Understanding Capital Assets and Thresholds in Financial Reporting

Learn about capital assets, their definitions, and the capitalization thresholds set by board policies for financial reporting purposes. Gain insights on different classes of assets and their treatment in accounting practices to enhance your knowledge in managing fixed assets effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

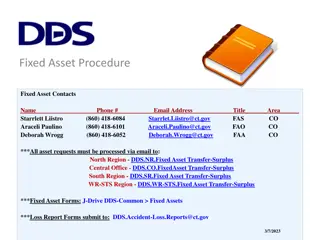

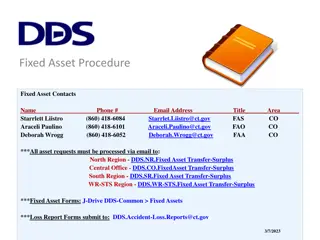

Fun with Fixed Assets! 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Introductions Tera Wagner, Moderator - Director of Finance, Consolidated High School District 230 Elizabeth Shields, Speaker - Business Manager/CSBO, Morris Community High School District 101 Betsy Allen, Speaker - Audit Principal, Miller, Cooper & Co., Ltd. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Raise your hand if you are coding purchases to Objects 300, 400, 500 or 700? Raise your hand if you have never heard of Object 700? Raise your hand if you know your District s capital asset threshold? 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Definition Assets that are used in operations and that have initial lives extending beyond a single reporting period (GASB Statement No. 34, Paragraph 19). Assets are recorded at estimated or historical cost and depreciated/amortized (leases) over their life. Expenditures that are normal maintenance and repairs, that do not add value or materially extend the life of the asset are not capitalized. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Definition Capital Assets may be either: Intangible (easements, water rights, licenses, leases) or Tangible (land, buildings, building improvements, vehicles, machinery, equipment and infrastructure) 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Capitalization Threshold Board Policy PRESS 4:80 Capitalization Threshold: To be considered a capital asset for financial reporting purposes, a capital item must be at or above a capitalization threshold of $5,000 and have an estimated useful life greater than one year. ISBE policy for threshold (Section 18-3 - School Code) $500 minimum value for purposes of calculating per capita cost Capitalization Threshold is set by the Board policy and can be changed with Board approval. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Capitalization Threshold May establish a single capitalization threshold for all capital assets or May establish different capitalization thresholds for different classes of assets 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Capitalization Threshold Capitalization Threshold should not be the only factor used when determining if an item should be capitalized. Should be cognizant of whether similar items are capitalized in order to be consistent in reporting (see example on next slide) 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Capitalization Threshold Assume a government, with a capitalization threshold of $10,000, purchases two pieces of similar equipment. Item A was purchased three years ago for $11,000, and item B was purchased in the current year for $9,000. The government also incurred its own direct costs (time spent by construction worker, architects and engineers on that project) and indirect costs (allocated costs of the capital improvements department of public works) for both items, which increased the values of the items to $13,000 for item A and $11,000 for item B. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Capitalization Threshold Without the inclusion of the government s own costs, item B would not have been capitalized, while other similar items would be capitalized because they were purchased at a higher price. In this case, the government may choose to capitalize item B for the sake of consistent treatment. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets What is the Cost? Capital Assets should be reported at historical or estimated historical cost. Donated capital assets should be reported at their estimated fair value at the time of acquisition plus ancillary charges, if any. Cost should include ancillary charges necessary to place the asset into its intended location or condition for use. Ancillary charges include: Costs that are directly attributable to asset acquisition Freight and transportation costs Site preparation costs Professional fees 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets What is the Cost? The cost of a capital asset is the total amount paid to put the asset into service. Tearing down a building Installation costs Delivery fees Software integral to its function Professional Fees Asbestos removal 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Equipment Example District 123 purchases 158 new Flat Panel Monitors to install in all buildings. The capitalization threshold is $3,000. The old monitors are fully depreciated and will be removed from the listing. Flat panel monitors are expected to last for 5 years. Invoices for the project are as follows: De-installation of old monitors $59,601.47 Lift-gate surcharges $2,250.00 Flat Panel Monitors $307,942.00 Balance Boxes $125,926.00 Software Interface $11,060 Cables & hardware $23,115.40 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Equipment Example District 123 purchases 158 new Flat Panel Monitors to install in all buildings. Invoices for the project are as follows: De-installation of old monitors $59,601.47 Lift-gate surcharges $2,250.00 Flat Panel Monitors $307,942.00 Balance Boxes $125,926.00 Software Interface $11,060 Cables & hardware $23,115.40 Yes Yes All items pertain to installing the new flat panel monitors and therefore they are ALL included in the capitalized cost. Yes Yes Yes Yes Total cost to be capitalized: $529,894.87 Divided by 158 flat panel monitors. $3,353.77 per monitor Capitalization threshold = $3,000 per item Decision: Capitalize at $3,353.77 per monitor over a period of 5 years. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Construction Example District 123 is beginning a large construction project to upgrade the HVAC system in one of its buildings. The building is 75 years old with a life of 80 years. Architects began drafting the specifications and seeking out bids in February. Work is expected to take place over the summer as the building will need to be closed in order to complete the asbestos abatement. Yes, this project will increase the life of the building and will be more than $3,000. Yes, but the amount is immaterial since the building is almost fully depreciated. If it was not, an estimate would need to be made on how much of the building s original cost to allocate. Is this a capital project? Is there an asset to be removed from the list? 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Construction Example What components should be included in the cost? Architect/Professional fees beginning with the first charge (even if they are in Object 300) Asbestos Abatement Construction Pay Applications Any other incidental costs such as new ceiling tiles, light bulbs, outlets, etc. When should it be capitalized? At June 30, any work completed pertaining to any of the included costs should be capitalized as Construction in Progress and NOT depreciated. Once the final pay application has been approved by the architects, signaling the project has cleared all punch list items, the date can be completed and the asset can begin being depreciated. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Construction Example After 5 years, the same building has two doors that are inefficient. The building is now fully depreciated. One door is a standard size and can be purchased and replaced for $3,000. The other door is a utility door with a customized width and will cost $10,000 to replace. Is this a capitalizable project? No. Neither door will materially extend the life of the asset and should be considered part of the normal maintenance and repairs on the building. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Future Item to Consider Governmental Accounting Standards Board (GASB) issued Implementation Guide No. 2021-1 Implementation guides are questions and answers that are intended to clarify, explain, or elaborate on GASB Statements 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Future Item to Consider Question 5.1 (effective for periods beginning after June 15, 2023): Should a government s capitalization policy be applied only to individual assets or can it be applied to a group of assets acquired together? Consider a government that has established a capitalization threshold of $5,000 for equipment. If the government purchased 100 computers costing $1,500 each, should the computers be capitalized? 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Future Item to Consider Original Implementation Guide 2015-1 It may be appropriate for a government to establish a capitalization policy that would require capitalization of certain types of assets where individual acquisition costs are less than the threshold for an individual asset. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Future Item to Consider Amended Implementation Guide 2021-1 A governmental should capitalize assets where individual acquisition costs are less than the threshold for an individual asset if those assets in the aggregate are significant. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Capital Assets Future Item to Consider Conclusion from example If the $150,000 aggregate amount (100 computers costing $1,500 each) is significant, the government should capitalize the computers. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

ISBE Coding Administrative Code 23 Illinois Administrative Code 100 Title 23: Education and Cultural Resources Subtitle A: Education Chapter I: State Board of Education Subchapter c: Finance Part 100 Requirements for Accounting, Budgeting, Financial Reporting and Auditing 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

ISBE Coding Object 500 Capital Outlay Expenditures for fixed assets or additions to fixed assets land, buildings, improvements, remodeling, equipment 510 Works of Art and Historical Treasurers 520 Land 530 Building and Improvements 540 Site Improvements and Infrastructure 550 Capitalized Equipment 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

ISBE Coding Object 700 Used for capital assets over $500, but under the District s Board approved capitalization threshold Covers a large range of items such as instruments and technology What does this mean ??? 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

ISBE Coding Object 700 Example District 123 is refreshing their supply of clarinets. Each clarinet is $1,140 with free shipping and is expected to last 7-10 years. The District will be purchasing 10 clarinets total. Meets all requirements for a capital asset, but does not meet the $3,000 capitalization threshold established in the board policy. BUT, we also learned that ISBE uses the threshold of $500 for their per capita calculation. We should use Object 700 Noncapitalized Equipment! ISBE created this object specifically for these circumstances. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

ISBE Coding Supplies and Materials vs. Noncapitalized Equipment vs. Capital Assets Less than $500 $500 to $3,000 Over $3,000 Object 400 Supplies & Materials Object 700 Noncapitalized Equipment Object 500 Capital Outlay 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Mini Break: Stand up if youre able. Sit down if your district does NOT use an appraisal company. Sit down if you are NOT in charge of sending in the additions and deletions. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Tracking Assets & Depreciation/Amortization Purposes for tracking Financial Reporting (audit) Insurance Multiple ways to track Financial reporting software fixed asset module Excel Appraisal Company Spoiler Alert! Pros and Cons with all methods 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Tracking Assets & Depreciation/Amortization Financial Software Cons Pros Might have more asset line items than necessary Two payments for one asset Might have to manually add architect fees coded to Object 300 Might miss leases or intangible assets Defined parameters to identify the asset from A/P input Within one system = fewer errors 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Tracking Assets & Depreciation/Amortization Excel Pros Cons Can completely control what gets added and when Ex. Construction in Progress Can only add assets that are for the financial reporting process Cumbersome Separate entry could create errors in spreadsheet Easy to over-depreciate Might miss items that should be insured 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Tracking Assets & Depreciation/Amortization Appraisal Company Pros Cons If you re having a full inventory (for insurance purposes), company can also provide report excluding items that are under your capitalization threshold (GASB 34 financial accounting purposes) You control what they receive via additions and deletions Construction in progress is not included on this report Certain Intangible assets are not included No insurance necessary for intangible assets 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Tracking Assets & Depreciation/Amortization Other Items for consideration Items purchased with grant dollars Must record the source and percentage paid by the grant Ex. Copy machine for Student Services might be 50% IDEA-CEIS and 50% local ISBE will expect this data to be in your capital asset listing documentation Have an ID number Disposition data Date, sale price 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Best Practices - Reminders Guidelines for capitalization thresholds (GFOA recommendations): Establish minimum cost and useful-life based on thresholds to avoid the cost of capitalizing immaterial items; Establish a minimum capitalization threshold of $5,000 for any individual item; Establish a minimum capitalization threshold of at least a two-year useful life for any individual item; Consider establishing different dollar capitalization thresholds for different classes of capital assets; 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Best Practices - Reminders Guidelines for capitalization thresholds (GFOA recommendations): Governments should exercise control over potentially capitalizable items that fall under the operative capitalization threshold, but require special attention; Governments should perform a periodic review of their capitalization threshold. 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Questions and Answers We thank you for your time! 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois

Presenters: MODERATOR INFO: Tera Wagner, Director of Finance; Consolidated High School Dist. 230 (708) 745-5228; twagner@d230.org PRESENTER INFO: Elizabeth Shields, Business Manager/CSBO; Morris CHSD 101 (815) 941-5426; eshields@morrishs.org Betsy Allen, Principal; Miller Cooper & Co. Ltd. (847) 205-5000; ballen@millercooper.com 2023 BOOKKEEPERS CONFERENCE March 10, 2023 | Rolling Meadows, Illinois