Decision Trees for Stock Market Forecasting

In this project presentation, Decision Trees are utilized for predicting stock market trends and values. The motivation lies in enabling investing companies to thrive by accurately forecasting stock market movements. Challenges such as managing large training sets and binarizing predicting attributes are addressed. A sample decision tree is shared, along with the processing techniques used, sample results, and the potential for combining advanced techniques with decision tree construction for enhanced stock trend prediction.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Data Mining BS/MS Project Decision Trees for Stock Market Forecasting Presentation by Mike Calder

Decision Trees Used for stock market forecasting Classification trees Regression trees Analysts attempt to predict the value of a given stock at some point in the future The methods can also be used to predict trends in the stock market as a whole 2

Motivation Accurate predictions in the stock market allow investing companies to thrive Identifying attributes that correlate with success in the stock market may lead to finding causation If causes of success can be controlled, the economy can be pushed in a good direction 3

Stock Market Challenges Training set can be very large All stock data over a period of time Predicting attributes tend to be binarized like we saw when using the ID3 algorithm The target attribute (increase/decrease in stock value) can be numeric or nominal 4

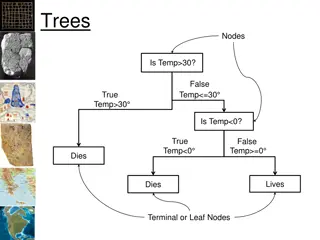

Sample Decision Tree Taken from (Trader, 2014) VAR1 if a stock s average true range (average max-min) is greater than the stock s moving average (average of end-of-day prices) VAR3 if a stock s end-of-day price is greater than the 50-day moving average VAR4 if a stock s end-of-day price divided by the daily range (max-min) is > 0.5 VAR5 if a stock s auto-correlation (degree of correlation with respect to its previous values) return has been > 0 for 5 days 5

Processing Used Correlation based feature selection Numeric attribute binarization Target regression calculation N-fold cross-validation (usually n=10) Decision tree pruning 6

Sample Results Taken from (Trader, 2014) The red lines show real data for the 4 stocks, black lines show the decision tree s predictions (y-axis represents the increase/decrease in stock value by percentage) 7

Additional Complexity Advanced techniques can be combined with decision tree construction Hierarchical hidden Markov model (HHMM) has been combined with decision trees for stock trend prediction Other machine learning algorithms have been used with decision tree methods to forecast stock market changes as well 8

References R. Trader. Using CART for Stock Market Forecasting . Data Science and Trading Strategies. 2014. S. Tiwara. Predicting future trends in stock market by decision tree rough-set based hybrid system with HHMM . International Journal of Electronics and Computer Science Engineering. 2012. T. Zhang. Stock Market Forecasting Using Machine Learning Algorithms . Stanford University. 2012. 9