Understanding Different Types of Savings Accounts

Explore the various types of savings accounts including short-term and mid-range options like high yield savings accounts, money market accounts, and certificate of deposit accounts. Learn about their benefits, features, and considerations to help you choose the right savings account for your financial goals.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Money Matters Topic 3 Types of Savings Accounts

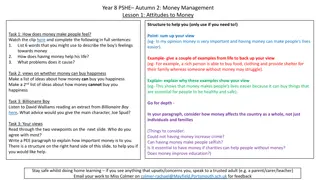

Savings Accounts These are used to hold spare money or back-up funds . Some can be linked to checking accounts or have automatic deposits and withdrawals. They can be categorized as either short-term savings accounts or medium range savings accounts.

Short Term Savings Usually used to store money that can be easily transferred to checking account when needed. Usually have fewer transactions than checking accounts. They typically earn a small amount of interest. Some require a minimum number of transactions to remain open. Often come from same institution as checking account. They should be FDIC insured.

Mid-Range Savings Accounts A few common types include High Yield Savings Account, Money Market Accounts, and Certificate of Deposit Accounts

High Yield Savings Account A form of savings account (mid range) that offers higher interest than traditional savings. Usually have relatively high minimum balance Interest may be compounded daily Interest rates change frequently May limit number of monthly or annual transactions Money is always accessible Many are online accounts only and do not have a local branch Should be FDIC insured.

Money Market Account A form of mid-range savings account. Money gains interest, and rates are usually based on prime interest rates. Accounts are usually federally insured by either FDIC or National Credit Union Association (NCUA-government backed, like FDIC). May limit the number of monthly transactions. They are not supposed to replace checking accounts. They usually are different from retirement accounts, though could be used to safeguard money once retirement is reached.

CD Account (Certificate Of Deposit) A safe way to save money at a better interest rate than a traditional, short-term savings account. Usually a set amount of time at a fixed interest rate. There are penalties for withdrawing money before the end of the term, so not the same as a savings account. FDIC insured. They usually are different from retirement accounts, though could be used to safeguard money once retirement is reached.

Where to open checking or savings accounts Banks, Credit Unions, and possibly investment firms-No fee options recommended. Credit Unions are similar in function to banks, but operate as non-profit institutions. So they usually are a bit cheaper with fees because they have fewer buildings, management fees, and lower operating costs.