What is a Bridging Loan

Unlock property opportunities fast with a UK bridging loan. Our guide reveals how to secure short-term finance for any project. Learn the secrets and get your funds quickly. Read the full blog now to leverage your assets!

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

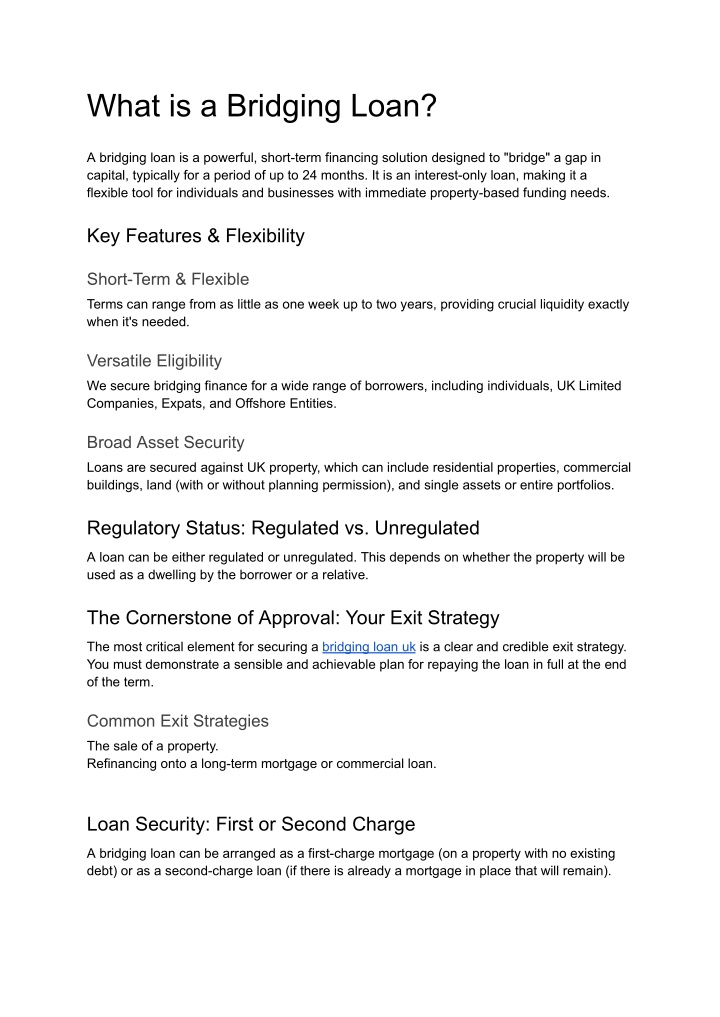

What is a Bridging Loan? A bridging loan is a powerful, short-term financing solution designed to "bridge" a gap in capital, typically for a period of up to 24 months. It is an interest-only loan, making it a flexible tool for individuals and businesses with immediate property-based funding needs. Key Features & Flexibility Short-Term & Flexible Terms can range from as little as one week up to two years, providing crucial liquidity exactly when it's needed. Versatile Eligibility We secure bridging finance for a wide range of borrowers, including individuals, UK Limited Companies, Expats, and Offshore Entities. Broad Asset Security Loans are secured against UK property, which can include residential properties, commercial buildings, land (with or without planning permission), and single assets or entire portfolios. Regulatory Status: Regulated vs. Unregulated A loan can be either regulated or unregulated. This depends on whether the property will be used as a dwelling by the borrower or a relative. The Cornerstone of Approval: Your Exit Strategy The most critical element for securing a bridging loan uk is a clear and credible exit strategy. You must demonstrate a sensible and achievable plan for repaying the loan in full at the end of the term. Common Exit Strategies The sale of a property. Refinancing onto a long-term mortgage or commercial loan. Loan Security: First or Second Charge A bridging loan can be arranged as a first-charge mortgage (on a property with no existing debt) or as a second-charge loan (if there is already a mortgage in place that will remain).