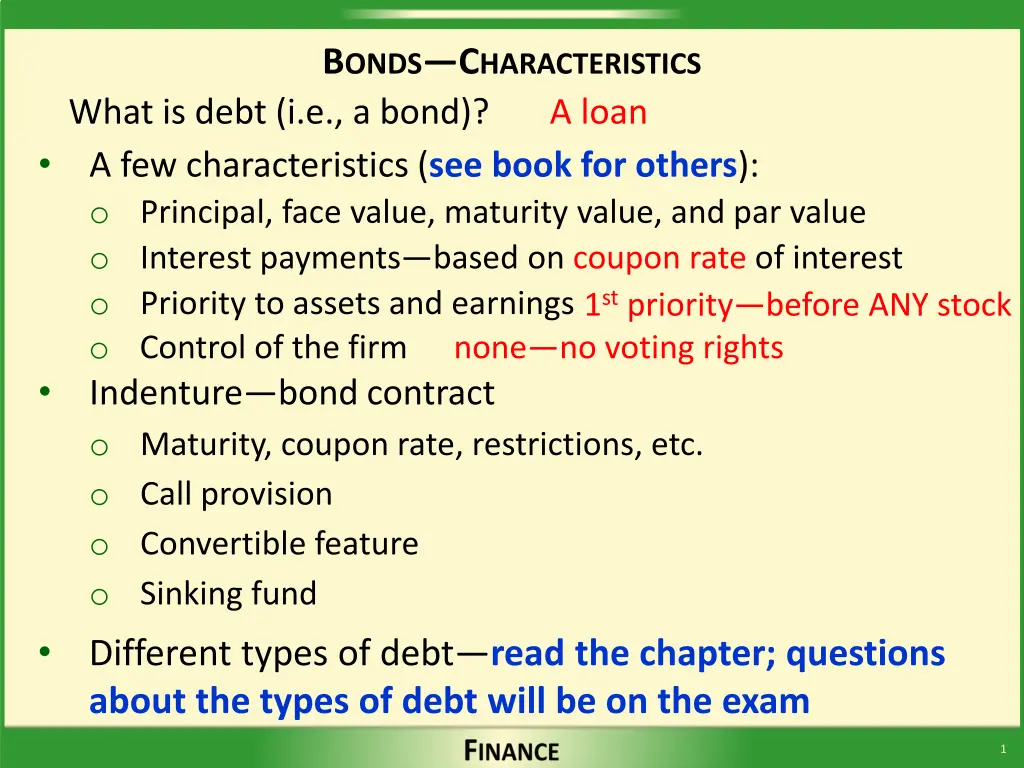

Understanding Bonds Characteristics and Valuation Models

Explore the key characteristics of bonds, including debt structure, ratings, and valuation models. Learn about different types of debt, bond ratings, and how to value bonds based on market rates and coupon payments.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

BONDSCHARACTERISTICS A loan What is debt (i.e., a bond)? A few characteristics (see book for others): o Principal, face value, maturity value, and par value o Interest payments based on coupon rate of interest o Priority to assets and earnings none no voting rights Indenture bond contract o Maturity, coupon rate, restrictions, etc. o Call provision o Convertible feature o Sinking fund 1st priority before ANY stock o Control of the firm Different types of debt read the chapter; questions about the types of debt will be on the exam 1

BONDSRATINGS Importance: Indication of default risk. Ratings changes affect a firm s ability to borrow and the cost of borrowing. Institutional investors are restricted to securities rated investment-grade or higher. 2

BONDSRATINGS Moody s S&P Aaa AAA High quality Aa AA Investment grade A A Baa BBB Ba Ba BB BB Substandard Junk Bonds B B B B Caa CCC Caa CCC Speculative C D C D 3

BONDSVALUATION Basic Valuation Model value of any asset Asset CF CF CF 1 2 n = + + + 1 2 n Value + + + 1 ( ) r 1 ( ) r 1 ( ) r n CF = t t = t + 1 ( ) r 1 CFt = expected cash flow Period in t r = required rate of return 4

BONDSVALUATION 1 N 0 2 3 rd INT INT INT INT PV of INT PV of M Bond Value = Vd M Lump-Sum Annuity 5

VALUATIONOF BONDSEXAMPLE Bond Characteristics: Face (maturity) value, M Coupon rate of interest, C Annual interest payment, INT Years to maturity, N Market rate, rd Market rate when bond was issued does not change $1,000 5% $50 = $1,000 x 0.05 8 6% Current market rate Should the bond be selling at a premium, at par, or at a discount? The bond s market value must change so the bond sells at a price that yields rd. In this example, rd = 6%. 6

VALUATIONOF BONDSEXAMPLE Bond Characteristics: Face (maturity) value, M Coupon rate of interest, C Annual interest payment, INT Years to maturity, N Market rate, rd $1,000 5% $50 = $1,000 x 0.05 8 6% 8 x 1 50/1 1,000 6/1 ? PMT N I/Y PV FV -937.90 7

VALUATIONOF BONDSEXAMPLE Existing (Old) Bond Characteristics: Annual interest payment, INT Years to maturity, N Market rate, rd The coupon rate on a NEW BOND issued today will equal the current market rate, which is 6 percent, such that the interest paid on a new bond will be $60 per year. Would you pay $1,000 to buy the old bond that pays $50 annual interest when you can buy a new bond for $1,000 that pays $60 annual interest? Any investor who buys the old bond is paid $10 per year less interest compared to a new bond. How much is the $10 difference worth today if the opportunity cost (market) rate is 6 percent? $50 CNew = 6% INTNew = $60 8 6% Absolutely NOT! 8

VALUATIONOF BONDSEXAMPLE INTNew INTOld = $60 $50 Years to maturity, N Market rate, rd Compute the PV of the $10 difference in annual interest payments. The PV represents the appropriate price adjustment to the market value of the old bond. $10 8 6% 8 10 0 6 ? PMT N I/Y PV FV -62.10 The market value of the old bond should be: Vold = $1,000 - $62.10 = $937.90 Investors who pay $937.90 for the old bond on average will earn 6 percent interest per year, which is the market yield. 9

VALUATIONOF BONDSSEMIANNUAL INTEREST PAYMENTS Most bonds pay interest semiannually Adjustments to computations: 1. N = # years x m = number of remaining interest payments m = # of interest payments per year 2. r = rd/m = 6-month market rate of return (yield)= rPER 3. INT = interest payment per period = (Annual INT)/m Example: M = $1,000, Years to maturity = 8, rd = 6%; C = 5% (paid semiannually), 16=8x2 25=50/2 25=50/2 1,000 3=6/2 ? PMT N I/Y PV FV -937.19 10

BOND YIELDS A bond s yield is the average return investors earn (demand) on their investment in the bond. Yield to maturity YTM = average annual return from the current period to maturity Yield to call YTC = average annual return from the current period to the first call date 11

BOND VALUATIONYIELDTO MATURITY, rd 1 - 1 1 N + (1 r ) r rd = YTM = + V INT M d d N + (1 r ) d d Bond Characteristics: Face (maturity) value, M Annual interest payment, INT Years to maturity, N Market price, Vd $1,000 $60 10 $964 1 1 - Solve for rd using trial-and- error method 1 10 (1 + r ) r 964= 60 +1,000 d 10 (1 + r ) d d 12

BOND VALUATIONYIELDTO MATURITY, rd Bond Characteristics: Face (maturity) value, M Annual interest payment, INT Years to maturity, N Market price, Vd $1,000 $60 10 $964 10 x 1 ? -964 60/1 1,000 PMT N I/Y 6.5 PV FV 13

BOND VALUATIONYIELDTO CALL Bond Characteristics: Face (maturity) value, M Call price Annual interest payment, INT Years to maturity, N Years to first call date Market price, Vd $1,000 $1,060 $60 10 5 $964 5 x 1 ? -964 60/1 1,060 PMT N I/Y 7.9 PV FV 14

VALUATIONRELATIONSHIP BETWEEN PRICESAND YIELDS Whenever the going rate of interest, rd, equals the coupon rate, a bond will sell at its par value An increase (decrease) in interest rates will cause the price of an outstanding bond to fall (rise). The market value of a bond will always approach its par value as its maturity date approaches, provided the firm does not go bankrupt. Long-term bonds are affected more than short- term by a change in interest rates. 15

VALUATIONRELATIONSHIP BETWEEN PRICESAND MATURITY Both Bond S and Bond L have the following characteristics: M = $1,000 INT = $50 (annual) rd = 5% Currently, VS = VL = $1,000 Suppose rd increases to 7 percent later today. VS = $918 VL = $752 % = -24.8% Bond S matures in 5 years Bond L matures in 30 years % = -8.2% 16

VALUATIONRELATIONSHIPOF YTM, COUPON, AND PRICE Example: N = 10 yrs; C = 6%; M = 1,000 Market Price, Vd Vd = M par Relationship of rates If rd = Vd = Market rate, rd = Coupon rate, C 6% 1,000.00 Vd < M discount Market rate, rd > Coupon rate, C 8% 865.80 Vd > M premium Market rate, rd < Coupon rate, C 4% 1,162.22 17

BOND VALUATIONINTEREST-RATE RISK When market rates change, bondholders are affected in two ways: o bond prices change in an opposite direction price risk o the returns investors earn change reinvestment risk Rate, rd 4% Value, Vd $1,162.22 Bond Characteristics: M = $1,000.00 INT = $60.00 N= 10 yrs Annual Interest 6 1,000.00 8 865.80 10 754.22 12 660.99 18

BOND VALUATIONRETURNON INVESTMENT Return on investment Capital gains yield Income yield = + INT Vd1 Vd0 Vd0 rd = + Vd0 Yield to Maturity Capital gains yield Current yield = + 19

BOND VALUATIONRETURN & CHANGEIN VALUE OVER TIME constant Bond Characteristics: M = $1,000.00, INT = $60.00, rd = 8% Years to Maturity End of Year Value, Vd 920.15 Capital Gain = (Vd1-Vd0)/Vd0 Current Yield = INT/Vd0 Total Return 5 933.76 1.48% 6.52% 8.00% 4 948.46 1.57 = 6.43 933.76 920.15 920.15 8.00% 0.0148 = Capital gain 3 V V = d1 d0 V 2 964.33 1.67 6.33 8.00% d0 1 981.48 1.78 6.22 0.0652 = 8.00% Current yield INT V 60.00 920.15 = = 0 1,000.00 1.89 6.11 8.00% d0 20

BOND VALUATIONRETURN & CHANGEIN VALUE OVER TIME INT = $60 (C = 6%) N = 5 yrs Market Value ($), Vd 1,100.00 1,089.04 if rd = 4% < C = 6% Premium bond, Vd > M 1,050.00 Par bond, Vd = M; rd = C = 6% M = 1,000 1,000.00 950.00 Discount bond, Vd < M 900.00 920.15 if rd = 8% > C = 6% 850.00 Years to Maturity 800.00 5 3 2 1 0 4 Assumes rddoes not change during the remainder of the bond s life. 21

BOND VALUATIONRETURN & CHANGEIN VALUE OVER TIME Bond Characteristics: M = $1,000.00, INT = $60.00 Maturity rd Vd Vd $1,100 5 8% $920.15 $1,050 4 6 1,000.00 $1,000 3 4 1,055.50 $950 2 7 981.92 $900 1 8 981.48 $850 5 4 3 2 1 0 0 1,000.00 Maturity 22

CHAPTER 6 QUESTIONS 1. What is debt? What are some of the characteristics of debt? 2. What information do bond ratings provide? Why are these ratings important? 3. How are bond prices determined? 4. How are bond yields determined? 5. What is the relationship between bond prices and (a) market rates and (b) time to maturity? i. If market rates rise after a bond is issued, what will happen to the bond s price and to its YTM? ii. Does the length of time to maturity affect the extent to which a given change in interest rates affects a bond s price? 23