Workshop on Treasury Guidelines for Public Entities

This workshop discusses the oversight and funding of public entities in a province, focusing on value for money, alignment with national goals, challenges in budget preparations, and the importance of accurate financial reporting. Key points include the rationalization of public entities, capacity challenges, and the budgeting process for public entities in alignment with government standards.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Workshop on the Treasury Guidelines Public entities PRESENTER: NOKUTHULA MLAMBO 7 JUNE 2018 1

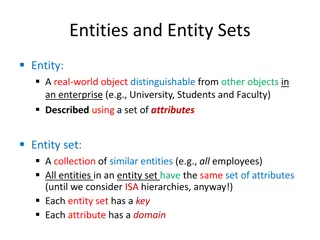

Introduction The province has 14 active listed public entities as at 1 April 2017. In addition, PT provides oversight to other unlisted entities which receive transfers from provincial depts. (i.e. Moses Kotane Institute and KZN Growth Fund Trust) The value of the transfer to the listed public entities in 18/19 is R2.157bn, growing to R2.359bn in 20/21 With the rationalisation of public entity process there is an increased focus on the performance of these institutions at various levels in national and provincial government 2

Focus of the 2019/20 MTEF (1) As a province we need to ensure value for money The amount transferred needs to realise equivalent or higher value returns in terms of service delivery Entities need to contribute positively to the NDP and the PGDP 3

Focus of the 2019/20 MTEF (2) The major challenges facing entities in the preparation of their 19/20 budget are: The rationalisation of public entities process. Recommendations were made to the PEC and in-principle decisions have been communicated to the Chairpersons and CEOs of the entities However, there is still a lot of uncertainty in respect of future roles and strategies of entities, which makes planning difficult Lack of capacity due to the lengthy processes to fill positions Lack of skills/capacity to implement new directives on infrastructure planning and other SCM practices Reporting demands from many different structures all with statutory timelines Entities reporting tools are not fully aligned to SCOA levels, and therefore additional work is required from entities to align to Treasury reporting templates 4

Budgeting Public entities (1) Public entities started using NT s budget database during the 16/17 budget process. Included in the database is: - Revenue - Expenditure at programme and economic classification level - Personnel details - Infrastructure details Revenue and expenditure items must be aligned to SCOA level 4 Transfer amounts need to balance back to transfers from govt. depts. 5

Budgeting Public entities (2) Entities need to capture relevant information required in respect of Board costs on the appropriate sheet Entities must ensure that the total value of the Board corresponds to the value of the Board reflected in the personnel sheet of the database 6

Budgeting Public entities (3) Depts. chapters of the 19/20 EPRE narrative must include a section relating specifically to each public entity, to: Briefly outline the purpose and objectives of the entity Highlight the major achievements for 18/19 (in the context of the planned projects included in the 18/19 EPRE) Highlight the major activities and projects planned for the 19/20 MTEF Discuss significant challenges facing the public entities Depts are required to liaise with their respective entities, to ensure input and comments reach Treasury by 31 July 2018 7

Schedules to be completed Costing of initiatives Each entity is allowed to motivate for 2 once-off initiatives (funding proposals) The initiatives are to be ranked in order of priority Service delivery to be motivated per initiative Tables include: - Revenue - Payments and estimates by programme for initiatives - Payments and estimates by eco. classification - Summary of infrastructure payments and estimates for initiatives - Goods and services table 8

Challenges Interpretation of excel spreadsheet not always in line with entity reporting: Updated database, was used for 1st time in the 17/18 budget process SCOA items not always user friendly in the public entities context no easy fit Communicate difficulties ASAP Treasury will make every attempt to be accommodating and to resolve problems in the database Entities not always able to obtain Board approval and relevant portfolio committee and dept., buy-in within the timeframes given IT Size/Structure of the database makes e-mailing files problematic 9

Way forward (1) If properly done, the budget process allows entities to: Enhance service delivery and ensure value for money Assess strengths, weaknesses, opportunities and threats and revise priorities and align resources over the medium term to meet the goals and objectives Engage all stakeholders (transferring departments and political principals) to discuss competing spending priorities and get consensus on best way forward in line with National and Provincial priorities Joint departmental/entity management task teams can plan and allocate resources to effect the recommendations of the rationalisation of public entity process Provides for a clear strategic path with milestones and timelines for the rationalisation process, thereby reducing uncertainties 10

Way forward (2) If properly done, the budget process allows entities to (cont.): Eliminate wasteful and fruitless expenditure, cut non-delivering or low priority service delivery areas and channel resources into high priority areas or areas of high potential return on investment It gives entities an opportunity to canvas support from relevant portfolio committees and Legislature 11

Thank You 12