Unlocking Success in Post-Covid MICE Tourism Sector: Research Insights

Explore how key organizations in the MICE tourism sector in Denmark, Iceland, and Latvia adapted to and thrived post-Covid through financial analysis, leadership evaluation, and strategic decisions. Discover the DNA of resilient companies, crucial lessons learned, and implications for future tourism strategies.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Jumpstarting tourism post Covid 19 Bj rn M. Sigurj nsson Senior lecturer EA Dania Randers Denmark

Collaborative research project Denmark, Iceland & Latvia Assemble a sample of 4-5 organisations/companies in Latvia, Denmark and Iceland which primary business is the MICE tourism sector. Research their financial statements before, under and after Covid 19, annual reports and other microeconomic pre- existing data Once we have looked at the financial data: What is the DNA/mindset of the company, and how did this allow them to survive the Covid- 19 crises? Qualitative analasys/interviews with company leaders.

What are we looking for? What is the strategy, leadership, culture and so forth in the company, that allowed them to survive or led to their demise? Searching for patterns, structures or the organisational DNA that may be a possible causal factor for the success or demise of the organisation.

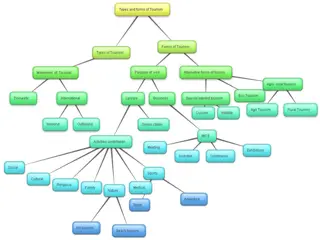

Selection of organisations A vertical cross section of the MICE tourism distribution channel A supplier An intermediary A retailer Subsidiary services to the MICE sector

The output Assemble a case from each organisation, use the data as input to build a businessmodel, find causal relationships in each case, try and identify key decisions that had decisive effects on the companies results (lessons learned) . Describe them and summarise for dissemination Use the material as cases in learning institutions in Denmark and Latvia. Build a database via spin offs, continut looking for patterns, structures or similiarities.

The method Analysis of financial statements and annual reports using BMA (Business Model Analysis) as issued by the EFMA. Transfer to tourism organisational analysis. Identify key financial parameters Follow up with qualitative interviews, emergent and exploratory by design.

Preliminary results: 2 examples 1. Travel agency with inbound tours, single largest marketshare of inbound tourism to Iceland. 2. Adventure activity company. Small entrepreneurial on a niche market in Iceland.

Travel agency in Iceland Pre Covid: Employees 160, PM 15-25% vertical value chain classical B2B distribution 24 months contract horizon. Zero gearing precovid, high equity, growth market. Classic multifunctional organisational structure, long strategic horizon. Rigidity, high value accounts.

During covid Layoffs, structural changes, strategic horison, equity and ownership. Employee positions from 122 to 20. Primary focus on account managers, protecting large business accounts, wholesalers, vouching, postponing, avoiding refunding. We were focusing on keeping those employees on, that were responsible for the accounts, the contacts and the business relations that are vital for the company

Travel agency II Structural changes During covid: 20 positions doing the job of 100. Need for a shorter strategic horizon, decisions made quicker. More frequent strategic meetings. Greater agility, employees shared tasks, knowledge flowed more freely between functions. Early in the pandemic we started reviewing all processes. Our goal was to ensure that once the pandemic was over, that we had a functional structure allowing us to grow quickly to the same business volume as before the pandemic, but that we could do so with reduced numbers of staff/employees. To do that we focused on automation, on the simplification of processes, and a better flow between departments.

Travel agency III [ ] broaden the functional scope of each employee, and knowledge and information flowed more freely between the employees. We also coordinated functional processes, prior we had had different methods of executing the same function, one department did things this way, another department their way.

Travel agency preliminary conclusion Precovid the company was near zero geared, high equity, operated in a growth market with a rigid structure in a long value chain and classic tourism distribution channels. The high equity and zero gearing meant financial strength to survive with solvency for an extended period. Post covid the company has a more flexible structure, shorter strategic horizon, more efficiency, higher degree of automation and has undergone a review of processes.

Travel agency conclusion II However operating in a traditional long value chain, B2B distribution channel means that during covid, turnover dropped almost completely, equity must be replenished and bookings and accounts have a 2 year latency period. It will take that time to recover completely in spite of tourism entering a new growth phase in Iceland.

Adventure activity company Entrepreneurial company founded in 2010 in South Iceland. Hiking and 4x4 superjeep tours to volcanoes and glaciers. Tailormade adventure tours for incentive market. Organic growth driven by increase in demand and popularity of the local area with tourists. 30 employees that went down to 3 at the start of the pandemic, but then ..

Adventure activity II In their own words: Then as it developed [from 2010] we had 4x4 jeeps, snowscooters and machinery that required buildings, so we needed a garage and a workshop, then we needed a place for the guides to spend the night between tours, then we needed a hostel. It was never my intention to start a restaurant, but it has become the solar plexus of the business today. This model is genial for us, we are our own suppliers [in essence the distribution channel is being developed into a horizontal one] Our growth potential is in the restaurant, our bookings are direct bookings [no intermediaries or tour operators]

Adventure activity in their own words: So in May 2020 we were still working minimum operations. But we did some brainstorming and product development. We saw that, the foreign market was closed. But we developed a simple hiking tour package for the domestic market. The package was a weekend hike across the [nearby mountain]. Guests start on a Friday, hence using the basecamp hostel. On Saturday we did the hike and a barbecue, a typical group of 50 people. At the same time I ran the restaurant for domestic market, where I could get two sessions for dinner covers [a double revpash of 2 factor]. Then when the hiking group got back, we threw them a party as the dinner guests had left. All in all we took in 600 guests enabling us to survive on the domestic market that year.

Adventure travel III Loose structure, high gearing, low equity, non existent distribution channels, B2C, organic growth driven by demand in a growth market, short strategic horizon, quick response to changes in the market. During covid: After the inital phase of lockdowns and consequently total drop in inbound tourism, a demand for domestic tourism arose. A quick response to a different segment resulted in a reopening in the middle of pandemic. Employees back to 30 after 2 months of lockdown.

Adventure activity IV Post covid. Need for new capital, refinancing and strengthening of equity. Restructuring of debt necessary. Back to same business volume as precovid, no latency period, no drop in demand and hence no significant drop in turnover. No change in the business model, no organisational change, no automation processes, no change in strategic horizon. No paid marketing (all on SoMe).