Year-End Financial Reports and Process Overview

Explore the year-end financial reports for the education sector, including unaudited actual financial statements and the impact of changes in estimated vs. actual revenues and expenditures. Learn about the process of reviewing and approving these reports in accordance with Education Code requirements.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

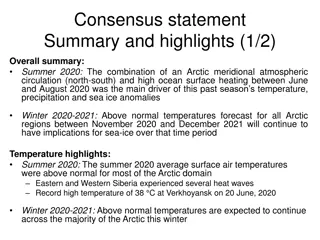

2020-21 Unaudited Actual Report September 9, 2021

YEAR END PROCESS Education Code 42100 requires school district governing boards to review and approve the audited actual financial statements to verify the reports have been completed in accordance with Education Code 41010 Reports must be filed with the County Superintendent by September 15th each year Budget and Interim reports reflect projected ending balances for the specific year June 30th is the only time that an accurate annual picture of the district s finances can be seen

YEAR END PROCESS All revenues and expenses are accounted for Ending balance reflects actual balances of non- spendable, restricted, assigned and unassigned reserves All other funds are also reported and actual revenues and expenses recorded Ending balances for each of the other funds is also reported

Impact of Changes In Estimated Actuals to Unaudited Actuals REVENUES ESTIMATED ACTUALS Local Control Funding Formula (LCFF) Federal Revenue Other State Revenue Other Local Income TOTAL REVENUES RECEIVED $54,498,559 $4,364 ($759,302) $355,747 $317,752 $54,417,120 Total decrease in revenues received $81,439

Impact of Changes In Estimated Actuals to Unaudited Actuals EXPENDITURES ESTIMATED ACTUALS Salaries and Benefits Books and Supplies Services & Other Operating Expenses Capital Outlay Other Outgo/Financing Uses TOTAL EXPENDITURES INCURRED $54,848,666 $58,934 ($963,474) ($1,324,874) ($19,010) ($234,949) $52,365,295 Total decrease in expenses incurred $2,483,371

Contributions to Restricted/ Required Program Special Education (excludes Transportation) Routine Repair & Maintenance Transportation Home-to-School * Special Education* LCFF Transportation offset Total Contributions to Restricted Programs $7,958,184 $6,313,615 $1,380,418 ($ 144,450) $ 108,615 $ 299,986 *Although Transportation services were not provided for most of the year, revised contracts were in place to ensure that services could continue if on-campus learning was allowed to resume. Total Transportation services offset by $144,450

Components of the Ending Fund Balance Estimated Actuals Unaudited Actuals Difference Revolving Cash Stores (Inventory) Prepaid Expenses Restricted Carryover Unrestricted/Site Allocation Carryover Kid Central Committed Funds-Textbooks/Technology Committed Funds Stabilization Funds Reserve for Economic Uncertainties Unappropriated Reserve TOTAL ADJUSTMENTS TO ACTUALS $15,000 $37,122 $15,000 $37,379 $83,566 $2,754,343 $2,386,273 $169,235 $1,250,000 $3,448,294 $1,570,959 $2,974,353 -- $257 -- $83,566 $201,055 $436,467 $169,235 $2,553,288 $1,949,806 -- $1,250,000 $3,448,294 $1,645,460 $1,388,500 -- -- ($74,501) $1,585,854 $2,401,932

Four Year Financial Summary 2020-21 Estimated Actual $12,637,577 2020-21 2021-22 Adopted 2022-23 Projected 2023-24 Projected Unaudited Actual Beginning Balance 7/1 $12,637,577 $14,689,402 $13,262,568 $9,303,807 Revenues $54,498,559 $54,417,120 $52,236,171 $47,727500 $48,895,391 Expenditures $54,848,666 $52,365,295 $53,663,005 $51,686,261 $51,874,833 Variance ($350,107) $2,051,825 ($1,426,834) ($3,958,761) ($2,979,442) Ending Balance $12,287,470 $14,689,402 $13,262,568 $9,303,807 $6,324,365 Components of the Ending Fund Balance Non-Spendable $52,122 $135,945 $52,122 $52,122 $52,122 Restricted & Assigned $4,503,094 $5,309,851 $2,305,766 $1,197,680 $1,170,711 Budget Stabilization (Resolution #16-17-18) $3,448,294 $3,448,294 $3,448,294 $2,851,486 -- Committed (Resolution #16-17-18) $1,250,000 $1,250,000 $1,250,000 $1,250,000 $1,143,356 Unassigned-Reserve for Economic Uncertainty Unassigned Unappropriated $1,645,460 $1,570,959 $1,609,890 $1,550,588 $1,556,245 $1,388,500 $2,974,353 $4,596,496 $2,401,932 $2,401,932 Percentage Ending Balance 5.53% 8.68% 11.57% 11.28% 7.63%

Other Funds Fund 08 Student Activity Fund Fund 13 Cafeteria Fund Fund 14 Deferred Maintenance Fund Fund 21 Building Fund Fund 25 Capital Facility Fund Beginning Balance $112,573 $1,044,829 $173,659 $8,287,995 $739,143 Revenues $11,084 $1,323,962 $179,410 $137,082 $1,030,948 Other Sources -- -- -- -- -- Expenditures $33,306 $1,631,447 $11,706 $2,365,489 $549,882 Transfers Out -- -- -- -- -- Variance ($22,222) ($307,486) $167,704 ($2,228,408) $481,066 Ending Balance $90,351 $737,344 $341,364 $6,059,587 $1,220,209

Other Funds Fund 35 School Facilities Fund Fund 40 Capital Outlay Fund Fund 51 Bond Interest & Redemption Fund Fund 56 Debt Service Fund Beginning Balance $157,855 $109,009 $27,123,856 $39,860 Revenues $4,991,682 $12,550 $2,425,114 $742 Other Sources -- -- -- -- Expenditures $98,787 -- $2,889,075 -- Transfers Out -- -- --- Variance $4,892,895 $12,550 ($463,960) $742 Ending Balance $5,050,750 $121,558 $26,659,896 $40,602

Next Steps 2021-22 District budget will be updated to reflect changes in State Enacted Budget and presented at the October 14th Board meeting along with the required ESSER III Plan Update 2021-22 budget with 2020-21 department and site carryover Continue to monitor enrollment and ADA projections and adjust as appropriate Keep Board, staff and community informed of significant changes Present most current budget to Board at its December meeting