Value Added Tax (VAT) and Responsibilities

Value added tax (VAT) is a tax on goods and services purchases, commonly found in the EU and Asia. Learn about VAT implications, payment, and responsibilities for departments handling grants and awards.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

VALUE ADDED TAX 1.10.13

WHAT IS VALUE ADDED TAX (VAT)? A tax on the purchase of a good or service Usually seen in the European Union, but also in Asia Generally between 15%-25%

DO WE HAVE TO PAY THIS TAX? No, but it may be difficult to avoid You can try to get a refund at the airport Best option is to buy item through the internet when you get back Note: The UW does not have a VAT number

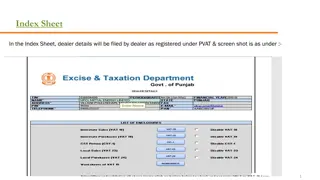

RESPONSIBILITIES - DEPARTMENT Check award documentation to see if VAT is or is not allowable. For any awards from NIH or other DHHS agencies (CDC, HRSA, etc.), the VAT would not be allowed because the foreign component of those awards is significant. VAT would need to be paid from non- sponsored funds. See sample NIH language below: Customs and Import Duties: Allowable under grants to domestic organizations when performance will take place entirely within the United States, its possessions, or its territories, or when foreign involvement in the project is incidental to the overall grant-supported project. Charges may include consular fees, customs surtaxes, value- added taxes, and other related charges. Consular fees, customs surtaxes, value-added taxes, and other related charges are unallowable on foreign grants or the foreign component of a domestic grant.

RESPONSIBILITIES DEPARTMENT, CONTD. Review prior purchases that include VAT and transfer any unallowed VAT off of the grant. Since OMB does not address these particular taxes, for other federal sponsors, review the particular terms and conditions to see if VAT is addressed. If no, then apply the general principles of allowability: reasonable, allocable, and consistent treatment.

RESPONSIBILITIES CENTRAL OFFICES Communicate the policy to campus and advise them on what they need to do to ensure they are only charging allowable costs to their grants Field questions (EIO/GCA Compliance/UW Tax Office)

CONTACT INFORMATION UW Tax Department taxofc@uw.edu or 206.685.0571 Equipment Inventory Office Erin Fujiwara efuji@uw.edu or 206.543.9859