VAT Refund Regulations and Risk-Based Verification Guidelines

Learn about Revenue Regulations No. 5-2024 pertaining to tax refunds, effective from April 27, 2024. The regulations introduce a risk-based verification approach for VAT refund claims, outlining criteria for low, medium, and high-risk classifications. Understand the documentary requirements and implications of COA involvement for approved VAT refunds.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

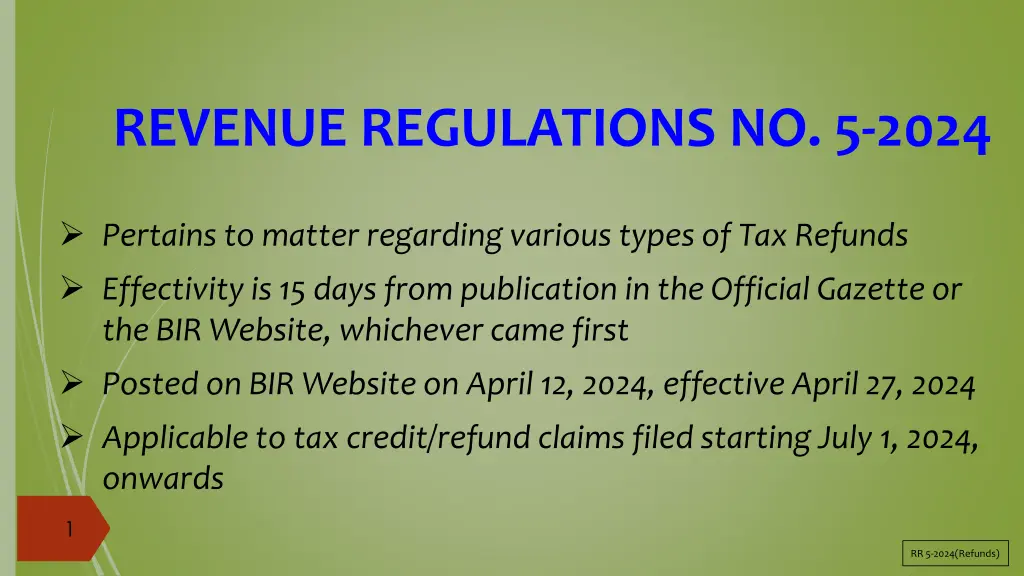

REVENUE REGULATIONS NO. 5-2024 Pertains to matter regarding various types of Tax Refunds Effectivity is 15 days from publication in the Official Gazette or the BIR Website, whichever came first Posted on BIR Website on April 12, 2024, effective April 27, 2024 Applicable to tax credit/refund claims filed starting July 1, 2024, onwards 1 RR 5-2024(Refunds)

Changes per EOPT Act 1. Introduction of risk-based approach to verification of VAT Refunds per Section 112(C) of the NIRC 2. Liability in case of COA disallowance of the amount refunded per Section 112(D) of the NIRC 3. Refund of excess income tax credit in case of dissolution or cessation of business under Section 76(C) of the NIRC 4. Introduction of 180-day period to process claims for tax refunds in certain cases per Section 204(C) of the NIRC 5. Amended policies on filing of judicial claims per Section 229 of the NIRC 2

Risk-based Verification of VAT Refund Claims 1. Introduced in Section 112(C) of the NIRC on period of granting VAT refunds applicable to : a. Zero-Rated Sales per Section 112(A) b. Cancellation of VAT Registration per Section 112(B) 2. Classifies claims into: a. Low Risk b. Medium Risk c. High Risk 3

Risk Matrix Complete Documentary Requirements Yes Risk Level Scope of Verification of Sales Scope of Verification of Purchases Low No verification No verification At least 50% of amount of sales and 50% of total invoices/receipts issued including inward remittance and proof of VAT zero-rating At least 50% of total amount of purchases with input tax claimed and 50% of suppliers with priority on "Big- Ticket" Purchases Medium Yes High Yes 100% 100% Subject to certain limitations per Section 3.B of RR 5-2024 4

Risk-based Verification contd 3. Risk Factors Considered: a. Amount of VAT refund claim b. Frequency of filing VAT refund claims c. Tax compliance history d. Other risk factors that may be identified 4. Application as to kinds of claims a. Generally applies to claims under Section 112(A) on Zero Rated Sales subject to limitations on the matrix b. Claims under Section 112(B) due to cessation of business are automatically classified as High Risk subject to full verification per Section 3(B)(5) of RR5-2024 5

COA involvement on VAT Refunds 1. Refunds do not need the approval of the COA 2. Approved VAT Refunds are subject to COA post-audit 3. In case of disallowance by the COA Only the taxpayer shall be liable for the disallowed amount Any BIR employee who may be found to be grossly negligent in the grant of the refund may be subject to administrative liability 6

Periods for Excess income tax credit per Section 76(C) 1. Regular Claims of existing entities who opted for tax credit or refund for excess income tax credits in their AITR a. Should be filed within 2 years from the date of filing of the AITR. Section 58(E) of the NIRC, as amended by Section 9 of the EOPT Act and Section A.4.a of RR 5-2024 b. BIR has 180 days to decide on the application Section 6(D) of RR 5-2024 2. Due to Cessation of Business a. Should be filed within 2 years from payment. Section 58(E) of the NIRC, as amended b. BIR has 2 years from the date of dissolution/cessation of business to decide on the application Section 5.B.2-3, RR -5-2024 7

Periods for VAT Refund Claims per Section 112 (C) 1. Zero-rated/effectively Zero-rated sales (regular claims) per Section 112(A) a. Should be filed 2 years from close of quarter when sales were made not new, already included in TRAIN Law and RR 13-2018 b. BIR has 90 days from the filing of the claim up to the release of the payment thereof per Section 112(C) not new, already in TRAIN Law and RR 13-2018, period used to be 120 days per RR 16-2005 2. Cancellation of VAT registration under Section 112(B), NIRC a. Should be filed within 2 years date of cancellation of registration not new, already in TRAIN Law and RR 13-2018 b. BIR has 90 days from the filing of the claim up to the release of the payment thereof per Section 112(C) Section 3.I of RR 5-2024 8

Processing of Refunds per Section 204(C) 1. Generally covers taxes erroneously or illegally received or penalties imposed without authority 2. Claim has to be filed within two (2) years after the payment of the tax or penalty Section 6(B) of RR 5-2024 /Section 31 of the EOPT Act, amending Section 204(C) of the NIRC A filed return showing overpayment shall be considered as a written claim for credit or refund. 3. In case of full or partial denial, the BIR shall state the legal and/or factual basis for the denial 9

Section 204(C) - contd 4. BIR shall process and decide within 180 days* from submission of complete documents in support of the application Failure of any BIR official, agent, or employee to observe the 180-day period to process shall be punishable under Section 269 of the NIRC for Violations committed by Government Enforcement Officers * 90 days was proposed in the CREATE Law, but the same was vetoed by PRRD, for being too short and administratively unfeasible. Delays on processing of refunds under 204 is now included. Before, it was only 112 that was mentioned Change was made per Section 31 of the EOPT Act, amending Section 204 of the NIRC/ Section 6(B) of RR 5-2024 10

END OF PRESENTATION THANK YOU! 11