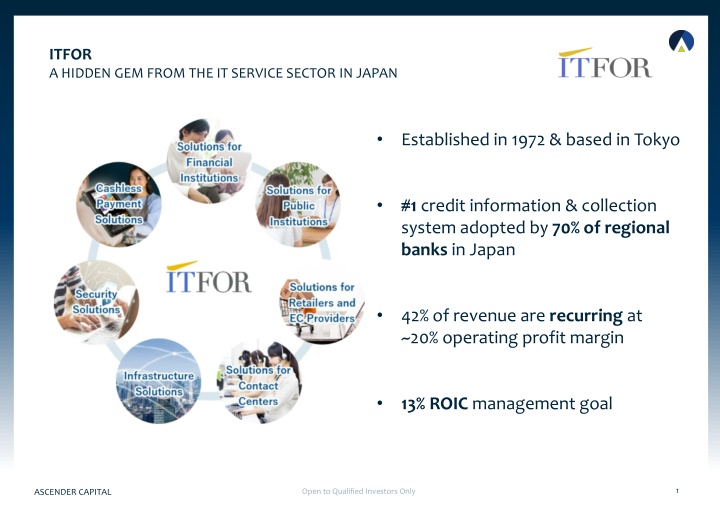

ITFOR: Unveiling a Hidden Gem in Japan's IT Service Sector

Dive into the world of ITFOR, a prominent player in Japan's IT service sector since 1972, with a credit information and collection system widely adopted by regional banks. Learn about their stable track-record, strong fundamentals, and attractive valuation, tailored for qualifying investors seeking promising opportunities in the market.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

ITFOR A HIDDEN GEM FROM THE IT SERVICE SECTOR IN JAPAN Established in 1972 & based in Tokyo #1 credit information & collection system adopted by 70% of regional banks in Japan 42% of revenue are recurring at ~20% operating profit margin 30 13% ROIC management goal 1 Confidential For Qualifying Investors Only Open to Qualified Investors Only ASCENDER CAPITAL ASCENDER CAPITAL 1

ITFOR STABLE TRACK-RECORD SUPPORTED BY STRONG FUNDAMENTALS 20,000 (JPY mm) 6% revenue CAGR 16,000 12,000 9% EBIT CAGR 8,000 16% EBITDA margin 4,000 70% FCF conversion 0 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 EBIT Gross profit Revenue Growing wallet shares 90%+ client retention 30 Maintenance fee up 30% after 5 years 2 Confidential For Qualifying Investors Only Open to Qualified Investors Only ASCENDER CAPITAL ASCENDER CAPITAL 2

ITFOR ALIGNMENT OF INTEREST WITH MINORITY SHAREHOLDERS Total shareholder returns to double to 70% in FY23 including buybacks Revert to pre-Covid trend after turning cautious during Covid Cancellation of 2.8% treasury shares in Sep-2023 30 3 Confidential For Qualifying Investors Only Open to Qualified Investors Only ASCENDER CAPITAL ASCENDER CAPITAL 3

ITFOR ATTRACTIVE VALUATION AT <5X EV/EBIT AT INITIAL INVESTMENT Total return since Ascender s initial investment in Oct-2021 160 October 2023 5.7x EV/EBIT 12.9x P/E 150 140 October 2021 May 2023 130 Ascender s initial investment Total return ratio doubled to 70% for FY23 Feb 2022 4.9x EV/EBIT 11.8x P/E 120 5 Yen special dividend and total return ratio raised to 40% 110 100 90 30 80 Oct-21 Feb-22 Jun-22 Oct-22 Feb-23 Jun-23 Oct-23 ITFOR (4743 JP) Topix Index Source: Bloomberg All data displayed accurate as of October 13th, 2023 4 Confidential For Qualifying Investors Only Open to Qualified Investors Only ASCENDER CAPITAL ASCENDER CAPITAL 4