Understanding Medicare: Eligibility, Parts & Coverage Options

Explore the history, eligibility criteria, and different parts of Medicare, including information on Original Medicare, Prescription Drug Coverage (Part D), and Medicare Advantage (Part C). Learn about the coverage options available and how to enroll in this federal health insurance program.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Medicare Basics for Medicare Eligible Individuals MCS35a 11/2024

History of Medicare Signed into law in July 1965, by President Lyndon B Johnson, Medicare initially provided federal health insurance for the elderly (over 65) and for financially challenged families. When first introduced, Medicare had only two parts: Medicare Part A and Medicare Part B. That s why you ll often see those two parts referred to as Original Medicare today In 1997, President Clinton signed into law the Balanced Budget Act which introduced Medicare Part C, which allowed Medicare Advantage plans that work with a network of providers. In 2003, President Bush signed a law that introduced Medicare Part D for prescription drug coverage.

Who is Eligible? Medicare is a health insurance program for: People aged 65 or older. People under age 65 with certain disabilities. People with End-Stage Renal Disease permanent kidney failure requiring dialysis or a kidney transplant. People of all ages with ALS also known as Lou Gehrig's disease

Parts of Medicare Part A Part B Part D Part C Prescription Drug Coverage Medicare Advantage (MA) Hospital Insurance Medical Insurance

Part A & B Original Medicare Part A Part B Hospital Insurance helps cover: Inpatient Care in Hospitals Skilled Nursing Facility Care Hospice Care Home Health Care Medical Insurance helps cover: Doctors and Providers Services Outpatient Care Home Health Care Durable Medical Equipment like wheelchairs, walkers and hospital beds Preventive Services like screenings, shots and yearly Wellness visits

Part D Prescription Drug Coverage Part D isprescription drug coverage and is available to everyone with Medicare. Two ways to obtain Medicare prescription drug coverage: Enroll in a Standalone Medicare Prescription Drug Plan (PDP) Enroll in a Medicare Advantage plan with Prescription Drug coverage (HMO or PPO)

Part C - Medicare Advantage = + + Part C Part A Part B Part D Part C refers to Medicare Advantage (MA) plans that are offered by private companies approved by Medicare and must follow rules set by Medicare. Most MA Plans include Part D, prescription drug coverage, although stand-alone drug plans are also available. Some plans may include added benefits like certain vision, hearing and dental services. These plans bundle your Part A and Part B with other benefits not offered by Original Medicare.

Medicare Advantage Plan Types Health Maintenance Organization (HMO) Preferred Provider Organization (PPO) Special Needs Plans (SNP) Choose a doctor (primary care physician) from a list of contracted / network physicians Care is coordinated through your primary care physician's office with referrals to specialists Most referrals are handled electronically to ease the process Some plans may not require referrals for certain services No out-of-network coverage except emergency, urgently needed services, and dialysis when traveling outside your plan's service area Select physicians of your choice, but out-of- pocket costs are generally less if using plan's available network No referrals to see a specialist Out-of-network coverage Coverage for emergency and urgently needed care More flexibility, but may have higher out-of- pocket costs Medicare SNPs are a type of Medicare Advantage Plan Limits membership to those with specific diseases or characteristics Chronic conditions (C-SNP) Dual-eligible (D-SNP) Institutional (I-SNP) Benefits, provider choices, and drug formularies designed to best meet specific needs of the groups they serve

Medicare Supplement Insurance Medicare Supplement Insurance (also called Medigap) is sold by private companies. These policies help fill gaps in Original Medicare by helping to pay some of the remaining health care costs that Original Medicare doesn t pay, such as: Copayments Coinsurance Deductibles Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the Medicare-Approved Amount for covered health care costs, then Your Medigap policy pays its share Medigap only works along side Original Medicare.

Current Medicare Costs Part Premium Deductible Coinsurance Days 1-60: $0 after you pay your deductible Days 61-90: $408 (2024 rate) per day $419 (2025 rate) Days 91-150: $816 (2024 rate) $838 (2025 rate) per lifetime reserve days After day 150: You pay all costs Part A $1,632 deductible in 2024 $1,676 deductible in 2025 for each time you re admitted to the hospital per benefit period, before Original Medicare starts to pay. Premium-free for most people that paid Medicare taxes while working a certain amount of time, generally at least 10 years. Part B $174.70 per month in 2024 $185.00 per month in 2025 or higher depending on your income. The amount can change each year. $240 deductible in 2024 $257 deductible in 2025 before Original Medicare starts to pay. You pay this deductible once each year. 20% of the cost for each Medicare-covered service or item after you ve paid your deductible. Part C Medicare Advantage plans are offered by private insurance companies and premiums, deductibles, copays and coinsurance vary by plan. You must keep paying your Part B premium to stay in your plan. Plans also have a yearly limit on what you pay out-of-pocket. Once you reach your plan's limit, you'll pay nothing for services Part A and Part B cover for the rest of the year. Prescription Drug Coverage is offered by private insurance companies and premiums, deductibles, copays and coinsurance vary by plan. Your actual costs vary depending on the medicines you take, if they are on your plan s list of covered drugs, and which pharmacy you use. Using a preferred pharmacy in your service area (if your plan offers them) can help you save money on your prescription medications. Part D What you pay for each prescription will also depend on the Coverage Phase you re in. We ll talk more about that on the next slide. Medicare Supplement The monthly Medigap policy premium varies based on the policy you buy, where you live, and other factors. Policyholders must continue paying both their monthly Part A premium (if they have one) and Part B monthly premium to keep Medicare Supplement Insurance.

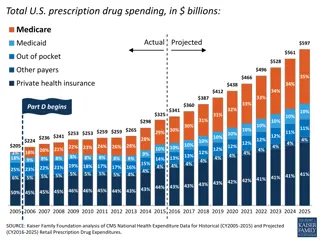

Part D Coverage Phases Stage Description You will pay the full cost of your prescriptions until your spending reaches your plan s deductible amount. In 2024, the maximum deductible allowed by Medicare is $545. Deductible Phase For 2025, the maximum deductible allowed by Medicare is $590. You will pay either 25% of the drug's costs until you reach your True Out-of-Pocket (TrOOP), which is $5,030 in 2024 and $2,000 in 2025. InitialCoveragePhase In 2025, your yearly out-of-pocket drug costs cap is $2,000. Once you reach this limit in 2025 (from your out-of-pocket spending plus certain payments other people or entities make, including Medicare s Extra Help program) you won t have to pay a copayment or coinsurance for covered Part D drugs for the rest of the calendar year. CatastrophicCoverage Phase

Medicare Prescription Payment Plan NEW for 2025 Things to know about this new payment option: works with your current drug coverage to help you manage your out-of-pocket drug costs, by spreading them across the calendar year (January December) might help you manage your expenses, but it doesn t save you money or lower your drug costs if you select this payment option, each month you ll continue to pay your plan premium (if you have one), and you ll get a bill from your health or drug plan to pay for your prescription drugs (instead of paying the pharmacy) all plans offer this payment option participation is voluntary Medicare.gov/prescription-payment-plan

Late Enrollment Penalty (LEP) Part D Part B You might pay a penalty if you don t sign up for a Part D plan when your first eligible and go more than 63 days without coverage. You might pay a penalty if you don t sign up for Part B when you re first eligible for Medicare (usually when you turn 65). How much is the Part D late enrollment penalty? How much is the Part B late enrollment penalty? You ll pay an extra 1% for each month (that s 12% a year) you could have signed up for Part D but didn t. This is not a one-time fee; the penalty is added to your monthly premium for as long as you have Part D, even if you change plans. You ll pay a 10% penalty, for each year you could have signed up for Part B but didn t. This is not a one-time fee; the penalty is added to your monthly premium for as long as you have Part B. If you have creditable drug coverage or if you qualify for Extra Help, you won t have to pay a penalty. You won t have a penalty if you qualify for a Special Enrollment Period, such as, you or your spouse are still working and have employer health coverage.

Income Related Monthly Adjustment Amount (IRMAA) + Part B Part D The Medicare income-related monthly adjustment amount, or IRMAA, is a surcharge on Medicare premiums for Medicare Part B (medical insurance) and Part D prescription drug plans. It applies only to Medicare beneficiaries who have a modified adjusted gross income, as reported on your IRS tax return from 2 years ago, is more than: 2024 2025 $103,000 if you file an individual tax return or are married and file separately $106,000 if you file an individual tax return or are married and filed separately $206,000 if you are married and file a joint tax return $212,000 if you are married and file a joint tax return

Enrollment Periods Initial Enrollment Period (IEP) 7 Month window when are turning 65 that includes: January July February May June March Birth Month 3 Months prior to and 3 Months after. Medicare Advantage Open Enrollment Period (MA OEP) Annual Open Enrollment Period (AEP) Special Enrollment Period (SEP) Special Enrollment Periods may differ for Medicare Part A & B and Medicare Advantage Plans January 1 March 31 October 15 December 7 December October November January February March

COBRA and Medicare Part B If you gained COBRA coverage before enrolling in Medicare Sign up for Medicare when you turn 65 to avoid gaps in coverage and a monthly Part B Late Enrollment Penalty Your COBRA coverage should end once enrolled in Medicare. If you gained COBRA coverage after enrolling in Medicare COBRA becomes your secondary payer, meaning they pay after Medicare. unless you have End-Stage Renal Disease COBRA coverage does not extend your Initial Enrollment Period, enroll in Medicare Part B as soon as you are eligible.

Comparing Plans Are prescription drugs covered? If so, are my drugs on the plan's formulary? Do I need to choose a primary care doctor? Can I get my health care from any doctor or hospital? Do I have to get a referral to see a specialist? What am I covered for when I travel? What do I need to be aware of as a snowbird? What else do I need to know about this type of plan?

Thanks for joining us! This is a solicitation of insurance. Contact may be made by an insurance agent or insurance company. Not affiliated with or endorsed by any government entity or agency. We do not offer every plan available in your area. Currently we represent 31 organizations which offer 8 products in your area. Please contact Medicare.gov, 1-800-MEDICARE (TTY: 1-877-486-2048), 24 hours a day, 7 days a week, or your local State Health Insurance Program (SHIP) to get information on all your options. MCS35a 11/2024