Understanding Alimony Agreements and Types

Dive into the complexities of alimony agreements, including the types and factors involved. Learn about traditional and newer forms of alimony, and explore possible modifications based on changing circumstances like income, expenses, and relationships.

Uploaded on | 2 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

6THHOUR: CLIENT VIDEO ALIMONY REFRESHER

THE AGREEMENT Husband will pay wife alimony in the amount of $2,500 a month beginning on May 1, 2020, with the payments to continue until the death of either party. Alimony payments will be reduced in the event of remarriage to $1,000 a month. Husband will make payments on the existing mortgage on the marital home, not including taxes and insurance, for a period of eight years ($2200 mortgage amount).

What kinds of alimony does the agreement create? Are they modifiable? Can Hunter modify or terminate alimony based on - his increased expenses and new family? - his decrease in income? - her increase in income? - her relationship with Will? ISSUES

THE ARMSTRONG FACTORS Should alimony be awarded, and if so, in what form and how much? Consider - length of the marriage - dissipation of assets - fault in the marriage breakup - tax consequences - age and health - any other relevant factor Is there a deficit? Consider the parties - incomes and expenses, assets and obligations - age, health, and earning capacities; - reasonable needs - standard of living of the marriage - need for childcare

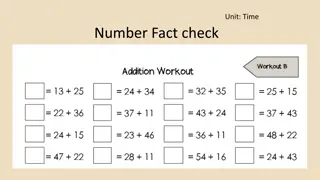

COMPARING INCOMES Child support recipient: Child support payor: $13,000 net income - $1,500 child support $4,500 net income $7,000 discrepancy $11,500/month

TRADITIONAL FORMS OF ALIMONY Permanent alimony - is ongoing - terminates at death of either - terminates at remarriage - can be modified based on a material change in circumstances Lump sum alimony - is a fixed amount - survives the death of either - survives remarriage - cannot be modified

NEWER FORMS OF ALIMONY Rehabilitative alimony Reimbursement alimony - is for a fixed term - is a fixed amount - terminates at death of either - survives the death of either - terminates at remarriage only if ordered or agreed - survives remarriage - cannot be modified - can be modified based on a material change in circumstances

THE AGREEMENT Husband will pay wife alimony in the amount of $2,500 a month beginning on May 1, 2020, with the payments to continue until the death of either party. Alimony payments will be reduced in the event of remarriage to $1,000 a month. Husband will make payments on the existing mortgage on the marital home, not including taxes and insurance, for a period of eight years ($2200 mortgage amount).

Courts can modify - permanent alimony - rehabilitative alimony - hybrid or 3d party payments classified as permanent or rehabilitative - agreed alimony - agreed escalation clauses - permanent to rehabilitative alimony - rehabilitative to permanent alimony WHAT CAN BE MODIFIED?

To modify alimony, a court must find a material change occurring since the last decree that was not foreseeable at that time. MODIFICATION TEST If the payor is seeking a reduction based on income loss, the income loss must have been involuntary. If these requirements are met, the court should compare the disparity between the parties ability to meet reasonable needs at the time of the last decree and currently.

1. Alimony cannot be awarded for the first time in a modification. 2. Permanent alimony may not be modified to lump sum. 3. Lump sum alimony may not be modified to permanent. 4. Arrearages prior to the filing of a modification petition may not be forgiven. 5. Out-of court modifications are not enforceable. LIMITS ON ALIMONY MODIFICATION

THE AGREEMENT Husband will pay wife alimony in the amount of $2,500 a month beginning on May 1, 2020, with the payments to continue until the death of either party. Alimony payments will be reduced in the event of remarriage to $1,000 a month. Husband will make payments on the existing mortgage on the marital home, not including taxes and insurance, for a period of eight years ($2200 mortgage amount).

COMPARING DISPARITY THEN AND NOW At divorce: H: $13,000 W: $0 income $2500 alimony $2200 mortgage Now: H: $10,000 ($13,000 imputed?) W: $4500 $70 from friend

Courts cannot order a party to maintain insurance for their spouse except to secure another financial award. INSURANCE TO SECURE ALIMONY AWARD The amount of court-ordered life insurance must be related to the size of the award and the amount likely to be in default. Parties can agree to provide insurance for their spouse unrelated to security for other awards.