Understanding Industry Life Cycle Stages: Pioneering, Expansion, Maturity, Decline

Learn about the stages of the industry life cycle - Pioneering, Expansion, Maturity, and Decline - according to Julius Grodinsky's theory. Discover the characteristics of each stage and their implications for investors. Explore how industries evolve from rapid growth to stabilization and eventual decline, impacting investment opportunities.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

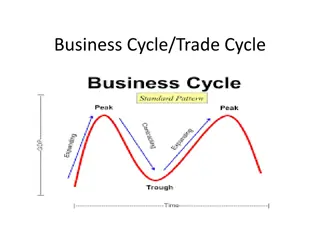

Industry Life Cycle According to Julius Grodinsky industry life cycle theory-the life of an industry can be segregated into the- Pioneering Stage Expansion Stage Stagnation Stage Decay Stage

Introduction stage/ Pioneering Stage: This is the first stage in the industrial life cycle of a new industry where the technology as well as the product are relatively new and have not reached a state of perfection. The pioneering stage is characterized by rapid growth in demand for the output of industry. As a result, there is a great opportunity for profit & highly risk. It s also called sunrises industries. For example, a leasing industry Computer Software & information technology etc.

Growth stage /Expansion Stage: This is second stage of expansion or growth and survived the pioneering stage. The stage of an industry are quite attractive for investment purposes. Investors cab get high returns at low risk because demand exceeds supply in the this stage. Companies will earn increasing amounts of profits and pay attractive dividends.

Maturity stage/Stagnation Stage: This is the third stage in the industry life cycle. In this stage, the growth of the industry stabilizes. The ability of the industry to grow appears to have been lost. sales may be increasing but at a slower rate than that experienced by competitive industries or by the overall economy. For example, Desktop PC Computers.

Decline stage/ Decay Stage: From the stagnation sage the industry passes to the decay stage. This occurs when the products of the industry are no longer in demand. New products and new technologies have come to the market. Customers have change their habits, style and liking. As a result, the industry becomes obsolete and gradually ceases to exist. Thus, changes in social habits, changes in technology and declining demand are the causes of decay of an industry.

The industry life cycle approach has important implications for the investor. It gives an insight into the apparent of investment in given industry a t a given time. In fact, each development stage is unique and exhibits different characteristic

Outcome of FUNDAMENTAL ANALYSIS The end goal of performing fundamental analysis is to produce a value that an investor can compare with the underlying assets current price in hopes of figuring out what sort of position to take with that security(under priced = buy, overpriced = sell). Valuation of Stock The intrinsic value of a share is the present value of all future cash flows INTRINSIC VALUE = DIVIDENDS + CAPITAL APPRECIATION Investment decision: 1. If the market price of a share is currently lower than its intrinsic value, such a share would be bought because it is perceived to be under- priced. 2. A share whose current market price is higher than its intrinsic value would be considered as overpriced and hence sold.