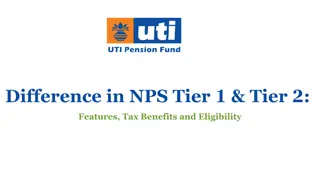

Maximise Your Tax Savings with Section 80 CCD Under NPS

Section 80CCD is related to the deductions available to individuals against contributions made to the National Pension System (NPS). Contributions made by employers towards the NPS also come under this section. nnTo know more, nVisit - // /blog

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

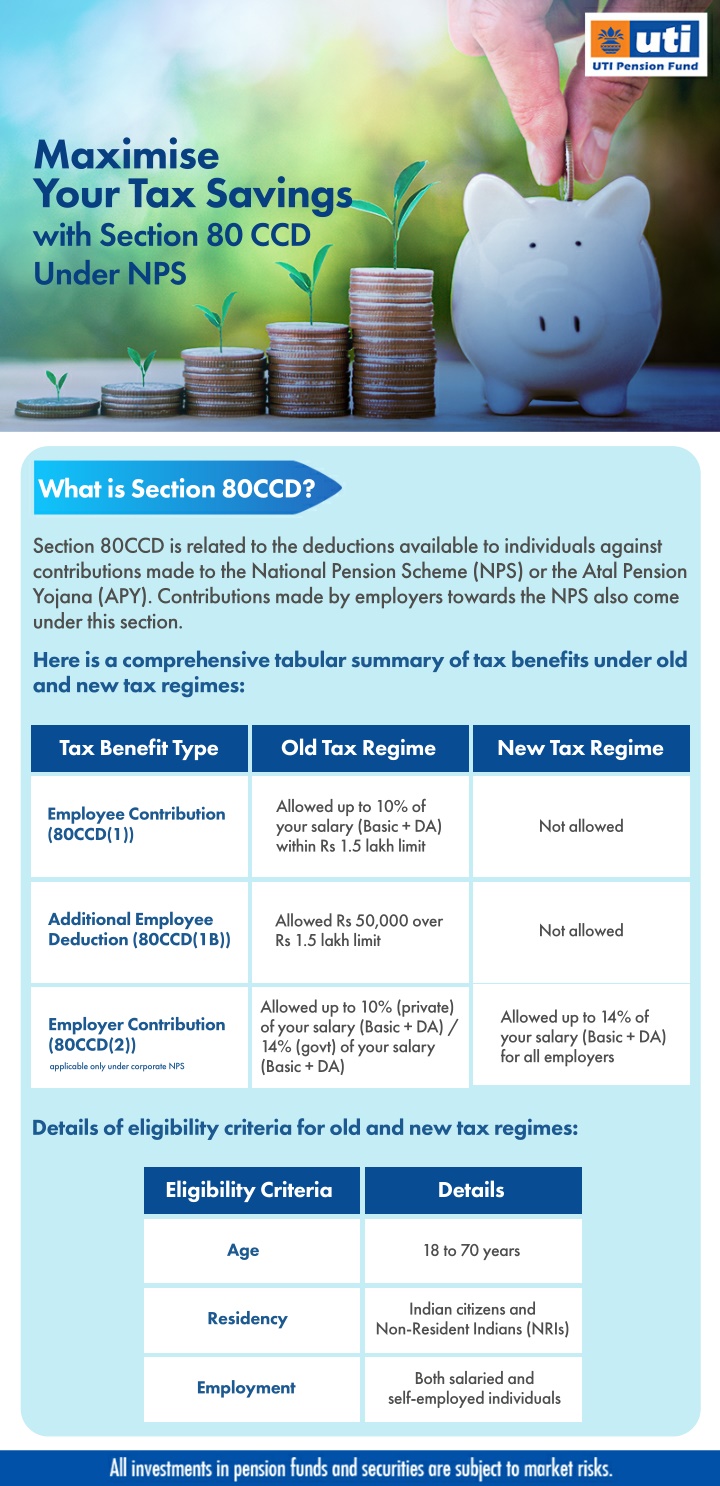

Maximise Your Tax Savings with Section 80 CCD Under NPS What is Section 80CCD? Section 80CCD is related to the deductions available to individuals against contributions made to the National Pension Scheme (NPS) or the Atal Pension Yojana (APY). Contributions made by employers towards the NPS also come under this section. Here is a comprehensive tabular summary of tax benefits under old and new tax regimes: Tax Benefit Type Old Tax Regime New Tax Regime Allowed up to 10% of your salary (Basic + DA) within Rs 1.5 lakh limit Employee Contribution (80CCD(1)) Not allowed Additional Employee Deduction (80CCD(1B)) Allowed Rs 50,000 over Rs 1.5 lakh limit Not allowed Allowed up to 10% (private) of your salary (Basic + DA) / 14% (govt) of your salary (Basic + DA) Allowed up to 14% of your salary (Basic + DA) for all employers Employer Contribution (80CCD(2)) applicable only under corporate NPS Details of eligibility criteria for old and new tax regimes: Eligibility Criteria Details Age 18 to 70 years Indian citizens and Non-Resident Indians (NRIs) Residency Both salaried and self-employed individuals Employment