Understanding the Role of CMA Surat Chapter in GST Implementation

Explore the pivotal role of the CMA Surat Chapter in implementing GST, focusing on IT system requirements, compliance processes, data fields, and ledger management for seamless transition. Gain insights from CMA Shailendra Saxena's presentation on GST implementation.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

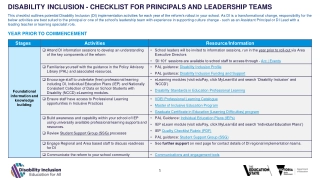

GST-IMPLEMENTATION-ROLE OF CMA SURAT CHAPTER OF WIRC OF THE INSTITUTE OF COST ACCOUNTANTS OF INDIA Dated 27/05/2017 A Presentation by CMA. (Dr.) Shailendra Saxena B.COM,SAP(FICO),ACS,FCMA,FCA,DISA(ICAI).Ph.D. 1

GST Comparison : Present Taxation Vs. GST shailendra.saxena@jlnus.com

CMA Role in IT Functional requirement for IT System Advice for preparing GST Compliant IT systems. Understan ding Client current System Understa nding Governme nt System Identifying requirements to be captured in the IT System. all possible business Coordinati ng with System Team Identifying requiremen ts Segregating the identified requirements into two parts (a) Mandatory and (b) Recommendatory Validating client IT System Validating the GST compliant IT System

When is IT System GST Compliant? Business Processes mapped to GST Sale / Services / Stock transfer / Transfer to own unit (Local + Interstate) Local and Inter State Procurement (goods and services) Imports (Separate Value for BCD and IGST) Bill to ship to procurement/su pplies Job work transaction under Section 43A Inter unit taxability /captive consumption Consignment agent / mixed supply / Free Supplies Taxes Export with payment of taxes and without payment of Input service distribution /Reverse Charge Mechanism Sales return / sale on approval Supplies without considerations OTHERS

When is IT System GST Compliant? Data fields identified and captured Master data Tax codes Pricing Procedure and Conditions Purchase order / Sales order etc. Invoices/debit or credit note etc. Input tax credit claims Preparation records/registers/other documentations etc. for all business processes. Computation of liability, Return preparation Others

When is IT System GST Compliant? GST Returns / GST Ledgers / GST Records & Registers All GST returns getting automatic generated from software with minimal human intervention. Line Item wise data required in return. Cash Ledger / ITC Ledgers / Tax Ledgers / ISD Ledger auto generated by Client System (GSTIN and PAN wise) Mapping of ledgers generated by Client System with ledgers maintained by GSTN system.

GST LEDGERS Three Electronic ledgers to be maintained: 1. Electronic tax liability register: 2. Electronic credit ledger: 3. Electronic cash ledger:

GST REFUNDS: Common refund application to be filed through GSTN. No Unjust enrichment: Refund application to be accompanied by prescribed documents along with CMA Certificate- GST RFD- 01 The acknowledgment for filing refund application will be available in GSTN after verification of information and documents filed. Immediate acknowledgment for cash ledgers- GST RFD-02 Provisional Refund of 80% subject to GST Compliance Rating- GST RFD-04 Refunds, provisional refunds and interest on delayed refunds to be directly credited to the bank accounts- GST RFD- 08/09

GST RETURNS: Different communication of the input tax mismatches, final acceptance, mismatches adding to the output liability, etc. forms prescribed for outward supplies, inward supplies, Finalization of GSTR-1 (sales register) and GSTR-2 (purchase register) at GSTN. GSTR-3 auto populated data: cash details as per Electronic cash ledger/ carried forward from previous tax period, ITC carried forward from previous tax period, ITC reversal and associated Interest/Penalty, taxes paid during the current tax period etc. To pay such amount as shown in the draft GSTR-3 return generated automatically. To debit the electronic cash ledger/ credit ledger and mention the debit entry No. in the GSTR-3 return.

WHENIS IT SYSTEM GST COMPLIANT? Reconciliation Effective mechanism of reconciliation of purchase details uploaded by Clients with details uploaded by vendor and customers in GSTN system on daily basis. Proper integration of details provided by GSTN system with details available in Clients system. Concept of acceptance/rejection to be captured in Clients System.

WHENIS IT SYSTEM GST COMPLIANT? Transitional Situations mapped Purchase / sales order prior to GST regime but invoice post GST Regime Issuance of debit / credit note issued post GST regime in respect of invoice issue pre GST Regime Receipt of goods from Job worker post GST regime but inputs issued pre GST regime Others

CMA ROLE - FINACIAL IMPACT GST IMPACT ANALYSIS Capturing the present business in as is condition and to identify the impact of Model GST legislation Mapping the current taxes paid on procurement of goods and services Mapping of GST to be paid on procurement of goods and services. Analyzing increase in credit blockage and working capital outflow on inward side. Taxes paid on output Analyzing any change in quantum of taxes to be paid under GST regime. Analysis of net GST impact on the current model including cash flow Recommendations and suggestions for tax optimization; IMPACT ON WORKING CAPITAL OUTFLOW CHANGE IN CREDIT IMPACT ON COST IMPACT ON PRICES IMPACT ON COMPANY

CMA Role in Transitional Advisory ISSUE : Pending Litigations Section 156 of Model GST Law {Transitional Provision} As per Section 156 of Model GST Law, upon finalization of proceedings regarding output tax liability, credit of amount paid not admissible. Strategy If matter decided against clients, whether credit of duty paid will be available to the customer? Should Clients pay tax under protest and raise supplementary invoice

CMA Role in Transitional Advisory ISSUE : Transitional Stock No transitional provision of excise duty benefit Strategy GST leviable on transitional stock but no excise duty benefit Stock optimization?

CMA ROLEIN TRANSITIONAL ADVISORY: Credit on inputs and inputs in semi-finished goods or finished goods held in stock: Presently transitional provision not including provisions for credit to be taken by traders (who have paid excise duty for goods), though representation have been made for same. Likely results to be incorporated in the amended provisions for same to avoid litigation. Credit of inputs, and inputs in semi-finished goods or finished goods held in stock on the appointed day permissible, if following conditions fulfilled: Such inputs/goods are used/intended to be used for making taxable supply Eligible for credit under the earlier law but for his not being liable for registration or the goods remaining exempt under earlier law Eligible for input tax credit in the GST law In possession of the invoices or other prescribed documents not older than 12 months preceding the appointed day

CMA ROLE TRANSACTION ADVISORY GST efficient restructuring of transaction Job work model vs P2P Model Re-examination of procurement policy ( Say FOR or Ex factory purchase, inter state or local etc.) Mechanism of giving post sale discounts Purchase of motor vehicle vs renting of motor vehicle vs transportation services. Avoiding blockage of seamless flow of Credit (Rule 5 of POPS Rules)

CMA: REPRESENTATIONTO POLICY MAKERS Representation related to amendment in GST Act/Rules Stock Transfer Valuation Provision / Transitional Provision for excise duty benefit on transitional stock etc. Representation related to issuance of Circular for clarifications ITC on construction related activities / Taxability of inter unit adjustment etc. Representation related to issues in return filing/procedure As and when required

CMA Role Additional Role Reviewing of Contracts Existing clauses / Transitional clauses / Benefit of extra ITC available to vendors to be passed on to Clients GST applicability on contracts with vendors Avail exemption / lower rate benefit ITC available only if vendor deposit the GST Safeguard in contract Training / workshop Central Information Cell : Common GST treatment for common issues across plants Appropriate training at all level of clients, across all plant and head office. Different departments to be trained. Vendors Training

CMA Role Additional Role GST implementation and compliances Guidance on the registration requirement, invoicing requirement, computation, set-off, etc.; Providing detailed compliance calendar under the GST Regime which needs to be followed by the company; Assistance for maintaining suitable records under the GST Regime; Review of the sample documentation such as invoices, bill, etc. and registration to ensure that these are compliant under the GST regime; Review/ vetting of initial first returns to be filed with the authorities under the GST

CMA Role Additional Role GST implementation and compliances Providing guidance as and when required on issues arising in routine business operations from GST regulation perspective; Time to time advise on routine queries raised by the company for initial months to ensure that appropriate compliances under the GST regime; and Providing suitable guidance on the key amendment / clarifications issued by authorities under the GST regime which may impact the company.

THANKS!! ANY QUESTIONS ? CONTACTFORPOSTSESSIONQUERY: CMA. (Dr.) Shailendra Saxena | E-mail: shailendra20535@yahoo.com Cell: +91-93774-10260 21 shailendra.saxena@jlnus.com