What's New in Medicare 2024: Coverage, Choices, and Updates

This content provides insights into what's new in Medicare for 2024, including coverage details, plan choices, and updates to Parts A, B, and D. It also highlights the importance of reviewing your plan annually and offers information on enrollment considerations for Part D plans.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

MICHIGAN MEDICARE ASSISTANCE PROGRAM (MMAP) AREA AGENCY ON AGING 1-B WHAT S NEW IN MEDICARE 2024 1 3/10/2025

WHAT WE WILL COVER Medicare What it is What s new to Medicare for 2024 Why you should review your plan each year What to look for when choosing a plan MMAP Who we are How MMAP can help you understand plan choices and potentially save money 2 3/10/2025

WHAT IS MEDICARE? Part A: Hospital Insurance Part B: Medical Insurance Part D: Part C: Medicare Advantage Prescription Drug Prescription Drug Coverage Prescription Medications Some Vaccinations Includes Parts A, B and D in one plan HMO and PPO Plan Options May Offer Extra Benefits Inpatient Care in Hospital Skilled Nursing Facility Care Hospice Care Home Health Care Services from Doctors Outpatient Care Home Health Care Durable Medical Equipment Preventative Services 3 3/10/2025

Your Medicare Coverage Choices Medicare Advantage (Part C) Original Medicare Includes Parts A & B HMOs or PPOs That Typically Include Parts A, B and D Part A = Hospital Insurance Part A = Hospital Insurance Part B = Medical Insurance Part B = Medical Insurance You Can Add Part D = Prescription Coverage PLUS Part D = Prescription Coverage You Can Add (Most plans cover prescription costs) Medigap Supplement (To help pay out-of -pocket costs)

ORIGINAL MEDICARE UPDATES PARTS A& B 5 3/10/2025

ORIGINAL MEDICARE 2024 INFO Part A Part B Benefit Period Deductible: $1,632 Monthly Premium: $174.70 Hospital copay: $400 (Days61-90) $816 (Days 91-150) SNF copay: $200 /day Annual Deductible: $240 Monthly Premium: Up to $506 6 3/10/2025

MEDICARE PRESCRIPTION DRUG BENEFIT UPDATES MEDICARE PART D & MEDICARE ADVANTAGE 7 3/10/2025

PART D PLAN ENROLLMENT THINGS TO CONSIDER Cost Premium, Deductible, Co-pays Senior Savings Model Coverage Are my drugs covered? Tiers Prior Authorization, Quantity Limits, Step Therapy? Nationwide coverage for travelers Pharmacy Network, Preferred Mail order 8 3/10/2025

MEDICARE ADVANTAGE PLAN ENROLLMENT THINGS TO CONSIDER Cost Premium, Deductible, Co-pays Senior Savings Model Coverage Are my drugs covered? What tier are they? Prior Authorization, Quantity Limits, Step Therapy? Pharmacy In-Network, Preferred, Mail Order Primary Care Physician/ Specialists Are they in or out of network? Do I need a new one that is in-network Extra Benefits Dental, Vision, Hearing Benefits Generally separate insurance rider Fitness Benefits Transportation Telehealth and more 9 3/10/2025

MEDICARE ADVANTAGE OPEN ENROLLMENT PERIOD If you have a Medicare Advantage Plan January 1, 2023 you have another enrollment period January 1- March 31. During this time if you are unhappy with your current Medicare Advantage plan coverage, you can: Change to a different MA plan Change to Original Medicare with a Part D plan However, you MUST already have a Medicare Advantage plan in order to utilize the MA OEP. 10 3/10/2025

MEDIGAP UPDATE MEDICARE SUPPLEMENTAL INSURANCE 11 3/10/2025

MEDIGAP PLANS- EXTRA BENEFITS Companies Offering Extra Benefits Extra Benefits: AARP/UHC Dental BCBS Vision HAP Hearing Humana Gym Membership Perkin Life Insurance Company Priority Health Wisconsin Physicians Service Insurance Corporation 12 3/10/2025

Medicare and You 2024 2024 MEDICARE & YOU BOOK: WHAT S NEW Starting January 1, 2024, if you have Medicare drug coverage (Part D) and your drug costs are high enough to reach the catastrophic coverage phase, you don t have to pay a copayment or coinsurance. Extra Help a program that helps cover your Part D drug costs will expand to cover more drug costs for certain people with limited resources and income. Go to pages 83 and 92. Saving money on your prescription drugs Coinsurance amounts for some Part B-covered drugs may be less if a prescription drug s price increases higher than the rate of inflation. Go to page 40. Lower costs for insulin and vaccines Your Medicare drug plan can't charge you more than $35 for a one-month supply of each insulin product Part D covers, and you don t have to pay a deductible for it. Go to page 88. If you take insulin through a traditional pump that s covered under Medicare s durable medical equipment benefit, that insulin is covered under Medicare Part B. You won t pay more than $35 for a month s supply and the Medicare deductible no longer applies. Go to pages 39 and 88. Recommended adult vaccines are also now available at no cost to you. Go to page 50. Changes to telehealth coverage You can still get telehealth services at any location in the U.S., including your home, until the end of 2024. After that, you must be in an office or medical facility located in a rural area to get most telehealth services. There are some exceptions, like for mental health services. Go to page 51. Managing and treating chronic pain Medicare now covers monthly services to treat chronic pain if you ve been living with it for more than 3 months. Go to page 34. Better mental health care Starting January 1, 2024, Medicare will cover intensive outpatient program services provided by hospitals, community mental health centers, and other locations if you need mental health care. Go to pages 46 47. More times to sign up for Medicare If you recently lost (or will soon lose) Medicaid, you may be able to sign up for Medicare or change your current Medicare coverage. There are other special situations that allow you to sign up for Medicare. Go to page 18. COVID-19 care Medicare continues to cover the COVID-19 vaccine and several tests and treatments to keep you and others safe. Go to page 37.

ENROLLMENT PERIODS Initial Enrollment Period (IEP) Annual/Open Enrollment Period (OEP) Special Enrollment Periods (SEPs) 14 3/10/2025

SEPs enable beneficiaries to make Part D plan changes in special situations, including: Involuntary loss of creditable coverage Moving Other exceptional circumstances SPECIAL ENROLLMENT PERIODS (SEP) Medicaid or LIS beneficiaries have an SEP. Join, or switch plans once per calendar quarter COBRA Not considered creditable coverage for Medicare Part B Drug coverage may qualify as an SEP into Part D enrollment 15 3/10/2025

PUBLIC HEALTH EMERGENCY UNWINDING AND SEP Special Enrollment Periods (SEPs) for beneficiaries losing Medicaid coverage who need to enroll in Medicare Available for up to 6 months Coverage begins either: The month after enrollment Retroactive to the date their Medicaid ended Those without MSP with have to pay premiums for retroactive months if they choose that No late enrollment penalty (LEP) 3/10/2025 16

A FEW THINGS TO REMEMBER If you do not enroll on-time and/or have creditable coverage (as good or better than what Medicare provides) you may be subject to penalties If you have a Medicare Advantage plan with a separate rider for Dental, Vision and/or Hearing, and you switch your plan, you must cancel the rider separately. It does not automatically cancel when you change plans If you switch from a Part D with a Medigap to a Medicare Advantage Plan, you must cancel your Medigap policy. It will not automatically cancel, and you cannot have both a Medicare Advantage Plan and a Medigap at the same time. It is always good to talk to us before making any changes. We can walk you through the process to help ensure you are not left with unnecessary expenses or hassle. 3/10/2025 17

MEDICARE AND EMPLOYEE COVERAGE Enrolling in Medicare Parts A and/or Part B Delaying enrollment into Parts A and Part B Receiving health coverage from an employer with 20+ employees and You cannot contribute pre-taxed dollars to HSA Want to continue putting funds into HSA tax-free Stop contributing the month your Medicare coverage begins Can use a special enrollment period to enroll in Medicare Can withdraw tax-free to pay qualified medical expenses Stop contributing to HSA at least 6 months before you enroll in Medicare Medicare pays primary to the job- based coverage

Part D Premiums are subject to income adjustments PART D INCOME RELATED MEDICARE ADJUSTMENT AMOUNT (IRMAA) Beneficiaries with significant income will pay a sliding scale higher Part D premiums (based on IRS tax returns from 2 years prior) There are 6 income categories Each category has a set dollar amount associated with it For more information on Part D IRMAA call MMAP 19 3/10/2025

2024 PART D IRMAA Individual tax filers with income: Joint tax filers with income: IRMAA for Part D < $103,000 < $206,000 $0 $103,001 to $129,000 $206,001 to $258,000 $12.90 + PP $129,001 to $161,000 $258,001 to $322,000 $33.30 + PP $161,001 to $193,000 $322,001 to $386,000 $53.80 + PP $193,001 to $500,000 $386,001to $750,000 $74.20 + PP Above $500,000 Above $750,000 $81.00 + PP 20

2024 PART B IRMAA Individual tax filers with income: Joint tax filers with income: IRMAA for Part B < $103,000 < $206,000 $174.70 $103,001 to $129,000 $206,001 to $258,000 $244.60 $129,001 to $161,000 $258,001 to $322,000 $349.40 $161,001 to $193,000 $322,001 to $386,000 $454.20 $193,001 to $500,000 $386,001to $750,000 $559.00 Above $500,000 Above $750,000 $594.00 21

3/10/2025 22

EXTRA HELP/LOW-INCOME SUBSIDY Subsidy provided by Social Security Administration Helps with the cost of Part D Prescription Drug Coverage: Premiums, Deductibles, Co-pays The partial low-income subsidy will be eliminated in 2024. Individuals receiving a partial subsidy will be automatically assigned a full subsidy by the Social Security Administration . This benefit is part of the Inflation Reduction Act of 2022. 23 3/10/2025

COVERAGE GAP/DONUT HOLE 2024: Beneficiaries who reach the coverage gap will pay a maximum of: 25% for their generic medications 25% for brand name medications 24 3/10/2025

MEDICARE PLAN FINDER Provides Personalized Search Saves your med list Create a Log-In Cost of medications Deductible pricing Monthly premium pricing Able to compare Part D and Medicare Advantage plans Anonymous Searches Available Will not save your med list 25 3/10/2025

MEDICARE PLAN FINDER STAR RATING SYSTEM Medicare Advantage Plans rating categories: Staying healthy: screenings, tests, and vaccines Managing chronic (long-term) conditions Plan responsiveness and care Member complaints, problems getting services, and choosing to leave the plan Health plan customer service Part D plan rating categories: Drug plan customer service Member complaints, problems getting services, and choosing to leave the plan Member experience with the drug plan Drug pricing and patient safety 26 3/10/2025

LOW PERFORMING PLANS & MEDICARE WEBSITE Plans who received less than 3-star quality rating for 3 consecutive years Beneficiaries will not be able to enroll on Medicare s website Can enroll directly through the plan or by calling 1-800-MEDICARE Warning will appear on Medicare s website 27 3/10/2025

Plan Annual Notice of Change (ANOC) Part D and Medicare Advantage Plans can change their benefits and costs annually ANNUAL PLAN CHANGES Be sure to check Premium, deductible, co-payment changes Are your drugs still covered? Are your drugs still covered at the same tier? Are there restrictions to your drugs? Is there another Plan that offers better coverage? 28 3/10/2025

3/10/2025 INFLATION REDUCTION ACT OF 2022 MEDICARE PRESCRIPTION DRUG PROVISIONS 29

IRA: MEDICARE PRESCRIPTION DRUG PROVISIONS Requires the federal government to negotiate prices for some of the most popular medications under Medicare Requires drug companies to pay rebates if prices rise faster than inflation for drugs used by Medicare beneficiaries Eliminates 5% coinsurance for catastrophic coverage in Part D Adds a $2,000 cap on Part D out of pocked spending (effective 2025) Limits annual increases in Part D premiums for a limited time Expands eligibility for Extra Help/ Low Income Subsidy (LIS) Limits monthly cost sharing for insulin to $35 Eliminates cost sharing for adult vaccines under Part D Delays implementation of the Trump Administration drug rebate rule 3/10/2025 30

TIMELINE 2023 2025 2027 2029 Drug Companies pay rebates Insulin $35 cap Vaccine copay reduction $2000 out-of-pocket cap in Part D Negotiation of 15 Medicare Part D drugs Delay drug rebate rule Negotiation of 20 Medicare Part B and Part D drugs Negotiation of 15 Medicare Part B and Part D drugs Eliminates 5% coinsurance Part D catastrophic level Expands LIS eligibility 2024 Negotiation of 10 Medicare Part D drugs 2026 2028 2026 2029: Implements negotiated prices for certain high cost drugs 2024 2030: Limits Medicare Part D premium growth to no more that 6% per year 3/10/2025 31

3/10/2025 MARKETING AND SCAMS KEEPING YOURSELF SAFE 32

SENIOR MEDICARE PATROL Seniors are being targeted by scammers in greater numbers than ever. Senior Medicare Patrol (SMP), for Michigan, charged with helping prevent, detect and report Medicare Fraud, Abuse and Scams. The SMP is a national program funded through federal dollars. MMAP Programs across the state are the SMP for Michigan If you think you have been a victim or want to report a potential scam, call us at 800-803-7174 or send an e-mail to MMAP@aaa1b.org 3/10/2025 33

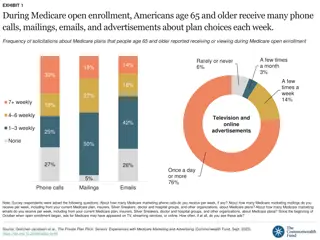

Medicare plans cannot: Market themselves as Medicare endorsed Solicit from door-to-door or go door-to-door to leave materials on your doorstep or mailbox Call people on national and state do not call lists MARKETING GUIDELINES Enroll people over the phone during a solicitation call Market outside the plan s service area Make unsolicited calls or leave voice messages Approach you or market to you in a public place like a grocery store or park 34 3/10/2025

BEING SAFE ON THE PHONE AND INTERNET & STAYING SAFE FROM TV AND RADIO ADS Don t pick up your phone if you don t recognize the number. If someone wants to talk to you, they will leave a message. Marketers are not allowed to leave a message. 1. Be leery even when you do recognize the number. Artificial Intelligence can imitate people s voices and make you believe you are talking to someone you know. 3. It s best to simply call the caller back. 4. Never share your personal information with people who don t need to have it. 5. If you get an e-mail or text message that, for example, states that a product you ordered is waiting for you to verify the address and all you have to do is call or click on a link, DON T. If you actually ordered something, call or e-mail the company directly. 6. The ads on TV and Radio generally have disclaimers that are written and/or read very fast and in very small print. Do not call the numbers they state. They may be legitimate or you may be scammed, and you quite possibly are not eligible for all the services. 7. Call MMAP if you are interested in specific plans or items mentioned in an ad. We will help you determine what you are eligible for. 8. 3/10/2025 35

Covered by Medicare Part B Covered by Original Medicare, Medicare Advantage and other plans Medicare Preventive Services Find problems early, when treatment works best

Paying for Preventive Services Original Medicare Pay nothing for most preventive services from a provider who accepts assignment May require coinsurance for office visit May pay more from provider who does not accept assignment Medicare Advantage or other Medicare plans may require copayment

WELCOME TO MEDICARE VISIT One-time visit Covered within first 12 months of getting Part B Review of medical and social history Height, weight and body mass index Simple vision test Education and counseling Doctor may refer you for additional screenings

Available every 12 months Blood pressure, height and weight measurements Personalized prevention plan Written screening schedule Health advice just for you Referrals for health education and preventive counseling Yearly Wellness Visit 39

Wellness and Preventive Services Service How Often Your Cost Cardiovascular disease screenings Every 5 Years No cost for the tests. 20% for doctor s visit Mammograms Every 12 months for women 40 years of age and older No cost Colorectal Cancer Screening Colonoscopy Every 120 months Every 24 months if high risk No cost for test. 20% for doctor s visit or hospital copay Prostate cancer screenings Every 12 months for men over 50 year of age No cost for test 20% for doctor s visit or hospital copay Flu shot One shot per season No cost Pneumococcal shot Most people only need once/lifetime No Cost Bone mass measurement Every 24 months No cost

Wellness and Preventive Services Service How Often Your Cost Glaucoma tests Every 12 months if you are high risk 20% for doctor s visit or hospital copay Diabetes Screening Up to 2 glucose laboratory test screenings each year No cost Pap tests/Pelvic exams Every 24 months Every 12 months if high risk No cost HIV (Human Immunodeficiency Virus) screening Every 12 months Between 15-65 years old Younger than 15 older than 65 and at an increased risk Up to 3 times during a pregnancy No cost Covid vaccines As recommended by the CDC guidelines No cost (this could change when the public health emergency ends)

A MMAP COUNSELOR CAN HELP 01 02 03 04 05 Understand Medicare health plans Compare and enroll in Medicare Advantage Coverage Compare or enroll in Medicare Prescription Drug Coverage Identify and report Medicare and Medicaid fraud and scams Assist with enrollment into low-income programs 42 3/10/2025

For a personalized MMAP Appointment call 1-800-803-7174 QUESTIONS? Open Enrollment is Oct 15th-Dec 7th 43 3/10/2025

MORE INFORMATION www.medicare.gov Medicare & You Handbook 1-800-MEDICARE MMAP 800-803-7174 44 3/10/2025