Understanding State Aid Adjustment Impact on JTPS Funding

Explore the ongoing impacts of S-2 on the Jefferson Township Board of Education's financial situation. Discover the potential scenarios with increased state aid, historical funding data, and the formula used to calculate aid adjustments. Gain insights into the challenges faced by JTPS and the projected losses over the next few years.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Continued Impacts of S-2 Jefferson Township Board of Education

WHAT COULD WE DO WITH $11 MILLION MORE DOLLARS PER YEAR? WHERE WOULD JEFFERSON BE WITH $45 MILLION MORE IN STATE AID BETWEEN 7/1/2018 AND 6/30/2025?

State Aid Funding History School Funding Reform Act of 2008 (SFRA) Was not implemented until 2011 Districts received less State aid 2010-2011 school year Budgets were capped at a 2% increase starting in July 2011 State aid was based on enrollment, a snapshot of the 2010-2011 school year Equalization aid has remained the same from the 2013-2014 school year through the 2017-2018 school year S-2 Enacted in July 2018

S-2 Basics Apply School Funding Reform Act of 2008 (SFRA) as enacted S-2 calculates a difference between the school district s total state aid allocation in the current budget year and the pre-budget year (differential) Districts with a positive difference, aka over-funded districts, have their state aid cut according to the following: 2019-2020: prior year aid LESS 13% of the differential 2020-2021: prior year aid LESS 23% of the differential 2021-2022: prior year aid LESS 37% of the differential 2022-2023: prior year aid LESS 55% of the differential 2023-2024: prior year aid LESS 76% of the differential 2024-2025: prior year aid LESS 100% of the differential

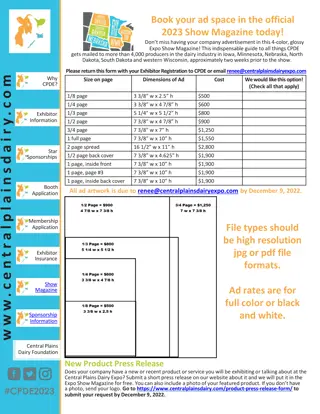

How has the State Aid Adjustment Impacted JTPS? Estimates based on 2023-2024 Equalization Aid Calculations **Not inclusive of non-recurring Supplemental Stabilization Aid BUDGET YEAR GENERAL FUND STATE AID CURRENT YEAR INCREMENTAL LOSS CURRENT YEAR LOSS VS. 17-18 SY 18-19 15,508,649 -554,620 -554,620 19-20 14,315,347 -1,193,302 -1,747,922 20-21 12,063,605 -2,251,742 -3,999,664 21-22 9,272,081 -2,791,524 -6,791,188 22-23 6,631,798 -2,640,283 -9,431,471 23-24 5,105,647 -1,526,151** -10,957,622 24-25 EXPECTED 7 YEAR CUMULATIVE LOSSES = -44,922,052 4,623,704 (Estimated) -481,943 (Estimated) -11,439,565

Formula Aid Volatility Uncapped SFRA Aid = Equalization Aid + Special Education Aid + Security Aid + Transportation Aid 18-19 Uncapped SFRA Aid = $9,193,744 23-24 Uncapped SFRA Aid = $4,623,704 Change in Uncapped SFRA Aid = $4,570,040 or 49.7% reduction Change in weighted average enrollment = 18.7% decline Unpredictability and volatility of Equalization Aid due to lack of transparency in multipliers presents a significant challenge when developing a multi-year budget strategy

Resource Management at Jefferson Township Closed Drummond & Milton Schools Relocated administrative offices, net decrease of one facility and nine staff Annual staffing review Reduction in Administrative Staff (Director of Curriculum, Asst. Business Administrator, Director of Transportation and Educational Facilities, Math Supervisor, Middle School Assistant Principal) Enrollment impact on staffing of certificated instructional positions Review of support staffing (Aides, Secretarial, Custodial, Maintenance, Technology) Yearly review of health benefit provider costs Seek out additional sources of revenue 2018 Referendum to address most critical infrastructure needs Review of all grant opportunities -- limited eligibility Began charging tuition for general education preschool program Applied for Preschool Education Aid

Budget Challenges Expiration of ARP and ESSER funding Drastic and unpredictable increases in health care 2010-2011 cost of family plan = $23,065.92 February 1, 2024 average cost of family plan = $38,816.38 Increase in costs = 68.3% Costs due to staffing shortages (permanent and substitute) Inflationary pressure across all categories of expenses Potential decline in State Aid based on enrollment Increased transportation costs Increase in number of homeless students (tuition, transportation) Increase in special education students enrolling in our district (teachers, aides, transportation) Increase in number of students sent for evaluations: risk to self/others, chemical screens, etc.

Budget Positives BOE and administration work hard to maintain and enhance most programs in place before the implementation of S-2 Introduction of internal academies Preschool funding will help stabilize the budget Expenses otherwise fully funded by the local taxes and state aid can be partially or fully funded by the preschool program Alternate sources of funding State & Federal Grants Advocating w/ Legislators Privately Funded Grants

Previous Years Budget Responses Eliminated instructional and support positions Removed all facility improvement projects from operating budget Reduced supply accounts Reduced staff professional development spending Paused certain upgrades to student laptops, impacting overall technology device management program Postponed purchase of buses, impacting overall fleet management program Realigned central office and building support staff Initiated tuition for our inclusive preschool disabled program Implemented activity fees at Middle and High Schools Implemented parking fee at High School

Potential Long-Term Consequences Deterioration of facilities and infrastructure Elimination of non-core programs, co-curricular activities, and athletics Reduction of technology Lack of ability to compete with neighboring towns Inability to attract quality teachers Increased costs to parents who are already overtaxed