Financial Statement Analysis for Business Success

Extract valuable insights on financial statement analysis and its critical role in evaluating a business's performance and future prospects. Explore the objectives, techniques, and implications of financial analysis, shedding light on how external influences and risk factors impact decision-making.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

FINANCIAL FINANCIAL ANALYSIS ANALYSIS 1

Did not one of your fellow craftsmen, the late Sir Mark Webster years ago that backers of horses have better information available than speculations on share ? ( (Jenkinson Did not one of your fellow craftsmen, the late Sir Mark Webster Jenkinson years ago that backers of horses have better information available than speculations on share ? Jenkinson, c1930) Jenkinson, say only a few , say only a few , c1930) 2

UNDERSTAND THE OBJECTIVES OF FINANCIAL STATEMENT ANALYSIS IDENTIFY THE EXTERNAL INFLUENCES AFFECTING A BUSINESS ENTITY COMPARE DIFFERENT TECHNIQUES FOR ANALYSING AND INTERPRETING FINANCIAL STATEMENTS CALCULATE KEY RATIOS FOR EVALUATING ALL ASPECTS OF A BUSINESS, INCLUDING PERFORMANCE AND CAPITAL STRUCTURE DESCRIBE THE RESULTS OF THE ANALYSIS, WITH EXPLANATION OF THE CAUSES CONSIDER THE BENEFITS AND LIMITATIONS OF FINANCIAL ANALYSIS 3

Objective of Financial Analysis To examine a firm s financial information in order to forecast maximise future earnings forecast the firm s ability to Future is uncertain, so we must forecast: The expected future earnings The risk associated with achieving these expected earnings 4

So, in order to extract the information they need and to analyse it Financial analysis allows users to assess the overall financial performance and position of a business So, financial analysis is used in order to evaluate a business AND the effectiveness of the decisions made by management! 5

A business entity is affected by many outside influences. The state of the economy in which it operates has a major influence on the entity Changes in a particular industry in which the entity operates also impact on its Financial position and results 6

When evaluating a business, one needs to consider RISK RISK 7

. A probability or threat of damage, injury, liability, loss, or any other negative occurrence that is caused by external or internal vulnerabilities, and that may be avoided through preemptive action. Risk is the potential that a chosen action or activity (including the choice of inaction) will lead to a loss (an undesirable outcome). 8

The probability that an actual return on an investment will be lower than the expected return. Financial risk can be divided into the following categories: The probability that an actual return on an investment will be lower than the expected return. Financial risk can be divided into the following categories: Basic risk, Capital risk, Country risk, Default risk, Delivery risk, Economic risk, Exchange rate risk, Interest rate risk, Liquidity risk, Operations risk, Payment system risk, Political risk, Refinancing risk, Reinvestment risk, Settlement risk, Sovereign risk, and Underwriting risk. 9

The performance of a business must be considered in relation to the risks associated with that business The performance of a business must be considered in relation to the risks associated with that business 10

Business risk is reflected by business operations There is a risk that unexpected outcomes could affect the incomes and expenses of a business leading to unexpected effects on profit 12

In addition to business risk, businesses also face FINANCIAL RISK Financial risk results as a result of how the business chooses to fund itself In other words, has the business selected funding through EQUITY or DEBT or a combination of the two? What risk does debt-financing expose a business to? 13

When a business using debt to finance operations, it is required to pay interest on the debt Financial risk is the risk that the business will not generate sufficient profits to make the interest payments Does an increase in earnings increase or decrease this risk? 14

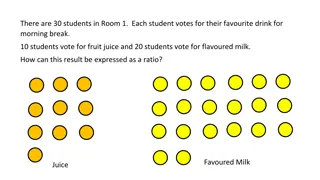

There are two main approaches that can be used to evaluate a business: Comparability Ratio analysis A combination of the two is often used, too. 15

What do you understand by the term comparability To what information can the financial result of a business be compared during analysis? Other companies that are similar Prior year results Industry averages Budgeted results 16

Are prepared using percentages for each item on the financial statements instead of showing the actual amounts In the case of the Income Statement, the sales are shown as 100%, with all other items shown as a percentage of sales In the case of the Balance Sheet, the totals of both the assets equity & liabilities section are shown as 100%, and individual items are shown as a percentage !!! 17

Indicates the percentage of sales absorbed by each expense item Indicates relationships between the various components in the SOFP Income statement Balance sheet 18

Reveals the relation between the various elements in the components of a financial report Useful for users who wish to compare different business entity s Used to perform a trend analysis for the same business over a period of time 19

All figures stated as a percentage of revenue UEL Ltd SOCI for year ended 31 December X6 X5 Revenue Cost of sales Gross profit Net operating costs Operating profit from trading activities Net costs from non-trading activities Operating profit Dividend received Interest income Interest paid Profit before taxation Taxation Profit attributable to ordinary shareholders 100.00% 69.07% 30.92% 18.92% 12.00% 1.01% 13.01% 0.03% 1.04% 3.12% 10.96% 3.77% 7.19% 100.00% 65.00% 34.99% 22.06% 12.93% 0.00% 12.93% 0.03% 0.91% 3.95% 9.92% 3.43% 6.49% 20

UEL Ltd Statement of financial position at 31 December X6 X5 Assets Non-current assets Property, plant and equipment Investments Current assets Inventories Trade receivable Accrued income Cash and Cash equivalents Total assets 47.54% 0.33% 61.59% 0.35% 4.48% 30.99% 0.08% 16.55% 100.00% 100.00% 5.46% 32.54% 0.03% 0.00% All figures stated as a percentage of total assets 21

Shows how the financial statements for each of the required number of years, side-by- side. Highlights changes in the individual items from year to year. The percentage increase or decrease in an individual item is calculated as follows: Current year amount Current year amount prior year amount Prior year amount prior year amount Prior year amount x 100% x 100% 22

One of the most common tools of managerial decision making Is a comparison of number to another mathematically, it is a simple division problem Involves the comparison of various figures from the financial statements in order to gain information financial performance, position and the efficiency of management It s the interpretation rather than the calculation, that makes it a useful tool for management Serves as indicators, clues, or red flags regarding note worthy relationships between variables used the business entity s performance 23

Trend analysis Spot trends that are cause for concern Serve as red flags for troublesome issues Benchmarks for performance measurement Trend analysis Competitors Industry averages Assist in forming judgment on key areas Monitor performance and pinpoint strengths and weaknesses Track individual firm performance over time Make comparative judgments regarding firm performance 24

There are numerous ratios that can be prepared during financial analysis We can t look at all of them, but we will focus on the main ones Our approach for each ratio will be: How it is calculated What it measures How it is expressed What it reveals 25

Primary sections of a business: Liquidity Asset management Debt management Profitability Du Pont analysis Market ratios 26

There are several ratios which are used to measure whether a business entity has sufficient liquid resources to enable it to meet its short-term liabilities: Main concern in business is ability to pay accounts as they become due. Liquidity refers to the speed with which current assets are converted into cash. This cash is then used to finance short-term debt, such as amounts owing to suppliers. 27

A company with enough liquid assets is more likely to settle debts on time. To measure liquidity, we compare the size of current assets to current liabilities. Why? Current assets are usually easily convertible into cash and this cash is used to settle short-term debts (current liabilities). 28

Current Assets Current Liabilities Measures how many times of business exceed current liabilities Higher the ratio, the more likely the business is able to settle debts on time! times current assets 29

UEL Limited Current Assets Current Liabilities X6 X5 43 601 177 28 672 370 12 989 020 15 801 519 3.35 times 1.81 times Current Ratio Current Assets = 43 601 177 Current Liabilities 12 989 020 Current Ratio for X6 is 3.35 times 30

Current Assets - inventory Current Liabilities Inventory least convertible into cash Measures how many times assets (less inventory) of the business exceed the current liabilities Higher the ratio, the more likely the business is to be able to settle debts on time! times the current 31

Current Assets - inventory Current Liabilities Inventory least convertible into cash Measures how many times assets (less inventory) of the business exceed the current liabilities Higher the ratio, the more likely the business is to be able to settle debts on time! times the current 32

UEL Limited Current Assets Inventory Current Liabilities X6 X5 43 601 177 28 672 370 3 750 000 12 989 020 15 801 519 4 120 000 3.06 times 1.55 times Acid test Ratio Current Assets Inventory = (43 601 177 3 750 000) Current Liabilities 12 989 020 Acid test Ratio for X6 is 3.06 times 33

The primary purpose of business is to generate profit To do so, business must successfully manage the assets used in the business (a process referred to as asset management). Assets are by definition income- generating items. 34

Measures how successfully assets have been used to generate profit in the business. Measures are sometimes called turnover measures Measure how efficiently or productively assets are used to generate sales. Measures how successfully assets have been used to generate profit in the business. turnover measures or asset utilisation asset utilisation measures. 35

Inventory x 365 Cost of Sales How quickly can the business sell products? Ratio expressed in days 36

UEL Limited X6 X5 Inventory Cost of Sales 3 750 000 85 657 057 78 395 467 4 120 000 16 days 19 days Days inventory on hand Inventory Cost of Sales x 365 = 3 750 000 85 657 057 x 365 16 days = DO NOT FORGET TO ROUND UP TO A COMPLETE DAY! 37

Cost of Sales Inventory How any times the inventory was sold during the year If we sell R 2 000 worth of goods over a year and have a closing balance of inventory of R 400, how quickly will the inventory be sold? Inventory turnover ratio is 5 Which is better, a high or a low ratio? 38

X6 X5 UEL Limited Cost of Sales Inventory 85 657 057 78 395 467 3 750 000 4 120 000 23 times 19 times Inventory turnover ratio Cost of Sales Inventory = = 85 657 057 3 750 000 23 days 39

Trade receivablesx 365 Credit sales How quickly is cash collected from debtors Ratio is expressed in days The shorter the period, the quicker cash is received from debtors What are the risks if the period is too short or too long? 40

UEL Limited Trade Receivables Credit Sales Debtors collection period X6 X5 26 778 570 123 999 879 120 607 873 191 days 24 528 570 186 days Assume Revenue consists only of Sales Income and 40% of sales are on credit. Trade Receivables, use amount GROSS of the Allowance for Doubtful Debts. Trade receivables Credit Sales x 365 = 26 778 570 (123 999 879 x 40%) x 365 Debtors collection period for X6 = 79 days 41

Trade payablesx 365 Credit purchases Measures how long the business takes, in days Good for the business to have a high ratio What are risks if too high! days, to pay its creditors Cost of Sales= OB Inventory + Purchases CB Inventory Purchases = Cost of Sales OB Inventory + CB Inventory 42

UEL Limited X6 X5 Trade Payable 2 665 740 2 850 000 Credit purchases 51 172 234 46 569 280 60% of purchases are on credit Creditors payment period 19 days 22 days Trade payables Credit purchases x 365 = (51 172 234 x 60%) x 365 2 665 740 Creditors collection period for X6 = 19 days 43

The debtors collection period + days inventory on hand measure the time delay between the purchase of inventory and the collection of cash from the credit sale of inventory. i.e. how long is cash tied up in inventory and trade receivables. 44

BUT what if we did not pay cash for the inventory but purchased on credit i.e. 90 day terms What is the time difference between when cash leaves (pay for inventory) and when we receive cash (sell inventory on credit)? 45

Days inventory on hand Debtors collection period Creditors payment period 46

16 days 191 days 19 days 47

Sales Total assets Looks at efficiency of all the assets together Shows how well assets have been used to generate Sales The Sales relative to the asset base 48

UEL Limited Sales X6 X5 120 607 123 999 879 873 Total Assets 83 649 877 75 358 570 1.48 times 1.60 times Total asset turnover Sales Total Assets = 123 999 879 83 649 877 = 1.48 times Total asset turnover = 1.48 times 49

Fixed Assets?? Generally, Property, Plant and Equipment Sales Fixed assets Similar to Total asset turnover Only Fixed assets efficiency is assessed Fixed asset turnover = Sales / PPE How efficiently is PPE used to generate sales 50