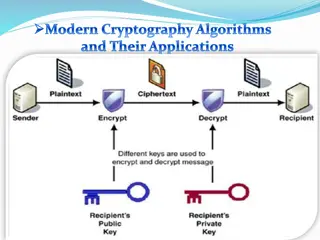

Basic Cryptography: Digital Signatures and Identity Management

This content delves into digital signatures including key generation, verification, and ECDSA, along with decentralized identity management in the realm of cryptocurrencies. It explores the link between public and secret keys, practice scenarios, and the significance of cryptographic hash functions.

Uploaded on Feb 27, 2025 | 1 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

WORLDWIDE EMPLOYEE BENEFITS (WEB) NETWORK Henry Talavera Shareholder, Polsinelli 1 1

PRESENTED BY: Speaker: Henry Talavera, Polsinelli PC, Dallas, TX With special gratitude to the following individuals who assisted in the preparation of these materials for an American Bar Association presentation on mergers & acquisitions: Vicki D. Blanton, AT&T, Dallas, TX Allison Wilkerson, McDermott Will & Emery, Dallas, TX 3 3

PRESENTERS BIO Mr. Talavera has a broad-based, comprehensive practice that involves all areas of employee benefits law related to benefit programs and arrangements for employees, directors, and independent contractors. His extensive experience includes guidance relating to public, private, and tax-exempt employers on the design, implementation, and administration of all types of welfare plans and tax-qualified retirement plans, including defined benefit and plans intended to qualify under sections 401(k), 403(b) and 457(b) of the Internal Revenue Code. Mr. Talavera also counsels a wide range of clients, including investors, investment funds, investment companies, fund managers (including registered investment advisers), private money managers and other institutional investors relating to the impact of ERISA and certain Internal Revenue Code requirements on such investments, including addressing ERISA plan asset and operating company compliance, such as matters relating to Venture Capital Operating Companies (VCOCs) and Real Estate Operating Companies (REOCs). In addition to M&A deals, a sampling of the many areas Mr. Talavera has worked include: Representing clients before the IRS, DOL & PBGC with respect to employee benefit plan audits and voluntary correction procedure filings Designing and implementing executive compensation and employment agreements, including equity compensation and deferred compensation arrangements for partnerships Negotiating employment and severance agreements for high-level executives and employers Advising on litigation matters related to employee benefits, including advising on class action lawsuits related to plan investments 4 4

Overview In-house client expectations in a benefits deal. Due Diligence in a benefits transaction. Representations and Covenants Getting a full picture with the entire agreement doesn t always happen, much less knowing all applicable benefit plans. Warranty Insurance for benefits. Transition issues of benefits. 5 5

Agenda/Framework What Is the Deal? Stock Purchase Asset Purchase Due Diligence Process Representation & Warranty Insurance (RWI) The Transaction Team Definitive Agreement Representations and Warranties Indemnification Requirements Covenants Post Closing Transition 6 6

7 Understanding the Deal . Asset Transaction vs. Stock Transaction Asset Deal - Buyer generally has choice on whether to assume seller's benefit plans Often buyer chooses not to assume seller's plans Generally, avoids assuming seller's plan liabilities except with respect to successor liability issues Results in a reduced need for benefits diligence information unless buyer assumes seller's plans as part of transaction Stock Deal - Buyer generally assumes seller's plans Usually results in assumption of seller's plan liabilities Results in a significant need for plan diligence information Aside: stock merger and its effect on buyer / seller roles Regardless of deal structure - are there special client concerns? 7 7

8 Understanding the Deal . Know your team Employee Benefit Consultants have become popular Ability to compare plans of seller and buyer and assist in transitioning benefits Add on service conducting high level benefits diligence Understand the engagement/limitations of the engagement to ensure diligence is appropriately handled What is the anticipated deliverable? Who handles the mark ups? Internal Client corporate team/benefits team Client risk tolerance will inform decisions on reps/warranties Understanding client plans and goals for benefits post closing will inform covenants 8 8

Due Diligence Process Understand seller / buyer plan design and philosophy to avoid significant plan transaction-related liabilities Identify problems with the plans Problems may affect fundamentals of transaction Identify issues with benefit levels Issues affect plan operations before and after transaction Serves as basis for provisions in purchase / merger agreement Representations, covenants, closing conditions and indemnity provisions Establish that board of directors or similar governing body met its fiduciary duties 9 9

Due Diligence Documents for Review Plan documents and amendments Participant communications (SPDs, handbooks, etc.) Service contracts IRS determination letters, etc. (what to do post DL world?) Form 5500 filings, etc. Collective bargaining agreements Nondiscrimination testing Controlled group info Plan loan info (outstanding loans, loan policies, etc.) Operations info (fiduciary, prohibited transaction, enrollment issues, etc.) 10 10

Due Diligence Documents for Review Executive compensation Appropriately identify the relevant documents Unwritten arrangements may be common Section 280G Equity arrangements Understand where the arrangements are held and the requirements on a transaction Section 280G Health and Welfare Self funded vs fully funded arrangements The hidden MEWA Form 5500 issues Cafeteria plans ACA compliance HIPAA requirements COBRA/post termination provision of benefits 11 11

Due Diligence Traps for the Unwary Retirement Plans Defined contribution arrangements Defined benefit arrangements Administrative matters Fiduciary requirements Investment options/fee disclosure issues Union issues Funded status Successor liability issues 12 12

Due Diligence Traps for the Unwary Employees on Leave Status of any disability benefits for employees on disability, whether on short or long-term can be important. Employment status of those on leave should be carefully considered and scrutinized. There are Americans with Disabilities Act issues to consider with your employment colleagues. Are the disability benefits insured and/or subject to the ERISA or just a payroll practice? It s not always certain. 13 13

Representations & Warranties Those are representations that the Buyer makes to Seller (typically extensive) as a condition of closing. Typically, the Seller has liability through an indemnification if the representations are false. In the review of the representations: Ensure that they are accurate. Accurately allocate risk relating to benefit plans as part of the deal. 14 14

Representations & Warranties Buyer representations are typically not extensive, particularly as they relate to benefits. Exceptions Where Seller could have residual liability? Examples - Union Contracts/Title IV of ERISA. Buyer s may have 2ndary liability under ERISA section 4204. Certain COBRA liabilities. See Treas. Reg. section 54.4980B-9. In an asset deal, Seller might have 2ndary liability. 15 15

Representations Liablities to Consider In order to determine the scope of review of reps, the to the extent plans are assumed, the more reps and warranties need to be more robust. These typically have the highest risk for Buyer. Defined Benefit Pension Plans. Other Title IV Withdrawal liabilities. 401(k)/401(a) Plans Typically qualification issues. Retiree medical. Sometimes it vests. 16 16

Representations Basics to Consider In a stock sale, if plans are sponsored by target, then representations should be extensive: Buyer will be responsible for all the same liabilities as in an asset sale, plus any liabilities associated with assumed plans If only subsidiary is being acquired and the plans are sponsored by parent and will continue post-closing at parent, may be able to agree to limited representations and warranties and gain protection through indemnification. 17 17

Representations Basics to Consider In an asset sale, seller s employees are terminated by seller and hired by buyer If buyer is not assuming seller s plans in an asset sale, then seller s employees risk: Forfeiture of unvested retirement benefits Loss of accrued but unused vacation/PTO Loss of health flexible spending account balances 18 18

Representations Basics to Consider These same risks exist in a stock sale if plans are sponsored by the parent and only the subsidiary is being acquired Depending on the structure of the transaction, a transition service agreement may be helpful. Will there be insurance or an insurer on the representations the deal? If so, there may be a third party to deal with in addition to buyer and seller. If plan assets will be rolled over from parent s plans to buyer plans, still will want representations regarding plan qualification, plan operations, and no prohibited transactions. 19 19

Representations Successor Liability Other issues. Successor liability by law Collective Bargaining Agreements. See Upholsterers Int l Union Pension Fund v. Artistic Furniture of Pontiac, 920 F.2d 1323, 1329 (7th Cir. 1990). Members of the Board of the Toledo Area Industries UAW Retirement Income Plan v. OBZ, Inc., Administration Case No. 3:15CV756, (N.D. Ohio December 26, 2018). https://scholar.google.com/scholar_case?case=112491019258305 03209&q=toledo+area+industries+UAW&hl=en&as_sdt=6,26 20 20

Representations Successor Liability PBGC liability for Pension Plans can occur possibly in an asset deal. PBGC v. Findlay Industries, Inc., 902 F.3d 597 (6th Cir. 2018)( [S]uccessor liability is necessary to implement the fundamental ERISA policy of protecting employees, in part by guaranteeing that employers who have promised pensions uphold their part of the deal. ) Fiduciary Breach Potentially. See U.S. Dep't of Labor v. Jackson County Hosp., Inc., No. 96-6664, 98-6665, 2000 WL 658843 (6th Cir. May 10, 2000) (Successor employer found liable for continuing fiduciary breach). Successor liability by contract can occur, but typically not in an asset deal. See Lickteig v. Tri-Steel Structures, Inc., 170 F. Supp. 2d 1158 (D. Kans. 2001) (typically, there is no successor liability in an asset deal absent express assumption). 21 21

Representations Successor Liability Mims v. HRC Autostaff, Inc., 2000 WL 251732 (N.D.Tex. March 3, 2000) (no successor liability in an asset deal). https://casetext.com/case/mims-v-hrc-autostaff-inc Successor liability by contract can occur, but typically not in an asset deal. SeeLickteig v. Tri-Steel Structures, Inc., 170 F. Supp. 2d 1158 (D. Kans. 2001) (typically, there is no successor liability in an asset deal absent express assumption). https://casetext.com/case/mims-v-hrc- autostaff-inc Severance Plans can sometimes require assumption by buyers. Grimm v. Healthmont, Inc., CV No. 01-982-BR, 2002 WL 31549095 (D. Or. Oct. 29, 2002) (successor liability is possible depending upon the facts). https://casetext.com/case/grimm-v-healthmont-inc Employment Agreements typically have hidden liabilities. 22 22

Representations Successor Liability Sometimes contracts are required to be assumed by purchaser or cannot be terminated. Brend v. Sames Corporation, 2002 WL 1488877 (N.D.Ill. 2002) (successor liability potentially in a top-hat case). https://casetext.com/case/brend-v-sames-corporation Addressing successor liability is one of the most important considerations in reviewing the representations and warranties. 23 23

Representations Negotiations Because of potential for successor liability of buyer, there is a tendency to want to due diligence through the representations instead and sue the breaching party. Prime considerations in negotiations: How tight will the representations be? Who has the leverage in the transaction? Typically, Buyer has leverage, because they have the cash. Is there a distress sale/bankruptcy? Always try to find out the business deal first and be logical in arguments. Be logically prepared to support any provision ( x firm doesn t accept that rep). Do reps survive closing? If so, how long do the ERISA reps survive? [Agree on this! might note that finding an ERISA issue in a typical 12-month survival period is rare if buyer, try to extend ERISA to Statute of Limitations or 3 years or something that more closely mimics audit risk]. 24 24

Representations Negotiations Is there a basket (e.g., like a deductible, how much will be Seller be responsible for before the Buyer is responsible?) The more reps don t survive closing and/or the Buyer assumes benefit plans, the tighter the reps must be. Will there be a Buyer entity with employees left after the deal? Will buyer be transferring employees to its plan(s) or will seller transfer it s benefit plans? What about Flexible Spending Accounts, cafeteria plan elections etc.? Participant plan loans? Will Seller be providing any transition benefits? Are there any MEWA concerns? Will any plans of seller be terminated as part of the transaction? Who pays for the wind-up of Seller plans? Will the Buyer accept rollovers and particularly loan notes? 25 25

Representations Negotiations Will any plans of seller be terminated as part of the transaction? Who pays for the wind- up of Seller plans? Will the Buyer accept rollovers and particularly loan notes? Are there any retiree medical benefits or any other benefits that might be vested (or otherwise accelerated) and cannot be terminated? How do you address benefits that cannot generally be terminated, such as collective bargaining agreements obligations for retirement plan benefits. Are there any severance benefits or other deferred compensation that may be subject to 409A or 280G? What happens if we re only given part of the deal documents? Are there joint and several liabilities (generally, Title IV of ERISA or COBRA liabilities)? Duplicate reps in contract, tax and labor & employment provisions (we always search for the words benefit, plan, Code & ERISA. ) Duplicate and slightly different reps is a good reason to object. It s best to consolidate. 26 26

Representations Negotiations Materiality, Knowledge and disclosures of representations are the best way to address outstanding issues in representations. Ex Except as disclosed on Schedule , there are no ERISA plans Always review the definitions. Does Buyer want: A list of current plans. All plans back for which Seller has any liability? All plans ever? Plans back 6 years? Why 6 years? Pension Benefit Guaranty Corporation v. IDAHO HYPERBARICS, INC., Case No. 4:16-cv-00325-CWD (D. Idaho 2017)(2009 cause ok to file in 2016) https://scholar.google.com/scholar_case?case=2272100777829072118&q =PBGC+statute+of+limitations+Idaho&hl=en&as_sdt=6,26&as_ylo=2017 27 27

Representations Covenants Covenants should be considered in any reps (will any plans need to be amended/terminated as part of the deal, any 280G study, 409A, termination of the retirement plan, vesting of benefits, rollover of loan notes, flexible spending accounts, COBRA, etc.) Covenants are promises that Buyer or Seller will perform as part of the deal. What happens when you find/disclose a problem? Who is in charge of fixing any particular problem disclosed? 28 28

Representations Covenants Covenants Should Address these Transition Issues: Service Credit under Retirement Plans Transfer of Health Flexible Spending Accounts Service Credit for Vacation/Paid Time Off Employment Taxes Health Plans Coverage Issues 29 29

Representations Covenants 401(k) Plan Issues Maintain Separate Plans Merge Plans/Spin-off Terminate/Freeze Stock Transactions and Plan Termination Plan Features Safe-Harbor Roth/After-Tax Profit Sharing ESOP 30 30

Indemnification Requirements Protection for breaches of representations Line item indemnification requirements RWI is becoming more common Insurer responsible for payment of any damages associated with breaches of reps/warranties Allows for broader reps/warranties Look out for scheduling requirements and non-market reps Underwriter is involved in diligence process Buyer counsel/consultants provide information as to comfort level with diligence process RWI diligence call pre-closing [who should be involved (Know the Team!)] Carved out coverages 31 31

Post-Closing Requirements Employee leasing arrangements/transition service agreements Often driven by transaction structure Buyer ability to establish benefits/enroll new employees on payroll and benefit arrangements efficiently following closing Tricky transition issues COBRA qualified M&A beneficiary issues [changes with new subsidy rules] Termination of the 401k plan pre OR post closing challenges Plan participant loan challenges 32 32

Questions? Henry Talavera, 214-661-5538 Polsinelli PC htalavera@polsinelli.com 33 33