CAPITAL STRUCTURE

Capital structure refers to the mix of a firm's capitalization, including debt, preference share capital, equity share capital, and retained earnings. Choosing the right components of capital is crucial based on the organization's function and risk level. Different patterns/forms of capital structure exist, and selecting the financing pattern depends on cost and risk principles. Considerations like cost of capital, business risk, and financial risk play a key role in determining the optimal capital structure for a business.

CAPITAL STRUCTURE

PowerPoint presentation about 'CAPITAL STRUCTURE'. This presentation describes the topic on Capital structure refers to the mix of a firm's capitalization, including debt, preference share capital, equity share capital, and retained earnings. Choosing the right components of capital is crucial based on the organization's function and risk level. Different patterns/forms of capital structure exist, and selecting the financing pattern depends on cost and risk principles. Considerations like cost of capital, business risk, and financial risk play a key role in determining the optimal capital structure for a business.. Download this presentation absolutely free.

Presentation Transcript

CAPITAL STRUCTURE CAPITAL STRUCTURE It refers to the mix of a firm's capitalization and includes long-term sources of funds such as debentures, preference share capital, equity share capital and retained earnings. According to Gerstenberg, "Capital structure is the make-up of a firm's capitalization." In other words, "It refers to the proportion of debt preference capital and equity capital."

Choice of Capital Choice of Capital It is very difficult to choose the components (equity, debenture, preference capital etc.) of capital for an organization as there is no ideal capital structure. A company's capital structure depends upon its function and how risky the particular business is.

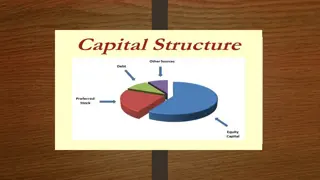

Patterns/Forms of Capital Patterns/Forms of Capital Structure Structure Whole equity share capital. Different proportions of equity and preference share capital. Different proportions of equity and debenture capital. Different proportions of equity, preference and debenture capital.

Fundamental Principles should be kept in Mind, while Selecting the Financing Pattern Financing pattern of an organisation is based on fundamental principles, i.e. cost principles and risk principles, These are as follows- Cost Principles -The best suited pattern of capital structure is one that minimizes cost of capital and maximizes Earning Per share (EPS). Risk Principles -According to this principle, reliance is placed more on equity for financing capital than excessive use of debt. There are two associated risk. Business risk Financial risk

So, while selecting the financing pattern, the following points be kept in mind. The risk less cost of the particular type of financing (rj) The business risk premium (b) The financial risk premium (f) Symbolically, cost of capital may be represented as : Ko = rj + b + f