,181,212,808 0.00415031 -13,305,572,766 -55,222,251.71 81,822,125.10 PART C: 2022-23 NET COST OF GENERAL FUND (PI-1506-AC REPORT) C1 TOTAL GF EXPENDITURES C2 DEBT SRVC TRANSFER C3 REORG SETTLEMENT C4 REFUND PRIOR YEAR REV C5 GROSS COST GEN FUND C6 DEDUCTIBLE RECEIPTS C7 OPERATIONAL DEBT, INTEREST C8 NET COST GENERAL FUND 10E 000000 000 10E 411000 838+839 10E 491000 950 10E 492000 972 (C1 - C2 - C3 - C4) (FROM LINE B9) 38E+39E 283000 680 (NOT LESS THAN 0) + - - - + - + = 459,443,855.00 0.00 0.00 33,376.09 459,410,478.91 81,822,125.10 0.00 377,588,353.81 PART H: 2023-24 EQUALIZATION AID - OCT 15 CERT H1 2023-24 EQUALIZATION AID - OCT 15 CERT (G5+G10+G15) NOT< 0 H2 PARENTAL CHOICE DEDUCT, EQUALIZATION AID (MPS only) H2A PAYMENT TO MILWAUKEE SCHOOL DISTRICT FROM CITY OF MILWAUKEE H3 MILWAUKEE CHARTER PGM DEDUCT, EQUALIZATION AID (Revised to 0 by JFC, 6/2021) H4A 2022-23 OCT-TO-FINAL ADJUSTMENT, EQUALIZATION AID H4B 2022-23 OCT-TO-FINAL ADJ, CHOICE/CHARTER DEDUCTION (previously Line I4) H5 PRIOR YEAR (2022-23) DATA ERROR ADJ/OR FEE PENALTY H6 2023-24 EQUALIZATION AID - OCT 15 CERT (ROUND) (H1+H2+H2A+H3+H4A+H4B+H5) 39,595,374.58 PART D: 2022-23 NET COST OF DEBT SERVICE FUNDS (PI-1506-AC REPORT) D1 TOTAL REVENUE & TRNSF IN D2 TRNSF FROM GEN FUND D3 PROPERTY TAXES D4 PAYMENT IN LIEU OF TAX D5 NON-REV RECEIPTS D6 DEDUCTIBLE RECEIPTS D7 TOTAL EXPENDITURES D8 AIDABLE FUND 41 EXP D9 REFINANCING D10 OPERATIONAL DEBT PAYMENT D11 NET COST DEBT SERVICE FUNDS 38R + 39R 000 10E 411000 838 + 839 38R + 39R 210 38R + 39R 220 38R + 39R 800 (D1-D2-D3-D4-D5) 38E + 39E 000 (DPI AMOUNT) 38E + 39E 282000 38E + 39E 283000 (CAN BE NEGATIVE) + - - - - - + + - - = 23,916,795.97 0.00 0.00 0.00 0.00 19,926,000.00 0.00 0.00 -1,700,170.00 0.00 0.00 3,990,795.97 22,365,818.05 3,493,206.82 37,895,205 *** PART I: 2023-24 SPECIAL ADJUSTMENT, INTER, AND INTRA AID SUMMARY - OCT 15 CERT *** 0.00 0.00 I1 2023-24 SPECIAL ADJUSTMENT AID and/or CHAPTER 220 - OCT 15 CERT I2A PARENTAL CHOICE DEDUCT, SPEC ADJ AID and/or CHAPTER 220 AID (MPS only) I2B MILW CHARTER DEDUCT, SPEC ADJ AID and/or CHAP. 220 AID (Removed by JFC, 6/2021) I2C 2022-23 OCT-TO-FINAL ADJUSTMENT, SPEC ADJ AID and/or CHAPTER 220 AID I3 2023-24 SPEC ADJ AID and/or CHAP 220 - OCT 15 CERT (ROUND) (I1+I2A+I2B+I2C) 0.00 0.00 0.00 21,868,228.90 -253.00 -253.00 PART E: 2022-23 SHARED COST (PI-1506-AC REPORT) E1 NET COSTS: GEN + DEBT SERV FUNDS E2 TRANSP OF INDIGENT PUPILS, REG 3K PGMS, AND/OR OTHER E3 IMPACT AID DISTS: IMPACT AID NON-DEDUCTIBLE REMOVED E4 TOTAL SHARED COST FOR EQUALIZATION AID (C8 + D11) + - - = 399,456,582.71 2,083,989.64 *I5 2023-24 OCT 15 CERTIFICATION OF GENERAL AID (H6+I3) 37,894,952 0.00 12/3 397,372,593.07

Ceilings and Guarantees Secondary Ceiling 90% of PY costs Primary Ceiling Set in statute 13/3

Guarantees and Ceilings GUARANTEES FOR OCT 15 CERTIFICATION K-12 UHS K-8 PRIMARY (G1) 1,930,000 5,790,000 2,895,000 Primary Ceiling: $1,000 Secondary Ceiling: $11,194 SECONDARY (G6) 1,984,342 5,953,026 2,976,513 TERTIARY (G11) 861,627 2,584,881 1,292,440 $ 1,984,342 $ 2,000,000 12,000 $ $ 9,227 $ 11,194 1,500,000 9,000 Cost Ceiling Guarantees $ 1,096,664 1,000,000 6,000 $ 531,951 $ 861,627 500,000 3,000 Secondary Guarantee Tertiary Guarantee Secondary Ceiling 0 0 2014-15 2023-24 14/3 Source: Department of Public Instruction

Part A: Prior Year Audited Membership PART A: 2022-23 AUDITED MEMBERSHIP A1 3RD FRI SEPT 2022 MEMBERSHIP* (include Challenge Academy) A2 2ND FRI JAN 2023 MEMBERSHIP* (include Challenge Academy) A3 TOTAL (A1 + A2) A4 AVERAGE (A3/2) (ROUNDED) A5 SUMMER 2022 FTE EQUIVALENT* (ROUNDED) A6A FOSTER GROUP + PARTTIME RESIDENT FTE EQUIVALENT (AVE SEPT+JAN) A6B PARTTIME NON-RESIDENT FTE EQUIVALENT (AVE SEPT+JAN) A6C STATEWIDE CHOICE & RACINE PUPILS STARTING IN FALL 15 & AFTER A6D STATEWIDE SPECIAL NEEDS SCHOLARSHIP PROGRAM PUPILS A6E INDEPENDENT CHARTER SCHOOLS (ICS) NEW AUTHORIZERS STUDENTS A7 AID MEMBERSHIP (A4+A5+A6A+A6B+A6C+A6D+A6E) (ROUNDED) * Ch 220 Resident Inter FTE counts only 75%. FTE 25,546.00 25,751.00 51,297.00 25,649.00 338.00 0.95 0.00 384.00 32.00 500.00 26,904.00 15/3

Part B: Deductible Receipts PART B: 2022-23 GENERAL FUND DEDUCTIBLE RECEIPTS (PI-1506-AC REPORT) B1 TOTAL REVENUE & TRNSF IN B2 PROP TAX + EXEMPT AIDS FROM DOR B3 GENERAL STATE AID B4 IMPACT AID DISTS: NON-DED IMPACT AID B5 REORG SETTLEMENT B6 LONG TERM OP BORR, NOTE B7 LONG TERM OP BORR, STF B8 PROPERTY TAX/EQUAL AID REFUND B9 DEDUCTIBLE RECEIPTS 10R 000000 000 10R 210 + 691 10R 000000 620 (DPI AMOUNT) 10R 000000 850 10R 000000 873 10R 000000 874 10R 000000 972 (TO LINE C6) + - - - - - - - = 452,755,733.10 325,247,224.00 45,686,384.00 0.00 0.00 0.00 0.00 0.00 81,822,125.10 16/3

Part C: Net Cost of General Fund PART C: 2022-23 NET COST OF GENERAL FUND (PI-1506-AC REPORT) C1 TOTAL GF EXPENDITURES C2 DEBT SRVC TRANSFER C3 REORG SETTLEMENT C4 REFUND PRIOR YEAR REV C5 GROSS COST GEN FUND C6 DEDUCTIBLE RECEIPTS C7 OPERATIONAL DEBT, INTEREST C8 NET COST GENERAL FUND 10E 000000 000 10E 411000 838+839 10E 491000 950 10E 492000 972 (C1 - C2 - C3 - C4) (FROM LINE B9) 38E+39E 283000 680 (NOT LESS THAN 0) + - - - + - + = 459,443,855.00 0.00 0.00 33,376.09 459,410,478.91 81,822,125.10 0.00 377,588,353.81 17/3

Part D: Net Cost of Debt Service PART D: 2022-23 NET COST OF DEBT SERVICE FUNDS (PI-1506-AC REPORT) D1 TOTAL REVENUE & TRNSF IN D2 TRNSF FROM GEN FUND D3 PROPERTY TAXES D4 PAYMENT IN LIEU OF TAX D5 NON-REV RECEIPTS D6 DEDUCTIBLE RECEIPTS D7 TOTAL EXPENDITURES D8 AIDABLE FUND 41 EXP D9 REFINANCING D10 OPERATIONAL DEBT PAYMENT D11 NET COST DEBT SERVICE FUNDS 38R + 39R 000 10E 411000 838 + 839 38R + 39R 210 38R + 39R 220 38R + 39R 800 (D1-D2-D3-D4-D5) 38E + 39E 000 (DPI AMOUNT) 38E + 39E 282000 38E + 39E 283000 (CAN BE NEGATIVE) + - - - - - + + - - = 23,916,795.97 0.00 19,926,000.00 0.00 0.00 3,990,795.97 22,365,818.05 3,493,206.82 0.00 0.00 21,868,228.90 18/3

Part E: Shared Cost PART E: 2022-23 SHARED COST (PI-1506-AC REPORT) E1 NET COSTS: GEN + DEBT SERV FUNDS E2 TRANSP OF INDIGENT PUPILS, REG 3K PGMS, AND/OR OTHER E3 IMPACT AID DISTS: IMPACT AID NON-DEDUCTIBLE REMOVED E4 TOTAL SHARED COST FOR EQUALIZATION AID (C8 + D11) + - - = 399,456,582.71 2,083,989.64 0.00 397,372,593.07 E6 PRIMARY COST CEILING PER MEMBER E7 PRIMARY CEILING (A7 * E6) E8 PRIMARY SHARED COST (LESSER OF E5 OR E7) E9 SECONDARY COST CEILING PER MEMBER E10 SECONDARY CEILING (A7 * E9) E11 SECONDARY SHARED COST ((LESSER OF E5 OR E10) - E8) E12 TERTIARY SHARED COST (GREATER OF (E5 - E8 - E11) OR 0) 1,000 26,904,000.00 26,904,000.00 11,194 301,163,376.00 274,259,376.00 96,209,217.07 SHARED COST PER MEMBER = $14,770 19/3

Part E: Shared Cost & Part F: EQ Property Value E6 PRIMARY COST CEILING PER MEMBER E7 PRIMARY CEILING (A7 * E6) E8 PRIMARY SHARED COST (LESSER OF E5 OR E7) E9 SECONDARY COST CEILING PER MEMBER E10 SECONDARY CEILING (A7 * E9) E11 SECONDARY SHARED COST ((LESSER OF E5 OR E10) - E8) E12 TERTIARY SHARED COST (GREATER OF (E5 - E8 - E11) OR 0) 1,000 26,904,000.00 26,904,000.00 11,194 301,163,376.00 274,259,376.00 96,209,217.07 SHARED COST PER MEMBER = UHS $14,770 K-8 GUARANTEES FOR OCT 15 CERTIFICATION K-12 PRIMARY (G1) 1,930,000 5,790,000 2,895,000 PART F: EQUALIZED PROPERTY VALUE F1 2022 TIFOUT VALUE (CERT MAY 23) + EXEMPT COMPUTER VALUE (CERT MAY 17) TERTIARY (G11) 861,627 SECONDARY (G6) 1,984,342 5,953,026 2,976,513 36,486,785,574 VALUE PER MEMBER = 1,356,184 2,584,881 1,292,440 High Spending & High Value = NEGATIVE TERTIARY AID 20/3

Part G: Equalization Aid by Tier PART G: 2023-24 EQUAL AID BY TIER - OCT 15 CERT G1 PRIMARY GUARANTEED VALUE PER MEMBER G2 PRIMARY GUARANTEED VALUATION (A7 * G1) G3 PRIMARY REQUIRED RATE (E8 / G2) G4 PRIMARY NET GUARANTEED VALUE (G2 - F1) G5 PRIMARY EQUALIZATION AID (G3 * G4) (NOT LESS THAN 0) G6 SECONDARY GUARANTEED VALUE PER MEMB G7 SECONDARY GUARANTEED VALUATION (A7 * G6) G8 SECONDARY REQUIRED RATE (E11 / G7) G9 SECONDARY NET GUARANTEED VALUE (G7 - F1) G10 SECONDARY EQUALIZATION AID (G8 * G9) G11 TERTIARY GUARANTEED VALUE PER MEMB G12 TERTIARY GUARANTEED VALUATION (A7 * G11) G13 TERTIARY REQUIRED RATE (E12 / G12) G14 TERTIARY NET GUARANTEED VALUE (G12 - F1) G15 TERTIARY EQUALIZATION AID (G13 * G14) 1,930,000 51,924,720,000 0.00051813 15,437,934,426 7,998,856.96 1,984,342 53,386,737,168 0.00513722 16,899,951,594 86,818,769.33 861,627 23,181,212,808 0.00415031 -13,305,572,766 -55,222,251.71 Primary (G5) + Secondary (G10) + Tertiary (G15) = $39,595,374.58 21/3

How the Formula Works in Theory Primary Tier & Aid 100% minus ($1,356,184 / $1,930,000) = 29.7% GUARANTEES FOR OCT 15 CERTIFICATION K-12 UHS K-8 PRIMARY (G1) 1,930,000 5,790,000 2,895,000 SECONDARY (G6) 1,984,342 5,953,026 2,976,513 Primary Aid: 29.7% * $26,904,000 = $7,998,936 TERTIARY (G11) 861,627 2023-2024 OCT 15 CERTIFICATION E4 = 2,584,881 1,292,440 Secondary Tier & Aid PART E: 2022-23 SHARED COST - CONTINUED E6 PRIMARY COST CEILING PER MEMBER E7 PRIMARY CEILING (A7 * E6) E8 PRIMARY SHARED COST (LESSER OF E5 OR E7) E9 SECONDARY COST CEILING PER MEMBER E10 SECONDARY CEILING (A7 * E9) E11 SECONDARY SHARED COST ((LESSER OF E5 OR E10) - E8) E12 TERTIARY SHARED COST (GREATER OF (E5 - E8 - E11) OR 0) 397,372,593.07 1,000 26,904,000.00 26,904,000.00 11,194 100% minus ($1,356,184 / $1,984,342) = 31.7% 301,163,376.00 274,259,376.00 Secondary Aid: 31.7% * $274,259,376 = 96,209,217.07 $86,818,815 Tertiary Tier & Aid SHARED COST PER MEMBER = $14,770 PART F: EQUALIZED PROPERTY VALUE F1 2022 TIFOUT VALUE (CERT MAY 23) + EXEMPT COMPUTER VALUE (CERT MAY 17) 36,486,785,574 VALUE PER MEMBER = 1,356,184 100% minus ($1,356,184 / $861,627) = -57.4% Tertiary Aid: -57.4% * $96,209,217 = -$55,222,204 22/3

Ceilings and Guarantees Secondary Ceiling 90% of PY costs Primary Ceiling Set in statute 23/3

Part H: EQ Aid & Part I: SA, Inter, and Intra PART H: 2023-24 EQUALIZATION AID - OCT 15 CERT H1 2023-24 EQUALIZATION AID - OCT 15 CERT (G5+G10+G15) NOT< 0 H2 PARENTAL CHOICE DEDUCT, EQUALIZATION AID (MPS only) H2A PAYMENT TO MILWAUKEE SCHOOL DISTRICT FROM CITY OF MILWAUKEE H3 MILWAUKEE CHARTER PGM DEDUCT, EQUALIZATION AID (Revised to 0 by JFC, 6/2021) H4A 2022-23 OCT-TO-FINAL ADJUSTMENT, EQUALIZATION AID H4B 2022-23 OCT-TO-FINAL ADJ, CHOICE/CHARTER DEDUCTION (previously Line I4) H5 PRIOR YEAR (2022-23) DATA ERROR ADJ/OR FEE PENALTY H6 2023-24 EQUALIZATION AID - OCT 15 CERT (ROUND) (H1+H2+H2A+H3+H4A+H4B+H5) 39,595,374.58 0.00 0.00 0.00 -1,700,170.00 0.00 0.00 37,895,205 *** PART I: 2023-24 SPECIAL ADJUSTMENT, INTER, AND INTRA AID SUMMARY - OCT 15 CERT *** I1 2023-24 SPECIAL ADJUSTMENT AID and/or CHAPTER 220 - OCT 15 CERT I2A PARENTAL CHOICE DEDUCT, SPEC ADJ AID and/or CHAPTER 220 AID (MPS only) I2B MILW CHARTER DEDUCT, SPEC ADJ AID and/or CHAP. 220 AID (Removed by JFC, 6/2021) I2C 2022-23 OCT-TO-FINAL ADJUSTMENT, SPEC ADJ AID and/or CHAPTER 220 AID I3 2023-24 SPEC ADJ AID and/or CHAP 220 - OCT 15 CERT (ROUND) (I1+I2A+I2B+I2C) 0.00 0.00 0.00 -253.00 -253.00 *I5 2023-24 OCT 15 CERTIFICATION OF GENERAL AID (H6+I3) 37,894,952 24/3

Special Adjustment Wauwatosa SPECIAL ADJUSTMENT COMPUTATION (NEW INFORMATION NOT FOUND ON PAGE 1) 1 EQUALIZATION AID ELIGIBILITY (LINE H1) FROM 22-23 FINAL AID 2 SPEC ADJ+INTER+INTRA ELIGIBILITY (LINE I1) FROM 22-23 FINAL AID 3 2022-23 REV LIMIT PENALTY FROM FINAL REV LIM RUN JUNE 2023 4 22-23 FINAL GEN AID ELIGIBILITY (1 + 2 - 3) (NOT < 0) 5 22-23 FINAL GEN AID ELIGIBILITY * 85% ("HOLD HARMLESS" THRESHOLD) 6 2023-24 EQUALIZATION AID ELIGIBILITY (LINE H1, PAGE 1) 7 2023-24 INTER + INTRA ELIGIBILITY 8 TOTAL GENERAL AID SO FAR IN THIS AID RUN (6+7) 9 2023-24 AID RUN SPEC ADJ (NON-CONSOLIDATION) AID COMPUTED (5 - 8)* (EXTRA NEEDED TO GET TO THE 85% HOLD HARMLESS THRESHOLD*) 10 2023-24 ADDITIONAL SPECIAL ADJUSTMENT FOR CONSOLIDATED DISTS (121.105(3)) 11 TOTAL 2023-24 OCT 15 CERT SPECIAL ADJUSTMENT AID ELIGIBILITY 18,571,963.57 110,712.58 0.00 18,682,676.15 15,880,274.73 4,463,373.91 76,512.75 4,539,886.66 11,340,388.07 0.00 11,340,388.07 25/3

WISCONSIN DEPARTMENT OF PUBLIC INSTRUCTION ANALYSIS OF GENERAL AID AND EQUALIZATION AID FORMULA COMPONENTS* ** ANALYSIS OF GENERAL AID AND EQUALIZATION AID FORMULA COMPONENTS* ** ANALYSIS OF GENERAL AID AND EQUALIZATION AID FORMULA COMPONENTS* ** ANALYSIS OF GENERAL AID AND EQUALIZATION AID FORMULA COMPONENTS* ** WISCONSIN DEPARTMENT OF PUBLIC INSTRUCTION WISCONSIN DEPARTMENT OF PUBLIC INSTRUCTION WISCONSIN DEPARTMENT OF PUBLIC INSTRUCTION Appleton Area Kenosha Madison Metropolitan Elkhart Lake-Glenbeulah 2014-15 FINAL AID FINAL AID (2013-14 DATA) 4,475,960,500 94,365,900 94,365,900 94,365,900 Longitudinal EQ Aid 2014-15 2014-15 FINAL AID FINAL AID 2014-15 2015-16 FINAL AID FINAL AID (2014-15 DATA) 4,475,960,500 4,475,960,500 4,475,960,500 2015-16 2015-16 FINAL AID FINAL AID 2015-16 2016-17 FINAL AID FINAL AID (2015-16 DATA) 4,584,098,000 108,137,500 108,137,500 108,137,500 2016-17 2016-17 FINAL AID FINAL AID 2016-17 2017-18 FINAL AID FINAL AID (2016-17 DATA) 4,584,098,000 4,584,098,000 4,584,098,000 2017-18 2017-18 FINAL AID FINAL AID 2017-18 2018-19 FINAL AID FINAL AID (2017-18 DATA) 4,656,848,000 72,750,000 72,750,000 72,750,000 2018-19 2018-19 FINAL AID FINAL AID 2018-19 2019-20 FINAL AID FINAL AID (2018-19 DATA) 4,740,048,000 83,200,000 83,200,000 83,200,000 2019-20 2019-20 FINAL AID FINAL AID 2019-20 2020-21 FINAL AID FINAL AID (2019-20 DATA) 4,903,590,000 163,542,000 163,542,000 163,542,000 2020-21 2020-21 FINAL AID FINAL AID 2020-21 2021-22 FINAL AID FINAL AID (2020-21 DATA) 5,013,590,000 110,000,000 110,000,000 110,000,000 2021-22 2021-22 FINAL AID FINAL AID 2021-22 2022-23 FINAL AID FINAL AID (2021-22 DATA) (2022-23 PI-1506 DATA) 5,201,590,000 188,000,000 188,000,000 188,000,000 2022-23 2022-23 FINAL AID FINAL AID 2022-23 2023-24 2023-24 2023-24 2023-24 OCT 15 CERT OCT 15 CERT OCT 15 CERT OCT 15 CERT (2013-14 DATA) 4,475,960,500 4,475,960,500 (2013-14 DATA) (2013-14 DATA) 4,475,960,500 94,365,900 (2014-15 DATA) (2014-15 DATA) (2014-15 DATA) 4,475,960,500 (2015-16 DATA) (2015-16 DATA) 4,584,098,000 4,584,098,000 (2015-16 DATA) 4,584,098,000 108,137,500 (2016-17 DATA) (2016-17 DATA) (2016-17 DATA) 4,584,098,000 (2017-18 DATA) (2017-18 DATA) 4,656,848,000 4,656,848,000 (2017-18 DATA) 4,656,848,000 72,750,000 (2018-19 DATA) (2018-19 DATA) 4,740,048,000 4,740,048,000 (2018-19 DATA) 4,740,048,000 83,200,000 (2019-20 DATA) 4,903,590,000 4,903,590,000 (2019-20 DATA) (2019-20 DATA) 4,903,590,000 163,542,000 (2020-21 DATA) 5,013,590,000 5,013,590,000 (2020-21 DATA) (2020-21 DATA) 5,013,590,000 110,000,000 (2021-22 DATA) (2022-23 PI-1506 DATA) 5,201,590,000 5,201,590,000 (2021-22 DATA) (2022-23 PI-1506 DATA) (2021-22 DATA) (2022-23 PI-1506 DATA) 5,201,590,000 188,000,000 GENERAL AID APPROPRIATION YEAR OVER YEAR APPRO CHANGE YEAR OVER YEAR APPRO CHANGE YEAR OVER YEAR APPRO CHANGE YEAR OVER YEAR APPRO CHANGE GENERAL AID APPROPRIATION GENERAL AID APPROPRIATION GENERAL AID APPROPRIATION 5,356,290,000 5,356,290,000 5,356,290,000 5,356,290,000 154,700,000 154,700,000 154,700,000 154,700,000 0 0 0 0 0 0 0 0 1,930,000 1,096,664 1,096,664 1,096,664 1,930,000 1,930,000 1,930,000 1,096,664 531,951 531,951 531,951 531,951 1,930,000 1,101,520 1,101,520 1,101,520 1,930,000 1,930,000 1,930,000 1,101,520 546,173 546,173 546,173 546,173 1,930,000 1,930,000 1,930,000 1,146,928 1,146,928 1,146,928 1,930,000 1,146,928 558,545 558,545 558,545 558,545 1,930,000 1,930,000 1,930,000 1,173,281 1,173,281 1,173,281 1,930,000 1,173,281 573,441 573,441 573,441 573,441 1,930,000 1,930,000 1,930,000 1,241,277 1,241,277 1,241,277 1,930,000 1,241,277 594,939 594,939 594,939 594,939 1,930,000 1,930,000 1,930,000 1,329,871 1,329,871 1,329,871 1,930,000 1,329,871 621,431 621,431 621,431 621,431 1,930,000 1,930,000 1,930,000 1,451,991 1,451,991 1,451,991 1,930,000 1,451,991 656,434 656,434 656,434 656,434 1,930,000 1,567,708 1,567,708 1,567,708 1,930,000 1,930,000 1,930,000 1,567,708 715,267 715,267 715,267 715,267 1,930,000 1,681,045 1,681,045 1,681,045 1,930,000 1,930,000 1,930,000 1,681,045 754,860 754,860 754,860 754,860 1,930,000 1,984,342 1,984,342 1,984,342 1,930,000 1,930,000 1,930,000 1,984,342 861,627 861,627 861,627 861,627 STATE PRIMARY GUARANTEE STATE SECONDARY GUARANTEE STATE TERTIARY GUARANTEE STATE TERTIARY GUARANTEE STATE TERTIARY GUARANTEE STATE TERTIARY GUARANTEE STATE PRIMARY GUARANTEE STATE SECONDARY GUARANTEE STATE SECONDARY GUARANTEE STATE SECONDARY GUARANTEE STATE PRIMARY GUARANTEE STATE PRIMARY GUARANTEE 1,000 1,000 1,000 1,000 9,227 9,227 9,227 9,227 1,000 1,000 1,000 1,000 9,401 9,401 9,401 9,401 1,000 9,538 9,538 9,538 9,538 1,000 1,000 1,000 1,000 9,618 9,618 9,618 9,618 1,000 1,000 1,000 1,000 9,729 9,729 9,729 9,729 1,000 1,000 1,000 1,000 9,781 9,781 9,781 9,781 1,000 1,000 1,000 1,000 10,030 10,030 10,030 10,030 1,000 1,000 1,000 1,000 10,760 10,760 10,760 10,760 1,000 1,000 1,000 1,000 10,951 10,951 10,951 10,951 1,000 1,000 1,000 1,000 11,194 11,194 11,194 11,194 1,000 1,000 1,000 PRIMARY COST CEILING SECONDARY COST CEILING SECONDARY COST CEILING SECONDARY COST CEILING SECONDARY COST CEILING PRIMARY COST CEILING PRIMARY COST CEILING PRIMARY COST CEILING 1. 22,509 27,678 520 15,007 4.9% -0.3% 0.9% -2.1% 22,501 27,884 516 15,099 0.6% 0.0% 0.7% -0.8% 22,471 27,942 486 15,397 2.0% -0.1% 0.2% -5.8% 22,117 27,755 467 15,497 0.6% -1.6% -0.7% -3.9% 21,837 27,778 463 15,434 -0.4% -1.3% 0.1% -0.9% 21,566 27,941 463 15,486 0.3% -1.2% 0.6% 0.0% 21,092 27,929 450 15,477 -0.1% -2.2% 0.0% -2.8% 20,051 26,962 430 14,581 -5.8% -4.9% -3.5% -4.4% 19,924 26,882 421 14,825 1.7% -0.6% -0.3% -2.1% 19,974 26,904 424 14,841 0.1% 0.3% 0.1% 0.7% DISTRICT MEMBERSHIP % CHANGE IN MEMBERSHIP % CHANGE IN MEMBERSHIP % CHANGE IN MEMBERSHIP % CHANGE IN MEMBERSHIP DISTRICT MEMBERSHIP DISTRICT MEMBERSHIP DISTRICT MEMBERSHIP 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 4 0 0 0 0 0 0 0 0 0 0 0 0 DISTRICT INTER MEMBERS DISTRICT INTRA MEMBERS DISTRICT INTRA MEMBERS DISTRICT INTRA MEMBERS DISTRICT INTRA MEMBERS DISTRICT INTER MEMBERS DISTRICT INTER MEMBERS DISTRICT INTER MEMBERS 259 263 163 124 90 60 35 24 27,678,000 227,706,906 4,278,040 15,007,000 123,462,589 609,304 139,078,893 228,183,657 306,608,861 5,581,245 22,509,000 185,181,543 20,493,114 51,223,955 783,205 520,000 15,099,000 126,846,699 2,352,284 144,297,983 235,943,081 313,053,088 5,623,275 22,501,000 189,030,901 24,411,180 50,915,604 772,359 27,884,000 234,253,484 4,334,916 516,000 22,471,000 27,942,000 238,568,796 49,686,457 1,335,200 15,397,000 129,499,258 191,857,398 25,200,422 239,528,820 316,197,253 5,970,668 486,000 4,149,468 15,497,000 130,927,686 190,604,306 24,573,371 237,294,677 320,379,043 5,569,451 22,117,000 27,755,000 239,192,590 53,431,453 1,077,845 467,000 4,024,606 15,434,000 133,540,960 190,615,173 22,956,886 235,409,059 328,468,167 5,461,714 21,837,000 27,778,000 242,474,162 58,216,005 957,187 463,000 4,041,527 15,486,000 135,982,566 1,934,530 153,403,096 239,167,313 333,675,756 5,322,330 21,566,000 189,371,046 28,230,267 60,384,835 793,727 27,941,000 245,349,921 4,065,603 463,000 15,477,000 135,861,782 190,460,760 22,228,887 233,781,647 343,677,333 5,815,709 21,092,000 27,929,000 252,198,870 63,549,463 1,302,209 450,000 4,063,500 14,581,000 141,471,044 195,697,760 22,644,311 238,393,071 349,422,118 5,881,309 20,051,000 26,962,000 263,149,120 59,310,998 1,254,509 430,000 4,196,800 19,924,000 26,882,000 267,502,782 91,592,770 1,231,655 14,825,000 141,295,899 198,263,724 12,483,751 230,671,475 385,977,552 10.5% 421,000 4,189,371 19,974,000 26,904,000 274,259,376 96,209,217 723,305 14,841,000 150,456,304 203,614,956 5,383,755 228,972,711 397,372,593 5,469,561 424,000 4,322,256 DISTRICT PRIMARY COST DISTRICT SECONDARY COST DISTRICT TERTIARY COST DISTRICT TOTAL SHARED COST % CHANGE IN SHARED COST % CHANGE IN SHARED COST % CHANGE IN SHARED COST % CHANGE IN SHARED COST DISTRICT PRIMARY COST DISTRICT SECONDARY COST DISTRICT TERTIARY COST DISTRICT TERTIARY COST DISTRICT PRIMARY COST DISTRICT SECONDARY COST DISTRICT TERTIARY COST DISTRICT TOTAL SHARED COST DISTRICT TOTAL SHARED COST DISTRICT TOTAL SHARED COST DISTRICT PRIMARY COST DISTRICT SECONDARY COST 0 0 0 0 0 0 0 144,896,258 146,424,686 148,974,960 151,338,782 156,052,044 156,120,899 5,842,026 165,297,304 1.8% 1.0% 2.7% 2.3% 3.8% 3.4% 2.1% 0.8% 0.4% 1.5% 1.0% 6.2% 1.1% -0.9% 1.3% -6.7% 1.7% -0.8% 2.5% -1.9% 3.0% 1.6% 1.6% -2.6% -1.3% -2.3% 3.0% 9.3% 3.1% 2.0% 1.7% 1.1% 0.0% -3.2% -0.7% 5.9% -0.7% 3.0% -6.4% 9,268 9,227 100.4% 109.9% 120.1% 116.3% 10,137 9,227 9,227 9,227 11,078 10,733 9,557 9,401 101.7% 111.5% 119.4% 115.9% 11,227 10,898 10,486 9,401 9,401 9,401 9,411 9,538 98.7% 111.8% 118.6% 128.8% 11,316 12,285 10,659 9,538 9,538 9,538 9,449 9,618 98.2% 111.6% 120.0% 124.0% 11,543 11,926 10,729 9,618 9,618 9,618 9,652 9,729 99.2% 110.8% 121.5% 121.2% 11,825 11,796 10,780 9,729 9,729 9,729 9,906 9,781 101.3% 113.4% 122.1% 117.5% 11,090 9,781 9,781 9,781 11,942 11,495 9,778 10,030 97.5% 110.5% 122.7% 128.9% 12,305 12,924 11,084 10,030 10,030 10,030 10,702 10,760 99.5% 110.5% 120.4% 127.1% 11,889 10,760 10,760 10,760 12,960 13,677 10,531 10,951 96.2% 105.7% 131.1% 126.7% 14,358 13,877 11,578 10,951 10,951 10,951 11,138 11,194 99.5% 102.4% 131.9% 115.2% 14,770 12,900 11,464 11,194 11,194 11,194 DISTRICT SHARED COST/MEMBER SECONDARY CEILING DISTRICT SHARED COST/MEMBER AS % OF SECONDARY CEILING AS % OF SECONDARY CEILING AS % OF SECONDARY CEILING AS % OF SECONDARY CEILING DISTRICT SHARED COST/MEMBER SECONDARY CEILING SECONDARY CEILING DISTRICT SHARED COST/MEMBER SECONDARY CEILING DISTRICT SHARED COST/MEMBER DISTRICT SHARED COST/MEMBER DISTRICT SHARED COST/MEMBER DISTRICT SHARED COST/MEMBER 2. 21,905,309,998 632,531,756 7,723,303,978 343,121 791,434 1,216,407 531,951 6,871,584,223 457,892 531,951 531,951 531,951 148.8% 228.7% 22,653,787,457 642,455,881 7,985,836,624 354,910 812,430 1,245,070 546,173 6,976,418,444 462,045 546,173 546,173 546,173 148.7% 228.0% 23,447,480,065 647,846,518 8,253,953,961 367,316 839,148 1,333,018 558,546 7,139,496,228 463,694 558,546 558,546 558,546 150.2% 238.7% 24,222,574,258 654,271,422 8,616,332,759 389,580 872,728 1,401,009 573,441 7,322,246,995 472,494 573,441 573,441 573,441 152.2% 244.3% 25,714,368,614 670,928,993 8,920,730,694 408,514 925,710 1,449,091 594,939 7,719,182,109 500,141 594,939 594,939 594,939 155.6% 243.6% 27,971,395,410 703,423,564 9,438,283,690 437,646 1,001,088 1,519,273 621,431 7,947,275,550 513,191 621,431 621,431 621,431 161.1% 244.5% 10,186,945,404 482,977 1,068,877 1,641,464 656,434 29,852,660,916 738,658,956 8,471,652,607 547,370 656,434 656,434 656,434 162.8% 250.1% 31,473,939,990 778,834,799 10,744,250,194 535,846 1,167,344 1,811,244 715,267 9,069,257,856 621,991 715,267 715,267 715,267 163.2% 253.2% 31,381,733,220 821,772,208 11,548,587,737 579,632 1,167,388 1,951,953 754,860 9,559,191,236 644,802 754,860 754,860 754,860 154.6% 258.6% 36,486,785,574 895,700,725 13,435,841,367 672,667 1,356,184 2,112,502 10,561,477,636 711,642 861,627 861,627 861,627 861,627 DISTRICT EQUALIZED VALUE DISTRICT EQ VALUE/MEMBER AVERAGE VALUE PER MEMBER DISTRICT EQUALIZED VALUE/MEM AS % OF STATE AVERAGE AS % OF STATE AVERAGE AS % OF STATE AVERAGE AS % OF STATE AVERAGE DISTRICT EQUALIZED VALUE DISTRICT EQ VALUE/MEMBER AVERAGE VALUE PER MEMBER DISTRICT EQUALIZED VALUE/MEM DISTRICT EQUALIZED VALUE/MEM DISTRICT EQUALIZED VALUE/MEM DISTRICT EQUALIZED VALUE DISTRICT EQ VALUE/MEMBER DISTRICT EQUALIZED VALUE DISTRICT EQ VALUE/MEMBER AVERAGE VALUE PER MEMBER AVERAGE VALUE PER MEMBER 3. 86.1% 64.5% 84.6% 65.0% 83.0% 65.8% 82.4% 67.9% 84.1% 68.7% 82.6% 70.4% 83.4% 73.6% 87.0% 74.9% 85.4% 76.8% 82.6% 78.1% 157.4% 245.2% 18,507,120 127,242,504 7,274,570 -24,986,793 -1,007,741 11,446,490 71,913,032 84,834 83,444,355 153,024,194 54,717,873 192,262 16,327,950 63,376,716 -467,113 192,262 18,363,094 128,124,983 8,548,460 -24,821,067 -988,330 11,484,171 73,639,373 362,325 85,485,870 155,036,537 52,804,114 183,120 16,146,139 61,479,042 -564,924 183,120 11,697,673 77,143,777 130,412,973 8,627,868 157,235,015 54,851,528 150,327 18,194,174 15,792,903 64,020,245 -24,961,619 -1,851,375 150,327 -673,253 11,702,983 78,201,544 127,315,429 7,878,932 152,846,780 48,590,217 127,998 17,652,418 15,204,305 61,272,566 -27,886,654 -1,555,506 127,998 -781,157 11,434,320 79,733,940 127,882,077 7,193,535 152,290,316 43,731,354 115,367 17,214,703 14,454,361 61,643,640 -32,366,647 -1,374,230 115,367 -676,629 16,675,546 127,051,115 8,348,948 -36,891,519 -1,146,774 11,368,137 83,507,581 336,951 95,212,669 152,075,610 37,214,148 98,531 13,447,927 60,657,740 -579,030 98,531 11,087,442 84,644,710 127,107,735 5,873,782 148,795,163 39,076,399 67,275 15,813,646 12,461,187 66,543,808 -39,928,596 -1,954,066 67,275 -530,255 9,881,813 85,342,066 128,807,845 5,680,201 148,971,945 40,370,709 26,458 14,483,899 10,654,162 67,203,421 -37,486,874 -1,922,235 26,458 -651,952 9,871,961 87,098,716 129,901,439 2,897,906 146,739,494 42,304,331 13,940,149 10,621,938 81,737,572 -50,055,178 -1,953,220 0 9,368,647 96,498,384 134,592,111 1,180,675 148,785,092 39,595,375 13,012,306 7,998,857 86,818,769 -55,222,252 -1,050,065 0 DISTRICT PRIMARY AID DISTRICT SECONDARY AID DISTRICT TERTIARY AID DISTRICT TOTAL EQUALIZATION AID DISTRICT TOTAL EQUALIZATION AID DISTRICT TOTAL EQUALIZATION AID DISTRICT TOTAL EQUALIZATION AID DISTRICT PRIMARY AID DISTRICT SECONDARY AID DISTRICT TERTIARY AID DISTRICT TERTIARY AID DISTRICT TERTIARY AID DISTRICT PRIMARY AID DISTRICT SECONDARY AID DISTRICT SECONDARY AID DISTRICT PRIMARY AID -675,136 -279,155 0 0 0 0 0 0 0 0 0 88,841,450 89,904,527 91,168,260 95,732,152 95,223,879 96,970,677 105,867,031 82.2% 68.7% 35.5% -48.8% -128.7% 59.0% 27.8% -10.9% 37.0% 76.3% 58.2% 13.9% 60.0% 67.1% 17.8% 3.4% 81.6% 67.8% 35.0% -48.7% -128.0% 57.9% 26.2% -13.0% 76.1% 58.1% 15.4% 59.2% 65.7% 16.9% 3.3% 35.5% 81.0% 68.0% 34.2% -50.2% -138.7% 56.5% 26.8% -16.2% 76.0% 59.6% 0.0% 61.3% 65.6% 17.3% 2.5% 30.9% 79.8% 66.8% 32.1% -52.2% -144.3% 54.8% 25.6% -19.4% 27.4% 75.5% 59.7% 0.0% 61.4% 64.4% 15.2% 2.3% 78.8% 67.1% 31.3% -55.6% -143.6% 52.0% 25.4% -16.7% 74.1% 59.7% 0.0% 61.2% 64.7% 13.3% 2.1% 24.9% 77.3% 67.1% 29.6% -61.1% -144.5% 48.1% 24.7% -14.2% 21.3% 73.4% 61.4% 17.4% 62.1% 63.6% 11.2% 1.9% 75.0% 66.7% 26.4% -62.8% -150.1% 44.6% 26.4% -13.0% 71.6% 62.3% 0.0% 63.3% 63.6% 11.4% 1.2% 14.9% 72.2% 65.8% 25.1% -63.2% -153.2% 39.5% 25.5% -15.5% 67.8% 60.3% 0.0% 61.0% 62.5% 11.6% 0.4% 6.2% 70.0% 65.5% 23.2% -54.6% -158.6% 39.5% 30.6% -16.1% 66.6% 61.6% 0.0% 62.1% 63.6% 11.0% 0.0% 0.0% 65.1% 66.1% 21.9% -57.4% -145.2% 63.1% 64.1% 0.0% 64.0% 65.0% 10.0% 0.0% 29.7% 31.7% -6.5% 0.0% PRIMARY TIER AID/COST RATIO SECOND TIER AID/COST RATIO TERTIARY TIER AID/COST RATIO TOTAL AID/COST RATIO TOTAL AID/COST RATIO TOTAL AID/COST RATIO TOTAL AID/COST RATIO PRIMARY TIER AID/COST RATIO SECOND TIER AID/COST RATIO SECOND TIER AID/COST RATIO PRIMARY TIER AID/COST RATIO SECOND TIER AID/COST RATIO TERTIARY TIER AID/COST RATIO TERTIARY TIER AID/COST RATIO TERTIARY TIER AID/COST RATIO PRIMARY TIER AID/COST RATIO 295,958 0 0 0 0 0 0 0 0 0 0 0 0 231,867 0 0 0 0 0 0 0 0 0 0 0 0 202,412 0 0 0 0 0 0 0 0 0 0 0 0 171,830 0 0 0 0 0 0 0 0 0 0 0 0 139,486 0 0 0 0 0 0 0 0 0 0 0 0 118,095 0 0 0 0 0 0 0 0 0 0 0 0 116,857 0 0 0 0 0 0 0 0 0 0 0 0 130,053 0 0 0 0 0 0 0 0 0 0 0 0 133,035 0 0 0 0 0 0 0 0 0 0 0 0 113,080 0 0 0 0 0 0 0 0 0 0 0 0 0 0 DISTRICT SPECIAL ADJUSTMENT AID DISTRICT INTER AID (CHAP 220) DISTRICT INTRA AID (CHAP 220) DISTRICT SPEC ADJ+CHAP 220 AID DISTRICT SPEC ADJ+CHAP 220 AID DISTRICT SPEC ADJ+CHAP 220 AID DISTRICT SPEC ADJ+CHAP 220 AID DISTRICT SPECIAL ADJUSTMENT AID DISTRICT INTER AID (CHAP 220) DISTRICT INTRA AID (CHAP 220) DISTRICT INTRA AID (CHAP 220) DISTRICT INTRA AID (CHAP 220) DISTRICT SPECIAL ADJUSTMENT AID DISTRICT INTER AID (CHAP 220) DISTRICT INTER AID (CHAP 220) DISTRICT SPECIAL ADJUSTMENT AID 512,027 512,027 295,958 498,046 498,046 231,867 384,021 384,021 202,412 320,017 320,017 171,830 256,014 256,014 139,486 192,010 192,010 118,095 128,007 128,007 116,857 64,003 64,003 130,053 6,295 6,295 133,035 113,080 26/3 DISTRICT GENERAL AID TOTAL % CHANGE IN GROSS GENERAL AID % CHANGE IN GROSS GENERAL AID % CHANGE IN GROSS GENERAL AID % CHANGE IN GROSS GENERAL AID DISTRICT GENERAL AID TOTAL DISTRICT GENERAL AID TOTAL DISTRICT GENERAL AID TOTAL 83,444,355 153,024,194 55,229,901 488,219 -15.0% 85,485,870 155,036,537 53,302,160 414,986 -15.0% 88,841,450 157,235,015 55,235,549 352,738 -15.0% 89,904,527 152,846,780 48,910,235 -11.5% -15.0% 299,828 91,168,260 152,290,316 43,987,368 -10.1% -15.0% 254,853 95,212,669 152,075,610 37,406,158 -15.0% -15.0% 216,625 95,732,152 148,795,163 39,204,406 184,132 -15.0% 148,971,945 40,434,712 156,512 95,223,879 -0.5% -15.0% 96,970,677 146,739,494 42,310,626 133,035 -15.0% 105,867,031 148,785,092 39,595,375 113,080 -15.0% 9.1% 2.9% 4.2% 2.4% 1.3% -3.5% 3.9% 1.4% 3.6% 1.2% -2.8% 1.4% -0.4% 4.4% -0.1% 0.5% -2.2% 4.8% 0.1% 3.1% 1.8% -1.5% 4.6% 9.2% 1.4% -6.4%

Final 2022-23 EQ Aid Source: Department of Public Instruction 27/3

Aid Worksheets How can I predict future aid amounts? SFS Home Current and historical July 1, October 15, and final aid worksheets (and final aid adjustments) Longitudinal Aid Data 29/3

Questions? DPI School Financial Services Team https://dpi.wi.gov/sfs dpifin@dpi.wi.gov 608-267-9114 Jennifer Buros, Assistant Director Ben Kopitzke, Finance Consultant 608-266-1966 608-267-9279 30/3