Understanding Microgrid Funding and Ownership Structures

Learn about microgrids, their key attributes, funding partners, popular financing structures, ownership structures, and more in this comprehensive guide. Explore how microgrids work, what to look for in a funding partner, different financing options, and ownership scenarios in the microgrid industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Microgrid Funding Steve Lawrence Sam Clineff 1

What is a Microgrid? A microgrid is a small-scale, localized energy system that can operate independently or in conjunction with the main power grid. It typically generates, stores, and distributes its own energy using a mix of renewable energy sources (like solar, wind, or hydro) and conventional energy sources (like diesel or natural gas generators). Microgrids can serve communities, industrial facilities, campuses, or military bases, and they're often designed to be more resilient and energy-efficient than traditional grids. 2

What are the key attributes of a Microgrid? 1. Self-Sufficiency: Microgrids can operate autonomously without relying on the larger power grid, especially in case of grid failures or natural disasters. 2. Distributed Energy Resources (DERs): Microgrids integrate renewable energy sources and/or backup generation to ensure a stable power supply. 3. Control and Automation: They have smart grid capabilities that allow for real-time monitoring and control of energy production, consumption, and storage. 4. Resilience: In the event of a grid outage, a microgrid can "island" itself. 5. Energy Storage: Many microgrids incorporate energy storage systems, like batteries, to store excess energy for use during periods of high demand or when renewable resources are not producing power. 3

What to look for in a funding partner 1. Financial Stability and Track Record 5. Project Management Support 2. Industry Knowledge and Expertise 6. Geographic Expertise 3. Alignment of Goals 7. Clear Exit Strategy 4. Flexibility in Funding Structures 8. Reputation and Integrity 4

Popular Financing Structures 1. Power Purchase Agreement (PPA) 4. Operating Lease 2. Energy Service Agreement (ESA) 5. Capital Lease 3. Energy as a Service (EaaS) 6. Loan 5

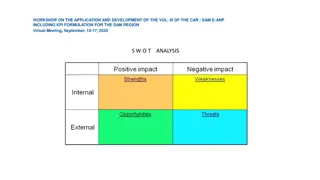

Ownership Structures Lender Owns Project Owns Lender Project Co Lender Project Co Construction Risk Monetizes ITC Monetizes Rebates and Incentives O&M Responsibility Performance Risk Contractual Upside 6