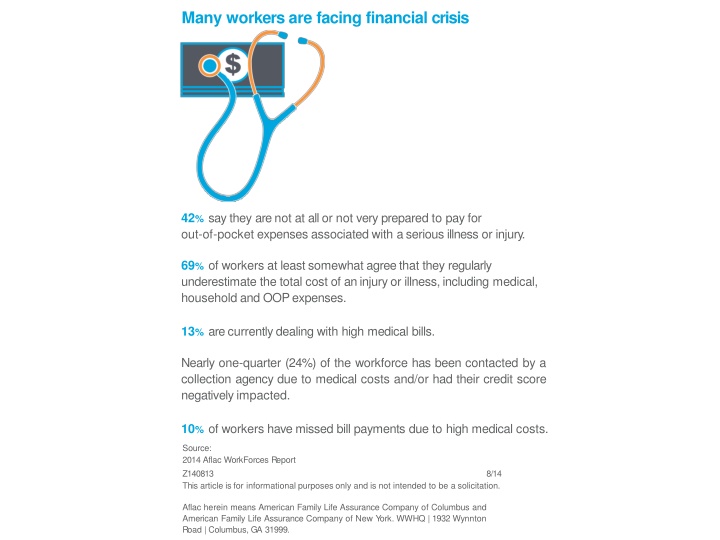

Workers Financial Crisis: Lack of Preparedness

Many workers are not financially prepared for out-of-pocket expenses related to illness or injury, facing high medical bills, collection agencies, and credit score issues. A significant percentage has minimal savings to cover unexpected medical costs and would resort to borrowing from retirement accounts or family. This highlights the financial vulnerability of a large portion of the workforce.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Many workers are facing financial crisis 42% say they are not at all or not very prepared to pay for out-of-pocket expenses associated with a serious illness or injury. 69% of workers at least somewhat agree that they regularly underestimate the total cost of an injury or illness, including medical, household and OOP expenses. 13% are currently dealing with high medical bills. Nearly one-quarter (24%) of the workforce has been contacted by a collection agency due to medical costs and/or had their credit score negativelyimpacted. 10% of workers have missed bill payments due to high medical costs. Source: 2014 Aflac WorkForces Report Z140813 This article is for informational purposes only and is not intended to be a solicitation. 8/14 Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York. WWHQ | 1932 Wynnton Road | Columbus, GA 31999.

Workers are not financially prepared 42% say they are not at all or not very prepared to pay for out-of-pocket expenses associated with a serious illness or injury. 49% of employees have $1,000 or less to pay for out-of-pocket expenses associated with an unexpected serious illness or accident. 27% of employees have less than $500 available to pay for out-of-pocket expenses associated with an unexpected serious illness or accident. 39% of workers would have to borrow from their 401(K) and/or from friends and family to pay for out-of-pocket expenses associated with an unexpected serious illness or accident. Source: 2014 Aflac WorkForces Report Z140814 8/14 This article is for informational purposes only and is not intended to be a solicitation. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York. WWHQ | 1932 Wynnton Road | Columbus, GA 31999.

Workers are not financially prepared 42% say they are not at all or not very prepared to pay for out-of-pocket expenses associated with a serious illness or injury. 49% of employees have $1,000 or less to pay for out-of-pocket expenses associated with an unexpected serious illness or accident. 27% of employees have less than $500 available to pay for out-of-pocket expenses associated with an unexpected serious illness or accident. 39% of workers would have to borrow from their 401(K) and/or from friends and family to pay for out-of-pocket expenses associated with an unexpected serious illness or accident. Source: 2014 Aflac WorkForces Report Z140815 8/14 This article is for informational purposes only and is not intended to be a solicitation. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York. WWHQ | 1932 Wynnton Road | Columbus, GA 31999.

Workers are not financially prepared 42% say they are not at all or not very prepared to pay for out-of-pocket expenses associated with a serious illness or injury. 49% of employees have $1,000 or less to pay for out-of-pocket expenses associated with an unexpected serious illness or accident. 27% of employees have less than $500 available to pay for out-of-pocket expenses associated with an unexpected serious illness or accident. 39% of workers would have to borrow from their 401(K) and/or from friends and family to pay for out-of-pocket expenses associated with an unexpected serious illness or accident. Source: 2014 Aflac WorkForces Report Z140816 8/14 This article is for informational purposes only and is not intended to be a solicitation. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York. WWHQ | 1932 Wynnton Road | Columbus, GA 31999.