Understanding Medicare Enrollment Guidelines

Learn about who is eligible for Medicare, how to enroll, automatic enrollment procedures, and enrollment periods. Find out if you qualify and when and how to sign up for Medicare coverage.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Medicare www.medicare.gov This presentation produced at U.S. taxpayer expense.

Who Can Get Medicare ? 65 & older -or- 24 months after entitlement to Social Security disability benefits -or- Amyotrophic Lateral Sclerosis Medicare coverage begins first month entitled to SSDI -or- Permanent kidney failure and receive maintenance dialysis- Medicare coverage begins 4th month of dialysis or if kidney transplant Medicare coverage begins immediately 2

Who Else Can Get Medicare? Disabled adult children Spouses or widows/widowers of deceased workers at age 65 Railroad retirement beneficiaries who are at least 65 Dependent parents of a fully insured deceased worker 3

Disabled Adult Child A person whose disability began before age 22 can receive benefits under their parent Parent must be deceased or getting Social Security disability or retirement benefits Benefit starts at age 18 or afterwards Beneficiary must be unmarried and found to be disabled before age 22 by Social Security This is called SSDI (Social Security Disability Insurance) not SSI (Supplemental Security Income) 4

How Does a Person Enroll in Medicare? Enrollment in Medicare A and B is through SSA Go to :Socialsecurity.gov or ssa.gov Enrollment in Parts C and D is by contacting the plan or going to: medicare.gov or by calling 1 800 MEDICARE (1 800 633- 4227)www.medicare.gov 5

Medicare-Automatic Enrollment If a person is receiving SS benefits prior to age 65, SSA will automatically enroll them in Parts A and B at 65 Medicare card usually arrives 3 months before 65th birthday Persons who receive Social Security disability benefits (SSDI) are automatically enrolled in Medicare A and B the 25th month of disability benefits 6

When Can I Enroll In Medicare ? Medicare Enrollment Periods: Initial at age 65 Special if still working General January-March 7 7

Initial Enrollment Period (IEP) Lasts 7 months Begins 3 months before you turns 65 and ends 3 months after you reach 65 For those who are not working or who do not have employer health coverage through a working spouse If you enroll during the first 3 months of your IEP, your coverage begins the month you reach 65 8

Initial Enrollment Period If you enroll in Medicare Part B the month you reach 65, your coverage begins the following month If you enroll the month after you turn 65, your coverage starts 2 months after enrollment If you enroll 2 or 3 months after age 65, your coverage begins 3 months after your enrollment 9

Special Enrollment Period (SEP) If a person has group health coverage from their own or their spouse s current employer, they have 8 months to apply for Medicare Part B whenever they or their spouse stops working SEP starts the month AFTER a person or their spouse stops working This is called the Special Enrollment Period (SEP) If a person does not apply for Medicare Part B during the SEP, they can only enroll during the General Enrollment Period (GEP) which is January-March of each year Employer must verify that person was covered under a group health plan while they were employed (or their spouse if insured through them) 10

General Enrollment Period (GEP) January to March of each year for late enrollees Coverage for Medicare Part B does not begin until July of the year that they enroll Medicare Part B premium is 10% higher for each 12 month period a person was eligible to enroll but did not Premium penalty for late enrollment never goes away 11

Medicare Has Four Parts Part A - Hospital Insurance Covers most inpatient hospital expenses 2020 deductible $1,408 Free for fully insured individuals, their spouses, widow/ers and/or disabled adult children If not fully insured, they can pay for Part A depending on how many work credits they have Part B - Medical Insurance Covers 80% doctor bills & other outpatient medical expenses after 1st$198 in approved charges 2020 standard monthly premium $144.60 12

Medicare Has Four Parts Part C Medicare Advantage Plans Health plan options offered by Medicare-approved private insurance companies When you join a Medicare advantage plan, you can get the benefits and services covered under Part A, Part B, and in most plans, Part D Part D Medicare Prescription Drug Coverage Covers a major portion of your prescription drug costs Your out-of-pocket costs monthly premiums, annual deductible and prescription co-payments will vary by plan You enroll with a Medicare-approved prescription drug provider not Social Security 13

Medicare Part A You don t have to enroll in Medicare Part A or B at 65 if you are employed and have health insurance through your employer The same is true if your spouse is employed and you are on her employer health plan If you enroll in Medicare Part A only and you have a Health Savings Account, you can t put any more money into your HSA or IRS will assess a tax penalty 14

Medicare Part A Medicare Part A is always 6 months retroactive but not earlier than age 65 If you enroll in Medicare Part A after age 65 and you contributed to your employer HSA during the 6 months prior to your enrollment, you may have to pay a tax penalty to IRS While you are working Medicare is secondary payer 15

Medicare Part A If you or your spouse has 40 work credits (quarters), Part A is premium free If you have 30-39 work credits, Part A monthly premium is $252 If you have less than 30 work credits or none at all, your monthly premium for Part A is $458 16

Medicare Part B Part B- Medical Insurance SSA uses Modified Adjusted Gross Income (MAGI) to determine premium amount Some may pay higher premiums due to higher income If MAGI exceeds $87,000 for persons filing individually or $174,000 if filing tax returns as married, filing jointly , Part B premiums will be higher SSA uses most recent federal tax return (For 2020, this would have been tax return for 2018 filed in 2019) If a person enrolls late in Part B, their premiums will incur a penalty which never goes away 17

Medicare for Military Members of the military, active or retired and their families should enroll in Medicare A and B when first eligible in order to keep their TRICARE If you have VA health coverage and don t enroll in Medicare Part B in a timely manner, your part B premium may be higher and you may have to wait to enroll during the General Enrollment Period (GEP) 18

What is Medigap? Medicare supplemental insurance policies Covers deductibles, coinsurance and copayments Sold by private insurance companies Plans with the same letter offer the same benefits Costs vary according to company rates 19

When to Buy a Medigap Policy Open enrollment begins the month you turn 65 or older Must be enrolled in Medicare Part B Can purchase a policy whenever company agrees to sell you one Go to: Medicare.gov/find-a-plan for the Medigap comparison tool 20

Do You Need Medigap? Only works if you have Original Medicare May not be needed if you have supplemental coverage Can you afford the premiums, deductibles and copays of your Medigap plan? Does not cover Medicare Part D Some companies offer Medigap only to seniors not to people getting SSDI 21

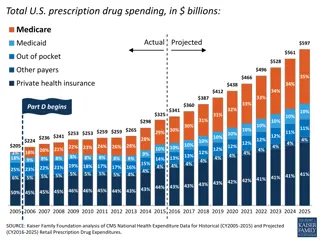

Medicare Part D Must have Medicare Parts A and B in order to enroll in Medicare Part D Administered through private plans Will only cover drugs which appear on the company s formulary Premiums, copays and deductibles with Medicare Part D 22

Medicare Part D Medicare Part D also has a premium penalty for late enrollees. Your Part D premium will be 1% higher for each month you could have enrolled in Part D and did not You should enroll in Part D during your IEP or within 63 days of not having Part D or creditable drug coverage Your Part D premium could be higher depending on your MAGI 23

Medicare Part D Enroll in Medicare Part D by calling 1-800- MEDICARE (1-800-633-4227) or by contacting private plans You can get Extra Help in paying for Part D if your resources are below $14,390 (individual) or $28,720 (couple) Income must be below $18,735 (individual) or $25,365 (couple) If you have a Medicare Advantage Plan (Part C), in most cases drug coverage is included 24

Medicare Part C Also called Medicare Advantage Plans (MA) or MA-PD (Medicare Advantage with Prescription Drug coverage) Managed by private companies approved by Medicare Medicare Parts A and B are included and most include drug coverage May have to use doctors in network Must pay Part B premium Does not work with Medigap policies 25

Medicare Parts C and D You can join, switch or drop your Part C or Part D Plan or return to original Medicare during Open Enrollment Period (OEP) OEP is from October 15-December 07 of each year Coverage begins January 1st of the following year If you enroll in Medicare during the General Enrollment Period (GEP) you can then enroll in Medicare C (if you have Medicare A and B) and/or Medicare D (if you have Medicare A and/or B) from April 01-June 30 26

Medicare Parts C and D If you are enrolled in a Medicare Advantage Plan (Part C) you can switch from a MA (No prescription drug coverage) to a MA-PD (Prescription drug) plan or from a MA-PD plan to a MA plan You can drop Medicare Part C and return to Original Medicare You will need to enroll in a Part D plan if you go back to Original Medicare You can do this from January-March You must be in an MA plan to use this enrollment period Coverage begins month after enrollment 27

Medicare Remember that Medicare does not cover hospitalization, prescription drugs or doctor costs while you are living or vacationing outside of the United States If you are on vacation, check with your carrier for vacationers insurance. It is not expensive. If you move outside of the United States, get health insurance coverage from the country where you reside

For More Medicare Information 1-800-MEDICARE (1-800-633-4227) TTY 1-877-486-2048 www.medicare.gov 29