Understanding Other Income and Debt Cancellation for Form 1040

Explore various types of other income like prizes, gambling winnings, and debt cancellations with a focus on reporting on Form 1040. Learn about insolvency considerations and how it impacts taxable income. Practice exercises provided for practical understanding.

Uploaded on | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

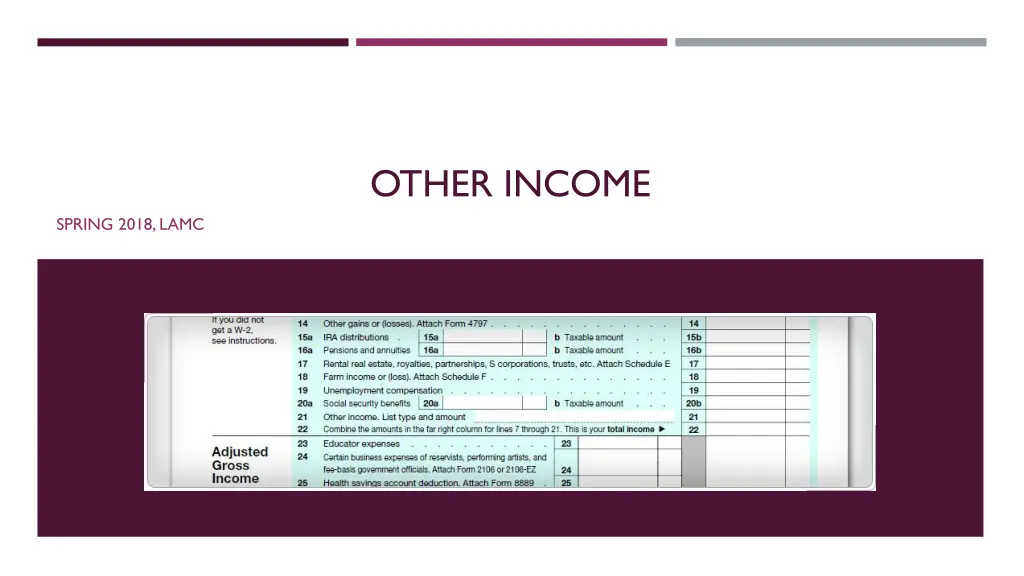

OTHER INCOME SPRING 2018, LAMC

OTHER INCOME Objectives Learn about other types of income and how to report them on Form 1040 Determine the requirements for the cancellation of debt on nonbusiness credit cards Determine when canceled credit cards are included in gross income on Form 1040 Types of Other Income Prizes and awards Gambling winnings, including lotteries and raffles Jury duty pay Nonbusiness credit card debt cancellation

OTHER INCOME Reported on Form 1040, line 21. Gambling Winnings Reported on Form W-2G Gambling losses can only be deducted on Schedule A (will cover this in future lessons) Cash For Keys Program Income from financial institution offered to expedite the foreclosure process. Taxpayers should receive Form 1099-MISC with income in box 3. Cancellation of Debt Reported on Form 1099-C. If the taxpayer was solvent (assets greater than liabilities) immediately before the cancellation of the debt, then all the canceled debt will be included on Form 1040, line 21. Lenders and creditors are required to issue Form 1099-C if they cancel a debt of $600 or more. If the taxpayer was insolvent (liabilities exceeded their assets) immediately before the cancellation of the debt then the cancellation will not be considered income. This is outside the scope of VITA. Refer to Publication 4012, Tab D (D-64) for Insolvency Determination Worksheet.

EXERCISE Michael was released from his obligation to pay her personal credit card debt. He owed approximately $11,000 to his credit card company, which agreed to accept $2,000 as payment in full. Before paying the credit card company, it was determined that Michael was solvent (assets greater than liabilities) and not in bankruptcy. The credit card company issued Michael a Form 1099-C, reporting $9,000 as the amount of debt discharged. 1. Based on this information, can Michael be assisted at his local VITA site? 2. If the VITA site is able to assist, what amount would be reported on Michael s Form 1040, line 21?