Understanding Hire Purchase and Installment System

Explore the features, differences, key terms, journal entries, and repossession in the context of Hire Purchase and Installment System. Learn about payment methods, ownership transfer, interest, and more in this detailed guide.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

HIRE PURCHASE AND INSTALLMENT SYSTEM

Features of Hire Purchase Payment in installments Interest is charged by the seller Down payment Property in the goods is transferred only on payment of last installment

Difference between Sale & Hire Purchase Transfer of ownership Payment of price Interest Repossession Right of resale Treatment of installments paid so far Governing Acts Risk of Goods

Key Terms Hire Purchase Cash price Hire Purchase Price Interest Down Payment Repossession of Goods Full - Partial Methods of Depreciation Straight Line Method / Fixed Installment Method Reducing / Diminishing Balance Method / Written Down Value Method

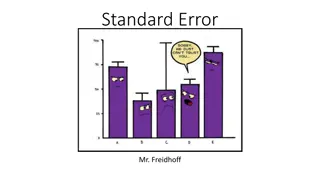

Hire Purchase Journal Entries IN THE BOOKS OF HIRE PURCHASER First Year 6 entries 1. Purchase of asset 2. Down payment 3. Interest for the year 4. Payment of installment 5. Depreciation 6. Transfer Entry No 1 & 2 First Day Entry No. 3 to 6 Last day of the year 2 nd year onwards

Hire Purchase Journal Entries IN THE BOOKS OF HIRE VENDOR First Year 5 entries 1. Sale of goods 2. Down payment 3. Interest for the year 4. Receipt of installment 5. Transfer Entry No 1 & 2 First Day Entry No. 3 to 5 Last day of the year 2 nd year onwards

Repossession -Special Right with hire vendor Complete end of relationship Asset A/c & H. V. Account - should become zero Complete / Total Relationship continues Asset A/c and H. V. Account do not become zero Partial

Complete Repossession Transfer HV A/c to Asset A/c Transfer Asset A/c to P & L Account H. V. A/c Dr To Asset A/c Profit & Loss A/c Dr. (Loss) To Asset A/c

Installment System Sale only Price paid in installment Interest Transfer of ownership Immediate Repossession Right of resale Treatment of installments paid adjusted against the price

Journal Entries In the books of Purchase Sr. No. Transaction Journal Entry 1 Purchase of Assets Assets A/c Dr. Interest Suspense A/c Dr. To Vendor A/c 2 Down payment Vendor A/c Dr. To Cash / Bank 3 Interest for the year Interest A/c Dr. To Interest Suspense A/c 4 Payment of installment Vendor A/c Dr. To Cash / Bank 5 Depreciation Depreciation A/c Dr. To Assets A/c 6 Transfer Profit & Loss A/c Dr. To Interest A/c To Depreciation

Ledger Account Books of Purchaser Every Year === Carry forward a) Assets A/c b) Vendor A/c c) Interest Suspense A/c

Journal Entries In the books of Vendor Sr. No. Transaction Journal Entry 1 Sale of Goods Purchaser A/c Dr. To Sales A/c To Interest Suspense A/c Dr. 2 Down payment Cash / Bank A/c Dr. To Purchase A/c 3 Interest for the year Interest Suspense A/c Dr. To Interest A/c 4 Payment of Installment Cash / Bank A/c Dr. To Purchase A/c 5 Depreciation NO ENTRY 6 Transfer Interest A/c Dr. To Profit & Loss A/c 7 Transfer of Sale Sales A/c Dr. To Trading A/c

Ledger Account Books of Vendor Every Year === Carry forward a) Purchaser A/c b) Interest Suspense A/c