Compliance Challenges for Going Public on U.S. Stock Exchanges

Explore the top compliance challenges faced by emerging companies when going public on U.S. stock exchanges, including Sarbanes-Oxley, corporate governance, Regulation Fair Disclosure, and listing requirements. Learn how these barriers impact exit routes, investor preferences, and the perceived risks associated with IPOs and M&A. Find out why compliance costs are prohibitive for small companies and the need for right-sized compliance requirements.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

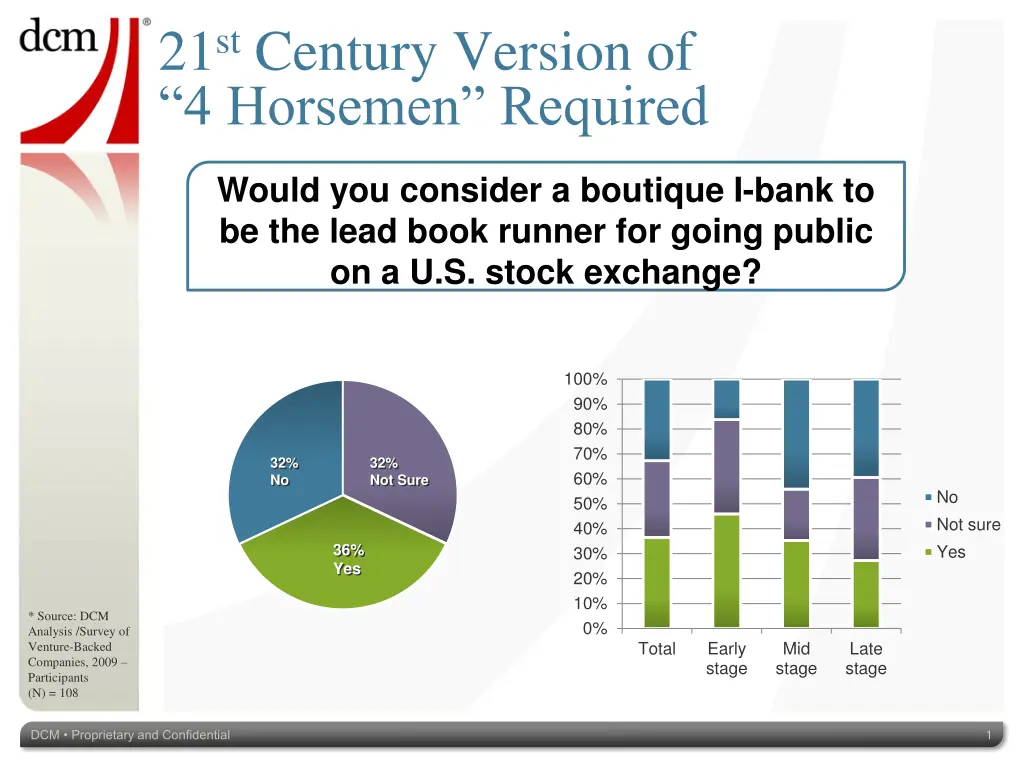

21st Century Version of 4 Horsemen Required Would you consider a boutique I-bank to be the lead book runner for going public on a U.S. stock exchange? 100% 90% 80% 70% 32% No 32% Not Sure 60% No Not sure Yes 50% 40% 36% Yes 30% 20% 10% * Source: DCM Analysis /Survey of Venture-Backed Companies, 2009 Participants (N) = 108 0% Total Early stage Mid stage Late stage 1 DCM Proprietary and Confidential

Emerging Company IPOs on International Exchanges: Additional New Liquidity Sources Top 3 Compliance Challenges to Going Public On U.S. Stock Exchanges # of Responses Answered as a Top 3 Issue (Participants =108) Global Venture-Backed IPOs* 86 Flag of the United States of America 6 2007 2008 102 Sarbanes-Oxley 45 5 80 Corporate Governance 2007 2008 Regulation Fair Disclosure 74 94 ** (Reg FD) 35 Listing Requirements of U.S. Stock Exchanges 62 2007 2008 6 * Sources: Thomson Reuters, Venture Source, Zero2IPO, Venture Intelligence ** Includes VC- and PE-backed IPOs Other 3 2 2006 2007 Source: DCM Analysis/Survey of Venture-Backed Companies, 2009 2 DCM Proprietary and Confidential

Barriers to Going Public on U.S. Stock Exchanges Exit Route Preference and Expectation (n=108) Top 3 Barriers to Going Public # of Responses Answered as a Top 3 Issue (Participants = 108) Compliance Requirements (Sarbanes-Oxley, Audit, Governance) 76 M&A 54% 74 Increased Volatility in the Public Markets 81% M&A Better Alternative (Faster Process, More Liquidity) 58 Investment-Banking Related Issues (Analyst Coverage, Requires High Rev Threshold) 53 Transaction Costs of Going Public (Legal, Banker Fees, Non-Compliance Related Costs) Higher Perceived Litigation Risk from 46% 33 IPO 19% 15 U.S. Investor Base Preferred Exit Route Likely Exit Route Other 15 Current Regulation Has a Major Impact on How Emerging Companies Consider Their Exit Route Source: DCM Analysis/Survey of Venture-Backed Companies, 2009 3 DCM Proprietary and Confidential

Cost of Compliance Is Prohibitive for Small Companies Top 3 Compliance Challenges to Going Public on U.S. Stock Exchanges # of Responses Answered as a Top 3 Issue (Participants = 108) 102 Sarbanes-Oxley Corporate Governance 80 Regulation Fair Disclosure 74 (Reg FD) Listing Requirements of U.S. Stock Exchanges 62 6 Other Emerging Companies Need Right-Sized Compliance Requirements to Thrive Source: DCM Analysis/Survey of Venture-Backed Companies, 2009 4 DCM Proprietary and Confidential