Vendor Identification Codes, Zip Codes, and 1099s

Explore the process of assigning vendor identification codes, creating zip codes, and managing 1099 information in this comprehensive guide. Learn how to efficiently handle vendor data and stay compliant with fiscal regulations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Vendor Identification Codes, Zip Codes, 1099s and Unclaimed Property Sylvia James Director of Fiscal Services Budget, Accounting & Reporting Council Conference March 2018

Todays Topics Vendor Identification Codes (Screen MM2001) Creating Zip Codes (Screen ZX0020) 1099s Unclaimed Property

Vendor Identification Codes (Screen MM2001) TO ADD From the System Menuenter MM2001 in the highlighted field and press the ENTER Key Using the vendors name covert the name to an identification code using Standard Naming Convention, by completing the following steps Standard naming convention: (First 5 letters of the first word in vendor name) + (1) + (First three letters of the second word in vendor name, INC or LLC may be used as well) Example: PIERC1COL would be for Pierce College If the name is too short, use 0 s as a place holder (Example: ABC001000) Once you have completed assigning a vendor identification code, enter the code in the highlighted field and press F2. Use the information from the vendor s W9 to input data into the open fields Be sure to select if the vendor is 1099 eligible, and enter the vendor s FED TIN If the vendor has a DBA, enter the first name on the W9 in the VENDOR NAME field, and the DBA in the line 1 of both the BUSINESS ADDRESS field and the PAYMENT ADDRESS fields Enter the year/month (18/03) in the NAME field at the bottom of the screen to indicate when the vendor info was updated TO CHANGE From the System Menu enter MM2001 in the highlighted field and press the ENTER Key After verifying you are looking at the vendor that would want to change, press F3 Change the data in the appropriate fields, update the year/month in the NAME field at the bottom to indicate when the vendor was updated last Press Enter when finished

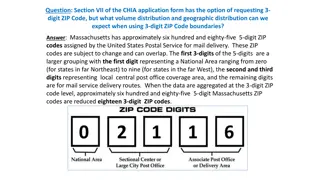

Creating Zip Codes (Screen ZX0020) TO ADD From the System Menu enter ZX0020 in the highlighted field and press the ENTER Key Enter the zip code you want to add in the Zip Code field and press the "F2" (Add). Enter the name of the City and press the "TAB" key to move to the next field. . Enter the State initials in caps in the State field Press the "ENTER" key after you have entered the information in the State field. City Code and County Code are optional fields. The line at the bottom of the screen above the boxes will say "Add complete". You can then continue to follow the procedures to enter more Zip Codes or press the "F8" (Menu) key to return to the System Menu. TO CHANGE Enter the Zip Code in the first field and press the "F3" (Change) key. Information that has been entered for that Zip Code will be entered into the appropriate fields. Move to the field(s) you want to change by using the "TAB" key. Make your changes. If you need to move backwards to another field press the "SHIFT" and "TAB" keys at the same time. When all changes are entered for that Zip Code press the "ENTER" key. The line at the bottom of the screen above the boxes will say "Change complete". You can then continue to follow the procedures to enter more Zip Codes or press the "F8" (Menu) key to return to the System Menu. TO INQUIRE Enter the Zip Code in the first field and press the "F4" (Inquiry) key. The information that has been entered for that Zip Code will come up on the screen. You can't make any changes when in inquire mode. **NOTE** You can do Inquiry, Add and Change all on the same screen. You don't need to go out of the zip code screen and come back into it for each type of action, just enter the Zip Code and press the corresponding F key for the action you want to perform.

1099s Instructions regarding 1099msc preparation can be found annually on the IRS website. *BEST PRACTICE* Update W9s with the payee annually. Reports to look at, at December month end: - MM2206 1099-MISC Summary (By Month) Report - MM2205A 1099-MISC Detail Report Review NO MATCH ON SOBJ - MM2205C 1099-MISC Error Report The MM2206 report shows which vendors are in the system that have the 1099 indicator marked with a Y. It totals, by month, how much money was sent to the vendor. Occasionally, some amounts do not show up on the report, so it is necessary to look up each of the vendors that show up on the MM2206, in the BM3002 screen to double check how much money we have sent to them. - Print each BM3002 for each vendor that needs a 1099. Add up the invoice payment amounts of any checks printed in the current year. Attach the calculator tape to the BM3002 print out. Compare with the MM2206 report. - Print each Vendor Screen (MM2001) for each vendor that needs a 1099. It provides evidence that we have the most current address. Occasionally you may get a notice from the IRS when the name on a 1099 does not match. The IRS considers a TIN as incorrect if either the name or number shown on the account does not match a name or number combination in their files or the files of the Social Security Administration. You are required to send a Backup Withholding Warning to the individual. The IRS requires that this documentation be kept by the college.

May 26, 2015 FIRST B NOTICE IMPORTANT TAX NOTICE ACTION IS REQUIRED Backup Withholding Warning! We need a Form W-9 from you before the date shown below: Date: June 30th, 2015 (Otherwise, backup withholding will begin.) Current Name on Account: XXX Current TIN on Account: XXX Current Filing Status: XXX on your account with us does not match their records. The IRS considers a TIN as incorrect if either the name or number shown on the account does not match a name or number combination in their files or the files of the Social Security Administration (SSA). If you do not take appropriate action to help us correct this problem before the date shown above, the law requires us to withhold 28 percent on the interest, dividends, and certain other payments that we make to your account. This is called backup withholding. The Internal Revenue Service (IRS) has notified us that the taxpayer identification number (TIN) give us your correct name/TIN combination. In addition to backup withholding, you may be subject to a $50 penalty by the IRS for failing to backup withholdings and penalty. This notice tells you how to help us make your account records accurate and how to avoid WHY YOUR TIN MAY BE CONSIDERED AS INCORRECT records because a name has changes through marriage, divorce, adoption, etc., and the change has not been reported to SSA, so it has not been recorded in SSA s files. An individual s TIN is his or her social security number (SSN). Often a TIN does not match IRS example, an account in a child s name may reflect a parent SSN. (An account should be in the name and SSN of the actual owner.) Sometimes an account or transaction may not contain the correct SSN of the actual owner. For

WHAT YOU NEED TO DO Individuals card and do not know your SSN), call your local SSA office and find out how to obtain an original (or a replacement) social security card. Then apply for it. If you have never been assigned a social security number (or if you have lost your social security us (shown at the beginning of this notice) with the name and SSN shown on your social security card. Then use the Individual Question Chart on the next page to decide what action to take. If you already have a social security number, compare the name and SSN on your account with Non-Individuals and Certain Sole Proprietors For most non-individuals (such as trusts, estates, partnerships, and similar entities), the TIN is the employer identification number (EIN). The EIN on your account may be incorrect because it does not contain the number of the actual owner of the account. For example, an account of an investment club or bowling league should reflect the organization own EIN and name, rather than the SSN of a member. Please put the name and EIN on the enclosed Form W-9, sign it, and send it to us. his or her sole proprietorship. In addition to his or her individual name, the sole proprietor may also furnish the business name for the sole proprietorship, provide his or individual name is listed before the business name. A sole proprietor must not furnish only the business name. Please put the individual name and SSN or RIN on the enclosed Form W-9, sign it, and send it to us. A sole proprietor must furnish his or her individual name and either his or her SSN or the EIN for IMPORTANT REMINDER! YOU MUST SEND US A SIGNED IRS FORM W-9 BEFORE THE DATE OF THIS NOTICE even if the name and number (SSN or EIN) on your account with us matches the name and number (SSN or EIN) on your social security card or the document issuing you an EIN. If we do not receive your Form W-9, and any other documents that we need to change the name or TIN (or both) on your account before the date on this notice, we are required by law to withhold 28 percent from any reportable payment that we pay to your account until we receive the necessary documents. A Form W-9 is enclosed for your convenience, as well as any additional documents allowing us to change the name/TIN combination on your account. PIERCE COLLEGE CONTACT: Wendy Vu Finance Office Fiscal Analyst 4 9401 Farwest Dr. SW Lakewood, WA 98498-1999 Phone: (253)964-7348 Fax: (253)964-6599 E-mail: WVu@pierce.ctc.edu

INDIVIDUAL QUESTION CHART 1.) IF: The last name and SSN on your account agree with the last name and SSN on your social security card. THEN: Contact your local SSA office to ascertain whether the information on the SSA s record is different from that on your card and resolve any problem. Also, put your name and SSN on the enclosed Form W- 9 following the instruction on the form. Sign the Form W-9 and send it to us. 2.) IF: The SSN on your account is different from the SSN on your social security card, but the last name is the same. THEN: Put your name and SSN, as shown on your social security card, on the enclosed form W-9, following the instruction on the form. Sign the Form W-9 and send it to us. You do not need to contact SSA. 3.) IF: The last name on your account is different from the last name on your social security card, but the SSN is the same on both. THEN: Take one of the following steps (but not both): (a)If the last name on your account is correct, contact the SSA to correct the name on your social security card. Put your SSN and name shown on your account on the enclosed form W-9, following the instruction on the form. Sign the Form W-9 and send it to us. However, is you are not able to contact SSA at this time, you can provide us with both last names. Put your SSN and the name shown on your social security card plus the last name shown on your account (in that order) on the enclosed Form W-9 following the instructions on the form, sign it, and return it to us. Please note, however, that you should contact SSA as soon as possible so they can correct their records. (b)If the last name on your social security card is correct, put that name and your SSN on the enclosed Form W-9 following the instructions on the form. Sign it, and return it to us. You do not need to contact SSA. information to us (and all other payers) for all of your accounts to avoid a problem in the future. If you are required to visit and SSA office take this notice, your social security card, and any other related documents with you. Before you go, you should call SSA so that they can explain what other documents you need to bring. Once you have resolved what your correct name and TIN combination is, you must provide this

Unclaimed Property 1. PURPOSE AND DESCRIPTION This procedure outlines the management and control over statutorily canceled warrants as well as the general accounting processes and Department of Revenue regulations for unclaimed property. SAAM 85.38.40, SAAM 85.38.50, SAAM 85.74.30, RCW 42.56.070(9), RCW 43.08.062 and RCW 63.29 2. RESPONSIBILITIES a. The Pierce College Business Office reviews the monthly banking reconciliation report and cancels warrants (checks) that have not been presented for payment within 180 days from the date of issue (SAAM 85.38.40.a & RCW 43.08.062). This is accomplished by removing the check from Key Total Treasury in the Check Maintenance Screen as well as cancelling the check in the Financial Management System (FMS, Screen BM3003). Cancellation of Warrants: Prior to checks being cancelled in the FMS (BM3003) the Business Office will also verify that the check has not been cashed through Key Total Treasury in the days following the production of the end of month report. FMS Batch Identifiers 52-55 will be set to manual release so that cancelled checks can be reviewed for any Financial Aid (Title IV) that must be returned. This includes but, is not limited to; Pell, Perkins, Stafford, etc. but, does not include institutional Pierce College grant funds. Batches are then reviewed and released. Items that will be sent to the Department of Revenue will be reversed and turned into a Liability for Canceled Warrants/Checks (SAAM 85.38.40.a (5)). Items moved into a Liability for Canceled Warrants/Checks are logged onto a spreadsheet of statutorily cancelled checks. Should this information be requested in accordance with the Public Records Act (RCW 42.56.070(9)), Pierce College is to ensure that this information will not be used for commercial purposes. Before releasing this information, Pierce College must have an Affidavit to Release Outstanding or Cancelled Warrants signed by the individual requesting a copy of the log. Should an individual contact the Business Office, please refer them to the College s Public Records Coordinator. b. Unpresented general checks are presumed abandoned after two years if they remain uncashed. Types of general checks for Pierce College include: accounts payable, expenses and drafts, vendor payments, and refunds. Department of Revenue, Unpresented Checks Between May 01 and August 01 of every year, the Business Office will send Due Diligence letters to the owners of the Unpresented Checks that are valued over $75. For reissue of statutorily canceled warrants, please see SAAM 85.38.40b. Pierce College must report and escheat Unclaimed Property, as of June 30, annually by November 01. Unclaimed Property reports and supporting detail must be kept for 6 years after the filing date (RCW 63.29).