Update on Credit Exposure & Expected Loss Analysis

"Explore the latest updates on credit exposure and expected loss analysis, including inputs, assumptions, distributions, and active counter-parties. Understand the methodologies and insights provided in the report for effective risk management."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Credit Exposure and Expected Loss update Spoorthy Papudesi ERCOT Credit January 18, 2017

Agenda Inputs and assumptions Exposure and collateral distributions Expected loss estimates Observations

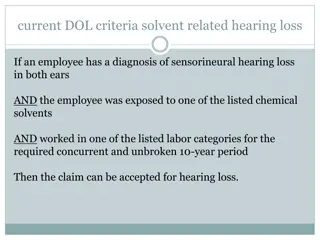

Credit Exposure and Expected Loss update Inputs and Assumptions: Only Active Counter-Parties are included Counter-Parties are classified by rating and market activity TPE and collateral balances used are averages for November and December 2016 Negative excess collateral shown is due to the adjustment to remove unsecured credit Counter-Parties that are subsidiaries of, or guaranteed by, rated entities are given the parent/guarantor s rating, adjusted down one notch Recovery Rate (RR) is assumed 0 Non-rated Counter-Parties are assigned the same PD as CCC 3 PUBLIC

Credit Exposure and Expected Loss update Inputs and Assumptions: Exposure at Default (EaD) is assumed to be equal to TPE TPE will typically exceed invoice exposure, so this is a conservative metric. It should be viewed as a relative indicator of credit portfolio risk, not a forecast for losses or uplift Probabilities of Default (PD) are from Global Corporate Average Cumulative Default Rates By Rating Modifier (1981-2015) , from S&P publication 2015 Annual Global Corporate Default Study And Rating Transitions Expected Loss (EL) computed as follows; EL = EaD * PD * LGD Where: Loss Giver Default (LGD) = (1-Recovery Rate) Recovery Rate is conservatively assumed at 0 as at the time of default, CP may be under stress and would have used up all funds 4 PUBLIC

Credit Exposure and Expected Loss update Inputs and Assumptions: Assumed 1 year Probabilities of Default Rating AAA AA+ AA AA- A+ A A- BBB+ BBB BBB- BB+ BB BB- B+ B B- CCC/C Not Rated PD (1981-2014) % PD (1981-2015)% Change in PD % 0.00 0.00 0.02 0.03 0.06 0.07 0.08 0.13 0.19 0.30 0.40 0.64 1.09 2.23 4.29 7.50 26.38 26.38 0.00 0.00 0.02 0.03 0.06 0.07 0.09 0.15 0.23 0.36 0.49 0.76 1.22 2.51 5.59 8.74 27.22 27.22 0.00 0.00 0.00 0.00 0.00 0.00 0.01 0.02 0.04 0.06 0.09 0.12 0.13 0.28 1.30 1.24 0.84 0.84 5 PUBLIC

Credit Exposure and Expected Loss update Exposure and Collateral Distributions 6 PUBLIC

Credit Exposure and Expected Loss update Active Counter-Parties distribution by rating and category 7 PUBLIC

Credit Exposure & Expected Loss update Average Total Potential Exposure distribution 8 PUBLIC

Credit Exposure & Expected Loss update Average Excess Collateral distribution 9 PUBLIC

Credit Exposure & Expected Loss update Expected Loss distribution 1 0 PUBLIC

Credit Exposure and Expected Loss update Summary statistics by market category 1 1 PUBLIC

Credit Exposure and Expected Loss update Summary statistics by rating group 1 2 PUBLIC

Credit Exposure and Expected Loss update Change from Oct 2016 to Dec 2016 * The PD rates increased by 1.3%, 1.24% and 0.84% for Counter- Parties rated B, B- and CCC/NR respectively. Number of active Counter-Parties has increased from 197 to 202. Market-wide TPE has decreased from 308 million to 262 million while market-wide Excess Collateral has increased from 1,469 million to 1,663 million. TPE of Load and Gen category has decreased by 1.8% while the excess collateral increased by 1.6%. TPE of Gen only category has increased by 1.9%. Expected Loss for the rating group B- to B+ increased by 3.6%. *Numbers presented are averages of Sep-Oct and Nov-Dec 1 3 PUBLIC

Credit Exposure and Expected Loss update Questions 1 4 PUBLIC