Household Energy Price Regulation in Hungary: Impacts and History

Explore the history and impacts of household energy price regulation in Hungary, detailing policy shifts, subsidy systems, and end-user electricity prices. Understand the dynamics behind residential energy pricing in Hungary, including the implications for average households and the broader energy market.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

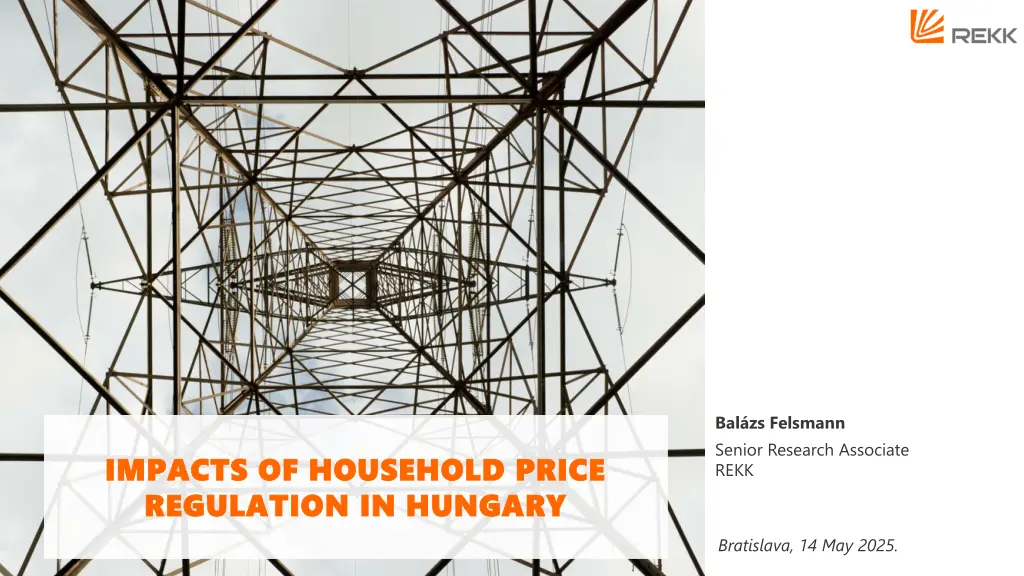

Balzs Felsmann Senior Research Associate REKK IMPACTS OF HOUSEHOLD PRICE IMPACTS OF HOUSEHOLD PRICE REGULATION IN HUNGARY REGULATION IN HUNGARY Bratislava, 14 May 2025.

History of household energy price regulation in Hungary 1) 1) 2007 2007- -2013: Market 2013: Market- -Based Pricing with Limited State Intervention Based Pricing with Limited State Intervention Market liberalisation in 2007 (electricity) and 2008 (natural gas) Free pricing for producers, regulation only in the commercial margins of retailers serving households. 2) 2) 2013 2013 Introduction of the Introduction of the Rezsics kkent s Rezsics kkent s (Utility Cost Reduction (Utility Cost Reduction Programme State-mandated price cuts on household electricity, gas, and district heating First, a 10% reduction was implemented; later, further cuts followed, eventually resulting in price freezes below market levels 3) 3) 2022 2022 Policy Adjustments Due to the Energy Crisis Policy Adjustments Due to the Energy Crisis Subsidised rates only up to average consumption thresholds (introduced mid-2022). Thresholds: 2,523 kWh per year for electricity and 63,645 MJ (1,729 m3) for natural gas Applied market-based rates for usage above those thresholds. Municipalities and some businesses were excluded from the capped pricing system. 4) 4) From 2023 From 2023 - - Tiered Subsidy System Continues Tiered Subsidy System Continues Subsidised prices for average users. High market rates for excess consumption. Programme) ) 2 2

Residential energy prices Electricity Electricity Unit prices below and above the threshold: Regulated end-user price (with VAT) below the 2523 kWh/year threshold: 36.39 Ft/kWh Above the threshold: 70.10 Ft/kWh Energy component in the regulated price: Below the threshold: 5.25 Ft/kWh Above the threshold: 31.8 Ft/kWh Natural gas Natural gas Unit prices below and above the threshold: Regulated fix price (with VAT) below the 1729 m3/year threshold: 99.9 Ft/m3 (2.9 Ft/MJ) Above the threshold: 767.2 Ft/m3 (22 Ft/MJ) 3 3

End-user electricity prices in April 2025 Hungary is by far the cheapest country for average households. The question is, who pays the bill? Average electricity prices for residential consumers in euro (euro cents/kWh) Electricity tariffs for residential consumers in euro (euro cents/kWh) April 2025 https://www.mekh.hu/household-energy-price-index 4 4

Electricity retail price components in the CEE region Household consumers 500 Industrial consumers 350 71.8 300 400 8 51.2 50.4 250 4 81 300 8 40 44 42.8 36 113.0 93.5 10.2 200 48 25 34 /MWh 44 /MWh 4 90.7 20 32 15 37 19 200 55 13 36.8 150 15 21 38 31 15 38.9 26.4 16.0 100 205 55.1 199 222.6 100 213.8 180 167 62.2 160 172.3 20.5 157 148 0.0 135 132 131 124 122 50 60.6 90.1 60.7 15.2 0 0 -64.4 HU EU27 SK AT RO DE HU EU27 SK AT RO DE -100 500-2000 MWh Energy 70-150 GWh HU Energy EU27 Network costs SK AT RO DE Network costs Other taxes, supports Source: Eurostat Other taxes, supports VAT Hungary has one of the highest energy tariffs (AT is more expensive in the smaller category) Highest in network charges, double the EU average If taxes and network charges are taken together, Hungary is still significantly more expensive than the EU average Extremely low energy tariffs for households in Hungary The grid tariff is also below the EU average (2/3 of the EU average) 5 5

Retail price trends in the CEE region (excluding taxes) Households DB: 1000-2500 kWh SME consumer IC: 500-2000 MWh Large consumer IC: 70-150 GWh 350 350 350 300 300 300 250 250 250 200 200 200 /MWh /MWh /MWh 150 150 150 100 100 100 50 50 50 0 0 0 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 2019 Hungary 2020 2021 2022 Romania 2023 2024 2019 Hungary 2020 2021 2022 Romania 2023 2024 2019 Hungary 2020 2021 2022 Romania 2023 2024 EU27 Slovakia Austria Germany EU27 Slovakia Austria Germany EU27 Slovakia Austria Germany Source: Eurostat Households have the lowest retail price in the region Retail prices have partly or fully covered price increases in all countries Hungarian prices 28% of the EU average in 2024 Only minor price differences between countries except Romania and Hungary (compared to other categories) Hungary is also the most expensive in this category, with a 54% premium compared to the EU average in 2023 Significant price increases in all countries Hungary the most expensive in the region in 2023 Retail prices in Hungary are 47% more expensive than the EU average 6 6

End-user natural gas prices in April 2025 Average prices of natural gas for residential consumers in euro (euro cents/kWh) Natural gas tariffs for residential consumers in euro (euro cents/kWh) https://www.mekh.hu/household-energy-price-index 7 7

Reduction of subsidised volume on consumption and prices Evolution of residential fixed natural gas prices (HUF/m3) and residential natural gas consumption (million m3/month) Impacts of the introduction of a subsidised threshold on average prices and consumption of households: The price of natural gas increased by almost two and a half times in the third quarter of 2022 and by almost twice in the first quarter of 2023. This means that around 80% of residential (ESZ) consumption remained below the threshold and 20% paid higher prices in the fourth quarter of 2022. In the first quarter of 2023, 85% of consumption remained below the threshold and 15% paid more. Source: Kotek et al. Demand adjustment in Hungarian natural gas consumption: effect of punitive block tariffs? REKK Policy Paper. 8 8

Demand-side adjustment: decreasing household gas consumption 2023 Actual TWh Estimated TWh Diff TWh Diff % Actual and estimated consumption, TWh/month Capital Large city City Town Village Large industrial consumers Total 15.7 16.4 19.9 1.0 8.2 19.4 20.0 23.9 1.3 9.9 -3.8 -3.6 -4.0 -0.2 -1.7 -19% -18% -17% -19% -17% 22.7 83.8 25.7 100.2 -3.0 -16.4 -12% -16% 2024 Actual TWh Estimated TWh Diff TWh Diff % Capital Large city City Town Village Final consumers Total 15.5 16.0 19.7 1.1 8.3 19.1 19.8 23.6 1.3 9.8 -3.6 -3.9 -3.9 -0.2 -1.4 -19% -20% -16% -14% -15% Natural gas consumption was 16% or 16.4 TWh lower than expected (weather-adjusted) based on past trends in 2023 and 15% or 15.1 TWh lower than the weather would have suggested in 2024. The biggest relative demand adjustment is in the large cities and the capital. Source: Kotek et al. Demand adjustment in Hungarian natural gas consumption: effect of punitive block tariffs? REKK Policy Paper. 23.6 84.1 25.7 99.2 -2.1 -15.1 -8% -15% 9 9

Conslusions Pros: Pros: Households faced only limited shocks from energy price increases in 2022 social stability. Households above the threshold adapted quickly energy efficiency, rapid adoption of alternative heating technologies (e.g. heat pumps). Based on two years of data, the effects appear to have been persistent, mainly in terms of reductions in household gas consumption. Cons: Cons: Energy efficiency incentives were different for the various building types. In many cases, adaptation was not in the most energy-efficient form (e.g. replacing above- threshold gas heating with split air-conditioning, even in cases where gas heating would have been more efficient.) The price above the threshold is less and less reflective of the market (unrealistically high for gas), while subsidised prices are far below costs - cross-subsidisation. Subsidised residential prices are paid by Hungary through the highest industrial prices in the region - a negative competitiveness effect. 10 10

Thanks for your attention! Bal zs Felsmann Balazs.felsmann@rekk.hu www.rekk.hu