Wells Fargo Scandal and Communication Design Case Study

Explore the Wells Fargo scandal involving fake accounts, its impact on personal customers, employee handbook recommendations, and efforts towards rebuilding trust through effective communication strategies. Dive into the complexities of corporate culture, ethical responsibilities, and the evolving landscape of organizational communication.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Scandal and Communication Design: The Case of Wells Fargo Joanna Schreiber Georgia Southern University

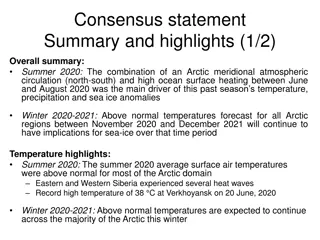

Wells Fargo Fake Account Scandal Timeline In 2016, Wells Fargo agreed to pay a $185 million settlement in the wake of a scandal involving approximately 2.1 million accounts fake accounts generated by WF employees. In 2017, additional fraudulent accounts were discovered for a total of approximately 3.5 million fake accounts. In 2018, Wells Fargo launched a marketing campaign with the tagline re-established 2018. It was received with mixed reviews .

Scandal Affects Personal Customers Corporate culture and performance metrics were largely blamed for the scandal. Scandal affected one customer category: Personal or Individual Customers. No evidence has emerged that business customers were directly affected.

In 2020, Wells Fargo continues to provide advice to its small business customers related to leadership, management, and building an effective corporate culture.

Shaping the Workplace (Extending Spilka) Extend Spilka: Scholars must take on the responsibility to engage complex problems that will be difficult to impossible to scope on the ground. We can t put all of our ethical action on individual technical communicators.

Wells Fargo Employee Handbook It starts with you Remember, every team member contributes to the culture of Wells Fargo with the words we use, the actions we take, the way we treat each other, and how we treat our customers. We will build a strong culture together by meeting companywide behavioral expectations that align to our Vision, Values & Goals. These clear and common expectations ensure that everyone understands and lives the Wells Fargo culture in our interactions with each other, our communities, and our customers. (2019 and 2020 Handbook)

Other topics that need to be explored from the handbook Values and Vision Statement How employee/management relationships are defined Performance metrics Corporate culture and ethics statements Processes and procedures for reporting issues

Things to consider when studying industry or corporate scandal 1. The same technologies that allow us to target customers, develop audience-specific content. 2. The issues in the financial industry involve complex problems related to user experience, technological affordances, design, discourse. 1. This is ground not to be left solely to Public Relations and Biz Comm.

Items collected Letters and communication with personal customers Employee handbook from 2019 and 2020 Marketing materials from failed 2018 rebranding effort Targeted web content

Research Questions How does the design of the site affect Wells Fargo s ability to maintain ethos with some customer groups? How do the technological and strategic affordances to target different groups of customers with different messages serve to also partition scandal? How can we use this case as a lens to look at larger systemic issues in the financial industry?

What can this become? An interesting case study? A broader study of the industry? An opportunity for intervention?