Understanding the Role of Merchant Banking in International Finance

Merchant banking, a specialized form of financial service catering to large corporations and high-net-worth individuals, focuses on international finance, long-term loans, and stock underwriting. Learn about the origins, services, and key players in this distinct sector of the banking industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Merchant Banking

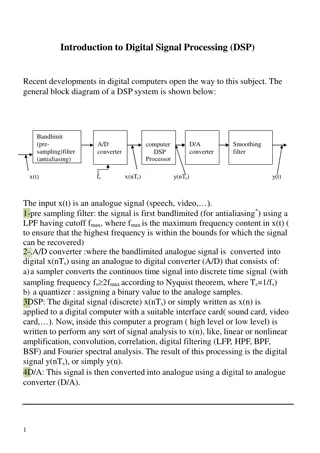

Introduction Bank that deals mostly in international finance, long- term loans for companies and stock underwriting. Merchant banking primarily involves financial advice and services for large corporations and wealthy individuals. Merchant banks do not provide regular banking services to the general public. Merchant banks invest their own capital in client companies & provide services for mergers and acquisitions.

A merchant bank is sometimes said to be a wholesale bank, or in the business of wholesale banking. It s because merchant banks tend to deal primarily with other merchant banks and other large financial institutions. As of today there are 135 Merchant bankers who are registered with SEBI, India. This includes Private, Public & Foreign players.

INTRODUCTION Investment Banking is an American Synonym of Merchant Banking; Merchants used to attend to extending of loans and arranging finance for trade purposes; As the time passed the banking assumed more importance and the merchants switched over to banking activities, hence the term merchant Banking took placed.

Meaning Merchant banking is a non-banking financial activity similar to banking; Merchant banking is a fee based business, where the bank assumes market risk but no long-term credit risk. These are financial institutions providing valuable solutions such as:- Acceptance of bills of exchange; Corporate finance; Portfolio management; Other non-banking services.

Definition An organization that underwrites securities for corporations, advices such clients on mergers, and is involved in the ownership of commercial ventures . According to Mr. Rosenburg Any person who is engaged in the business of issue management either by making arrangements regarding selling, buying or subscribing to the securities as manager; consultant adviser; or one rendering corporate advisory services in relation to such activities in the management . According

Origin In Britain started in the 13thcentury when a few private firms engaged themselves in foreign trade and finance. Based on the British model Dutch and Scottish traders started merchant banking. In USA merchant banking was developed by the European bankers. West Germany developed close link with the commercial banks thus services to customers. In 1972 merchant banking practice was started in SouthAfrica. offering variety of

Indianscenario In 1857, the chartered mercantile bank of india started its operations. During the 19thcentury, the foreign bankers operated in India through the popular agency house called East India House. National Grind lays Bank opened its branch in 1967. SBI floated its merchant banking division in 1972. Some of the banks which started Merchant banking are Central bank of India, BOI, syndicate bank, BOB, Standard chartered bank, ICICI, IFCI and IDBI etc.

Functions Issue Running the IPOs/FPOs/Right issues/Debt issues Project appraisal; Corporate AdvisoryServices; Underwriting of equity issues; Banker to the Issue/Paying Banker; Refund Banker; MonitoringAgency; Debenture Trustee; Management Services to act as Book Lead Manager/Lead Manager for

Categories To act as a merchant banker, a person or firm should hold a certificate granted by the regulator- the securities and exchange board of India. SEBI regulations provide for 4 categories of Merchant Bankers; Category I: It Will take up activities associated with issue management. Category II: Allowed to carry the roles of advisor, consultant, co-manager, underwriter and portfolio manager; Category III: Allowed to act as underwriter, advisor, and consultant; and

CAPITAL ADEQUACY NORMS: Category I : Rs.5 crores Category II : Rs.50 lakhs CategoryIII : Rs.20 lakhs Category IV : Nil