Understanding Bond Notation and Terminology

Learn about bond notation and terminology for a 10-year bond with 8% semiannual coupons and a redemption value of $1200. Explore how the bond price is calculated, the yield, and the payment structure over the bond's term.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

SOA Exam FM Module 3 Section 4 Bond Notation and Terminology

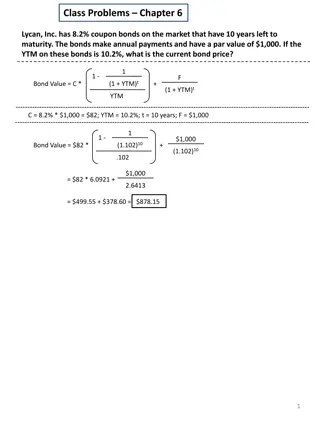

Bond Example You buy a 10-year 1000 face value bond with 8% semiannual coupons and a redemption value of 1200. The price of the bond is 1259.51 to yield 6% compounded semiannually.

Bond Example You buy a 10-year 1000 face value bond with 8% semiannual coupons and a redemption value of 1200. The price of the bond is 1259.51 to yield 6% compounded semiannually. ? = 1259.51 Paid Today

Bond Example You buy a 10-year 1000 face value bond with 8% semiannual coupons and a redemption value of 1200. The price of the bond is 1259.51 to yield 6% compounded semiannually. ? = 1259.51 Paid Today ? = 0.03 = seir(yield rate)

Bond Example You buy a 10-year 1000 face value bond with 8% semiannual coupons and a redemption value of 1200. The price of the bond is 1259.51 to yield 6% compounded semiannually. ? = 1259.51 Paid Today ? = 0.03 = seir(yield rate) ? = 1200

Bond Example You buy a 10-year 1000 face value bond with 8% semiannual coupons and a redemption value of 1200. The price of the bond is 1259.51 to yield 6% compounded semiannually. ? = 1259.51 Paid Today ? = 0.03 = seir(yield rate) Paid in 10 Years (when the bond matures) ? = 1200

Bond Example You buy a 10-year 1000 face value bond with 8% semiannual coupons and a redemption value of 1200. The price of the bond is 1259.51 to yield 6% compounded semiannually. ? = 1259.51 Paid Today ? = 0.03 = seir(yield rate) Paid in 10 Years ? = 1200 (when the bond matures) Coupons paid every 6 months for 10 years

Bond Example You buy a 10-year 1000 face value bond with 8% semiannual coupons and a redemption value of 1200. The price of the bond is 1259.51 to yield 6% compounded semiannually. ? = 1259.51 Paid Today ? = 0.03 = seir(yield rate) Paid in 10 Years ? = 1200 (when the bond matures) ? = 1000 0.08 Coupons paid every 6 months for 10 years 2= 40

Timeline You buy a 10-year 1000 face value bond with 8% semiannual coupons and a redemption value of 1200. The price of the bond is 1259.51 to yield 6% compounded semiannually. ? = 1259.51 Paid Today ? = 0.03 = seir(yield rate) Paid in 10 Years ? = 1200 (when the bond matures) ? = 1000 0.08 Coupons paid every 6 months for 10 years 2= 40 1200 40 40 40 1 20 2 ? = 1259.51

Notation and Terminology ? Price of the Bond ? Yield Rate (as a Periodic Effective Interest Rate)

Notation and Terminology ? Price of the Bond ? Yield Rate (as a Periodic Effective Interest Rate) ? Redemption Value

Notation and Terminology ? Price of the Bond ? Yield Rate (as a Periodic Effective Interest Rate) ? Redemption Value ? Face Value (or Par Value) ? Coupon Rate (as a Periodic Effective Interest Rate)

Notation and Terminology You buy a 10-year 1000 face value bond with 8% semiannual coupons and a redemption value of 1200. The price of the bond is 1259.51 to yield 6% compounded semiannually. ? = 1259.51 ? = 0.03 = seir ? = 1200 ? =0.08 2= 0.04 ? = 1000

Notation and Terminology ? Price of the Bond ? Yield Rate (as a Periodic Effective Interest Rate) ? Redemption Value ? Face Value (or Par Value) ? Coupon Rate (as a Periodic Effective Interest Rate) ? Coupon Payment (? = ? ?)

Notation and Terminology You buy a 10-year 1000 face value bond with 8% semiannual coupons and a redemption value of 1200. The price of the bond is 1259.51 to yield 6% compounded semiannually. ? = 1259.51 ? = 0.03 = seir ? = 1200 ? =0.08 2= 0.04 ? = 1000 ? = ? ? = 40

Notation and Terminology ? Price of the Bond ? Yield Rate (as a Periodic Effective Interest Rate) ? Redemption Value ? Face Value (or Par Value) ? Coupon Rate (as a Periodic Effective Interest Rate) ? Coupon Payment (? = ? ?) ?? Amount of Interest Earned with the ?th Coupon

Notation and Terminology ? Price of the Bond ? Yield Rate (as a Periodic Effective Interest Rate) ? Redemption Value ? Face Value (or Par Value) ? Coupon Rate (as a Periodic Effective Interest Rate) ? Coupon Payment (? = ? ?) ?? Amount of Interest Earned with the ?th Coupon ?? Amount of Principal Adjustment with the ?th Coupon

Notation and Terminology ? Price of the Bond ? Yield Rate (as a Periodic Effective Interest Rate) ? Redemption Value ? Face Value (or Par Value) ? Coupon Rate (as a Periodic Effective Interest Rate) ? Coupon Payment (? = ? ?) ?? Amount of Interest Earned with the ?th Coupon ?? Amount of Principal Adjustment with the ?th Coupon ? = ??+ ??

Notation and Terminology ? Price of the Bond ? Yield Rate (as a Periodic Effective Interest Rate) ? Redemption Value ? Face Value (or Par Value) ? Coupon Rate (as a Periodic Effective Interest Rate) ? Coupon Payment (? = ? ?) ?? Amount of Interest Earned with the ?th Coupon ?? Amount of Principal Adjustment with the ?th Coupon ? = ??+ ?? ?? Book Value (Amortized Value) Immediately After the ?th Coupon

Timeline ? ? ? ? ?= Price

Timeline ? ? ? ??= book value just ????? ?th coupon ?= Price

Timeline ? ? ? ? ?= Price = ?0

Timeline ? ? ? ? ?= Price = ?0 ??

Timeline ? ? ? ? ?= Price = ?0 ?? = ?

Timeline ? ? ? ? ?= Price = ?0 ?? = ? The last coupon is paid at time ? The redemption value is paid at time ?+

Timeline ? ? ? ??= book value just ????? ?th coupon ?= Price

Timeline ? ? ? ??= book value just ????? ?th coupon ?= Price ??? book value just ?????? ?th payment = ??

Timeline ? ? ? ??= book value just ????? ?th coupon ?= Price ??? book value just ?????? ?th payment = ?? ??? ? = ?? ??

Timeline ? ? ? ??= book value just ????? ?th coupon ?= Price ??? book value just ?????? ?th payment = ?? ??? ? = ?? ???= ??+ ? ?? ??

Timeline ? ? ? ??= book value just ????? ?th coupon ?= Price

Timeline ? ? ? ? ??= book value just ????? ?th coupon ?= Price

Timeline ? ? ? ? ??= book value just ????? ?th coupon ?= Price ?? 1= book value just ????? (? 1)?t coupon

Timeline ? ? ? ? ??= book value just ????? ?th coupon ?= Price ?? 1= book value just ????? (? 1)?t coupon ???= ?? 1 1 + ? ??

Timeline ? ? ? ? ??= book value just ????? ?th coupon ?= Price ?? 1= book value just ????? (? 1)?t coupon ???= ?? 1 1 + ? ?? ???= ??+ ? ??