Insights from CFPB's Fifth Research Conference on Financial Trends Amidst COVID-19

Gain valuable insights from the CFPB's Fifth Research Conference presentation by Jason Brown, focusing on the impact of the COVID-19 pandemic on credit markets. Discover how credit applications across different sectors were affected, including mortgages, auto loans, and credit cards. Explore changes in financial well-being and credit card debt during the pandemic, as well as shifts in credit application success rates. Stay informed on key trends shaping the financial landscape in the wake of the pandemic.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

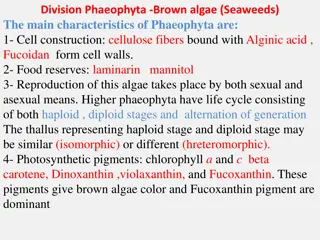

CFPBs Fifth Research Conference Jason Brown Assistant Director for Research, Consumer Financial Protection Bureau May 6, 2021 Disclaimer: This presentation is being made by a Consumer Financial Protection Bureau representative on behalf of the Bureau. It does not constitute legal interpretation, guidance, or advice of the Bureau.

Applications fell dramatically across credit markets in March 2020. Source: Nagypal, E., C. Gibbs, S. Fulford, The Early Effects of the COVID-19 Pandemic on Credit Applications, CFPB Office of Research Special Issue Brief, May 2020. 2

Mortgage applications quickly returned toand even surpassedpre-pandemic levels. Source: Nagypal, E., Unpublished, 2021 3

Auto loan applications were slower to return to pre-pandemic levels. Source: Nagypal, E., Unpublished, 2021 4

Credit card applications remained depressed even longer than in the other markets. Source: Nagypal, E., Unpublished, 2021 5

Several measures of financial well-being improved at the start of the pandemic. Average change in Financial Well-Being During the Pandemic June 2019 CFPB Financial Well- Being Score Percentage of individuals who had difficulty paying for a bill or expense in the previous year Credit Score Metric June 2020 Difference 51.1 52.1 +1* 40 36 -4* 699 710 +11* Source: Fulford, S., M. Rush, and E. Wilson, Changes in consumer financial status during the early months of the pandemic, CFPB Data Point No. 2021-2, April 2021. 6

Credit card debt fell both for those who did report trouble paying bills and those that did not. Source: Fulford, S., M. Rush, and E. Wilson, Unpublished, 2021 7

Credit application success rose in the pandemic for auto loans and mortgages, but fell for credit cards. Source: Ricks, J. and R. Sandler, Unpublished, 2021 8

Black and Hispanic mortgage borrowers were more likely to be delinquent or in forbearance than White borrowers through March 2021. Racial and Ethnic Distribution by Mortgage Performance Group 100% 0.03 0.05 0.07 0.11 90% 0.2 0.3 0.06 80% 70% 0.13 0.12 60% 50% 0.78 40% 0.61 30% 0.55 20% 10% 0% Forbearance 60+ Days Delinquent Current White Black Hispanic Other Source: Durbin, E., G. Li, D. Low, and J. Ricks, Characteristics of Mortgage Borrowers During the COVID-19 Pandemic, CFPB Office of Research Special Issue Brief, May 2021. 9

Mortgage refinances have been rising since prior to the pandemic. 10

But refinances for Black and Hispanic borrowers have been falling as a share of total refinances. 11