Understanding Payroll Tax and Independent Practitioner Arrangements in Medical Practices

Dive into the implications of payroll tax in medical practices, as highlighted by the Thomas and Naaz Pty Ltd case. Explore the key issues, tax thresholds, and considerations when engaging practitioners in healthcare settings.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

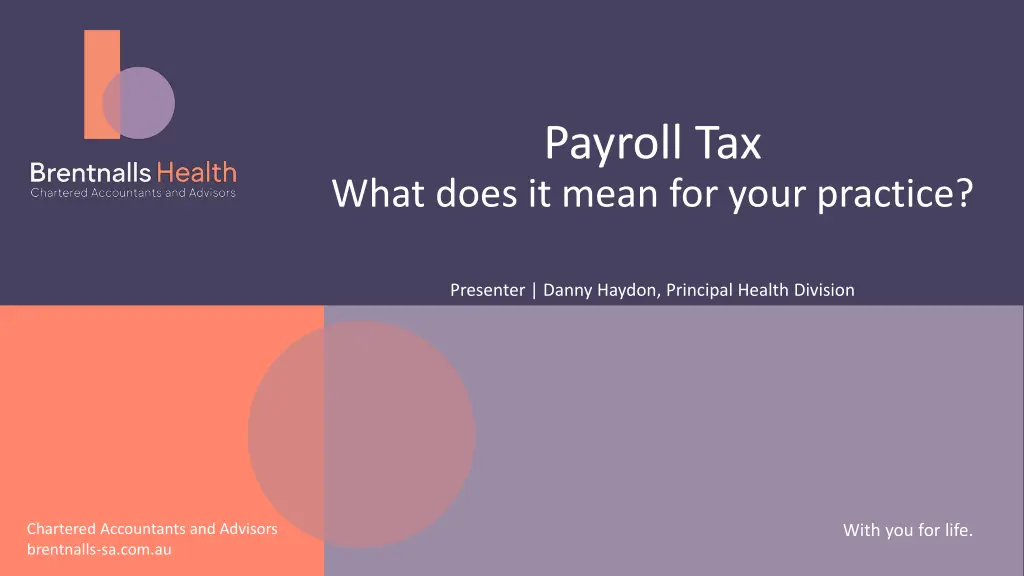

Payroll Tax What does it mean for your practice? Presenter | Danny Haydon, Principal Health Division Brentnalls Affilitation Chartered Accountants and Advisors brentnalls-sa.com.au With you for life.

DISCLAIMER This document is for general information only and is not intended to give advice as it was prepared without taking into account the objectives, financial circumstances or needs of you or any particular person. Before acting on anything contained in this document, you should consider the appropriateness to your situation and you should seek advice based on your individual circumstances. Brentnalls SA | ABN 74 705 292 014 255 Port Road, Hindmarsh SA 5007 Chartered Accountants and Advisors brentnalls-sa.com.au

Payroll Tax Thomas and Naaz Pty Ltd Case The Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue [2021] NSWCATAD 259payroll tax case has put the spotlight on Independent Practitioner arrangements commonly used in medical practices across Australia.

Payroll Tax Thomas and Naaz v Chief Commissioner of State Revenue (NSW) Doctors were engaged with service agreements that provided for a 30% service fee (plus GST) for room rental, shared administration and medical support. Revenue NSW held that doctors were contractors engaged under Relevant Contracts - deemed employees for payroll tax purposes. Key Issues: Inconsistent with Agreements, doctors were paid 70% of patient fees generated Flow of funds - patient fees were banked into one account and then 70% was paid to the doctors and the balance retained by the practice. Reporting for tax purposes - all patient fees recorded as income & payments to doctors reported as contractor expenses. Level of control exercised by Practice over its doctors (clauses in agreements) Patients were determined to be customers of both the medical practice and the doctor With you for life.

Payroll Tax Threshold Payroll Tax Threshold Payroll Tax Rate $1,250,000 4% between $1.25m and $2m 6.1% if >$2m TAS Payroll Tax is a State Based Tax $2,000,000 6.85% ACT SA, QLD and TAS have variable rates depending on level of group wages $1,500,000 Variable 0% to 4.95% between $600,000 - $1.7m SA 4.95% if >$1.7m While payroll tax is state based, the underlying legislation were supposed to be harmonised across all states (except WA) $1,500,000 5.5% NT $1,300,000 4.75% if <$6.5m QLD 4.95% if >$6.5m $1,250,000 4% between $1.25m and $2m TAS 6.1% if >$2m $1,200,000 4.85% NSW $700,000 4.85% VIC

Engaging Practitioners Type Key factors Hourly rate +/- percentage split PAYG withholding Superannuation High level of control Payroll tax applies Employee Contractor essentially provides labour services to the practice Works exclusively or primarily for one principal No superannuation No PAYG withholding Some level of control Payroll tax applies unless eligible for an exemption Relevant Contract Tenancy and agency model Payment for services provided by the practice Low level of control Payroll tax may/may not apply Independent Practitioner With you for life.

Flow of Funds Management of Bank Accounts High Risk Arrangement 100% Patient Fees Practice Bank Account Doctor Payments Registrar Wages Where Patient Fees are collected by the Practice into its operating account, there is significant risk of that the amount remitted to Doctors, net of service fee , will be considered remuneration / contractor payments and be subject to payroll tax.

Flow of Funds Management of Bank Accounts Lower Risk Arrangement 100% Patient Fees Doctor Service Fees Practice Bank Account Separate Billings Trust Bank Account Registrar Patient Fees Doctor Net Payments Registrar Wages With you for life.

Flow of Funds Thomas and Naaz appeal to the Supreme Court Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue [2023] NSWCA 40 Section 63 If patient fees are paid directly to the practitioner the only transaction between the practitioner and the practices is the payment of the service fee there is no payment from the practice to the practitioner Payroll tax does not apply. Based on this Supreme Court ruling, medical practices are being widely advised that patient fees owed to independent medical practitioners need to be directed in full to the practitioner s bank account. This view is supported by the recent Queensland Revenue Office announcement, confirming that direct payments from patients to practitioners are not subject to payroll tax liability.

Flow of Funds Management of Bank Accounts Individual Practitioner Accounts 100% Patient Fees Practitioner Business Bank Account Practice Bank Account Registrar Patient Fees Doctor Net Payments Registrar Wages With you for life.

Payroll Tax State by State Update Tasmania Liberal party made a political promise prior to the election that payments made to independent practitioners (GPs) would not be accessible for payroll tax purposes. They essentially agreed to maintain the status quo. The situation for non-GP practitioners remains unclear. Western Australia WA is not party to the Harmonisation of legislation Stated that they would not be pursuing payroll tax for payments made to GPs. ACT Payroll tax exemption offer for practice that bulk bill rate is greater than 66%.

Payroll Tax State by State Update Queensland Offered a 2 year amnesty ending on 30 June 2025 to allow practices time to review their circumstances Public Ruling PTAQ000.6.2 confirmed that if there is no direct payment to the practitioner from the practice, there is no payroll tax liability South Australia GP practices offered a 1 year amnesty ending on 30 June 2024. Deemed the vast majority of practitioner agreements to be relevant contacts that are accessible for payroll tax Determined that patient fees paid directly to the practitioner s bank account are Third Party Payments , and the net amount received is accessible for payroll tax. Subsequently offered an exemption (deduction) for the proportion of services items that are bulk billed. With you for life.

Payroll Tax State by State Update Victoria Strongly held the position that GPs will pay payroll tax on remuneration paid to practitioners. Subsequently (on the same days as SA) offered an exemption (deduction) for value of services that are bulk billed. NSW Agreed to pause any action for 12 months to 30 June 2024 Further announcement pending So much for harmonisation!!

Payroll Tax With you for life.

Payroll Tax This continues to be an area of grey rather than black and white. The current state of play in Tasmania is based on a political promise, without changes being made to the legislation. To minimise any future risks, you are strongly advised to: 1. Keep informed about what is happening in your state and across Australia 2. Seek guidance from your advisors Accounting and legal 3. Ensure your independent practitioner arrangements are set up correctly 4. Ensure you are reporting correctly on financial statements and tax returns 5. Ensure that your Services Agreements are sound 6. Check that the management of patient fees and payments to practitioners are consistent with your service agreements

Subscribe to our eNewsletter With you for life.

Relevant Contractor exemptions There are six exemptions excluding contracts from payroll tax: 90 day exemption (total no. of days in a year is less than 90) 180 day exemption (services of a kind which are ordinarily required by the principal for less than 180 days in a financial year) Engaging others (have employees), 2 or more persons providing services Services are ancillary to the supply of goods Services not ordinarily required Ordinarily rendering services of the same kind to the public If you meet any one of these exemptions, payroll tax will not apply With you for life.

Independent Practitioner Payments Profit & Loss Statement Payroll tax calculation: Income Service Fees (35%) $1,400,000 Remuneration Registrars $200,000 Remuneration Admin & Nurses $800,000 Patient Fees (Registrars) $400,000 Total Wages $1,000,000 Total Income $1,800,000 As remuneration is below TAS threshold of $1,2500,000, no payroll tax payable Expense Remuneration Registrars $200,000 Remuneration Admin & Nurses $800,000 Total Expenses $1,000,000 Net $800,000

Independent Practitioner Payments Profit & Loss Statement If doctors were included as relevant contractors for payroll tax purposes Income Patient Fees (Contractors) $4,000,000 Rem Registrars $200,000 Patient Fees (Registrars) $400,000 Rem Admin & Nurses $800,000 Total Income $4,400,000 Rem Associate Doctors $2,600,000 Total Wages $3,600,000 Expense Payroll tax calculation: Contractor Payments (65%) $2,600,000 Total Remuneration $3,600,000 Remuneration Registrars $200,000 Less Deduction Entitlement ($1,250,000) Remuneration Admin & Nurses $800,000 Net Taxable Wages $2,350,000 Tax Rate 6.1% >$2m Total Expenses $3,600,000 Payroll Tax Payable $141,500 Net $800,000 With you for life.

Independent Practitioner reporting versus contractor reporting Independent Practitioner Contractor

Level of Control Other factors Website - representation of the relationship, advertising to the public Adherence to policies and procedures right to autonomy in their practice Managing of leave right to freely determine their availability Practice fees right to set independent fees With you for life.

Medical Services Agreement Consistency with Practice Is the management of patient fees and payments to practitioners consistent with the terms of their Service Agreement? Provisions in the Service Agreement 2. In consideration of the provision of the services referred to in clause 1:- 2.1 the Practitioner will pay to the Company a service fee being; 2.1.1 thirty five percent (35%) of the gross fees collected by or on behalf of the Practitioner in each month. 2.2 the Practitioner agrees to be bound by the restraints imposed under clause 9 of this Agreement. 3. The Practitioner AGREES that the service fee payable pursuant to clause 2 may be deducted by the Company from all fees billed/collected on behalf of the Practitioner pursuant to clause 1. Incorrect payment in practice contractor payment Practitioner is paid 65% of their billings + GST

Medical Services Agreement Caution re obligations for hours of work or limits to leave With you for life.

Medical Services Agreement Caution re restraints 9. During the period of twelve (12) months following termination of this Agreement, the Practitioner must not:- 9.1 carry on practice in competition with the practice conducted by the Company anywhere within a radius of five (5) kilometres of the premises either alone, in partnership or as a director, employee or shareholder in any company; 9.2 solicit or persuade with any other medical practitioner who has entered into an agreement with the Company for the provision of services to terminate that agreement or practice in association or partnership with such other medical practitioner.

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)